Question: SO CALCULATIONS WITHOUT EXCEL 3 :: . :: T U 0 O 5 1 TI a D F G H K L E w V

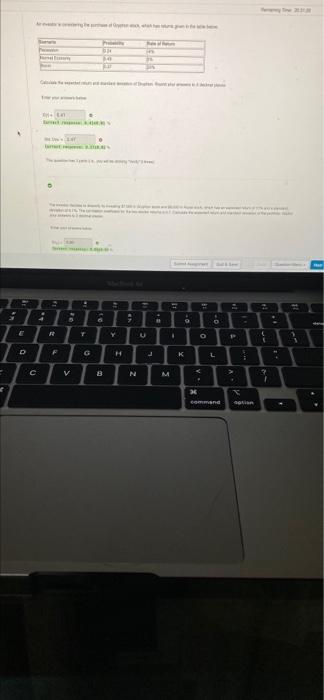

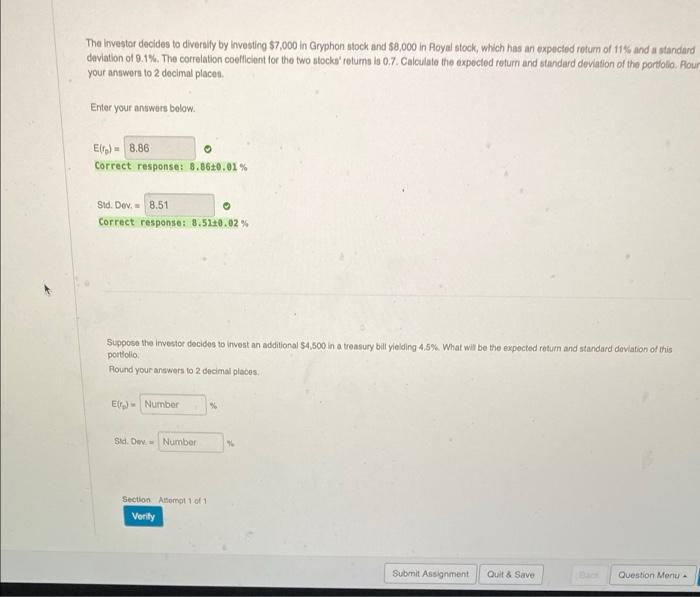

3 :: . :: T U 0 O 5 1 TI a D F G H K L E w V 8 N M > . 1 26 Command BUS The Investor decides to diversity by Investing $7,000 in Gryphon stock and $8,000 in Aoyal stock, which has an expected rotum of 11% and a standard deviation of 0.1%. The correlation coefficient for the two stocks' returns is 0.7. Calculate the expected return and standard deviation of the portfolio Pour your answers to 2 decimal placen. Enter your answers below. Elro)- 8.86 Correct response: 8.860.01% Sid. Dov. = 8.51 Correct response: 8.510.02% Suppose the inwestor decides to invest an additional 54,500 in a treasury bill yielding 4.5% What will be the expected return and standard deviation of this portfolio Round your answers to 2 decimal places Er) Number Sid. De Number Section Attomat 1 of 1 Verily Submit Assignment Quit & Save Question Menu 3 :: . :: T U 0 O 5 1 TI a D F G H K L E w V 8 N M > . 1 26 Command BUS The Investor decides to diversity by Investing $7,000 in Gryphon stock and $8,000 in Aoyal stock, which has an expected rotum of 11% and a standard deviation of 0.1%. The correlation coefficient for the two stocks' returns is 0.7. Calculate the expected return and standard deviation of the portfolio Pour your answers to 2 decimal placen. Enter your answers below. Elro)- 8.86 Correct response: 8.860.01% Sid. Dov. = 8.51 Correct response: 8.510.02% Suppose the inwestor decides to invest an additional 54,500 in a treasury bill yielding 4.5% What will be the expected return and standard deviation of this portfolio Round your answers to 2 decimal places Er) Number Sid. De Number Section Attomat 1 of 1 Verily Submit Assignment Quit & Save Question Menu

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts