Question: so, dont put write down of inv, restruct cost under other expenses please... the class i am in uses it as operating exp coorp end

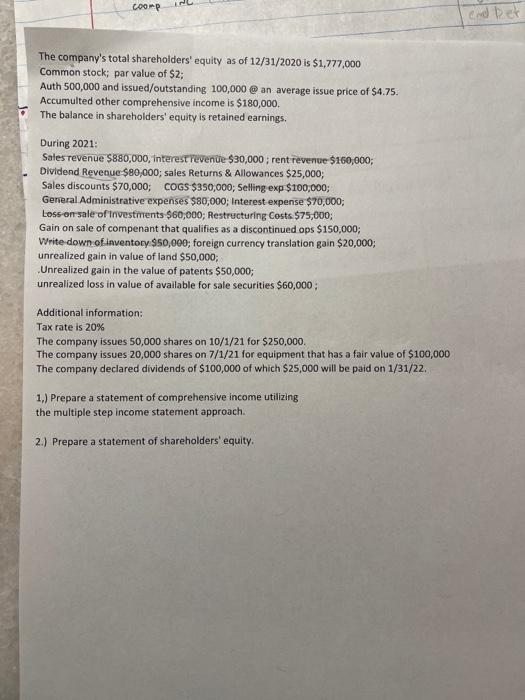

coorp end bet The company's total shareholders' equity as of 12/31/2020 is $1,777,000 Common stock; par value of $2; Auth 500,000 and issued/outstanding 100,000 @ an average issue price of $4.75. Accumulted other comprehensive income is $180,000 The balance in shareholders' equity is retained earnings. During 2021 Sales revenue $880,000, Interest revenue $30,000; rent revenue $160,000, Dividend Revenue $80,000; sales Returns & Allowances $25,000 Sales discounts $70,000; COGS $350,000; Selling exp $100,000; General Administrative expenses $80,000; Interest expense $70,000, Loss on sale of investments $60,000; Restructuring Costs $75,000; Gain on sale of compenant that qualifies as a discontinued ops $150,000, Write down of Inventory $50,000; foreign currency translation gain $20,000; unrealized gain in value of land $50,000; Unrealized gain in the value of patents $50,000; unrealized loss in value of available for sale securities $60,000; Additional information: Tax rate is 20% The company issues 50,000 shares on 10/1/21 for $250,000. The company issues 20,000 shares on 7/1/21 for equipment that has a fair value of $100,000 The company declared dividends of $100,000 of which $25,000 will be paid on 1/31/22. 1.) Prepare a statement of comprehensive income utilizing the multiple step income statement approach 2.) Prepare a statement of shareholders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts