Question: So far I have: I know that the equation for variance of portfolio P that consists of assets A and B is: and for the

So far I have:

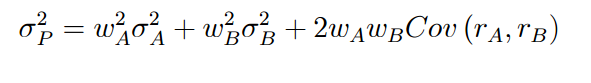

I know that the equation for variance of portfolio P that consists of assets A and B is:

I know that the equation for variance of portfolio P that consists of assets A and B is:

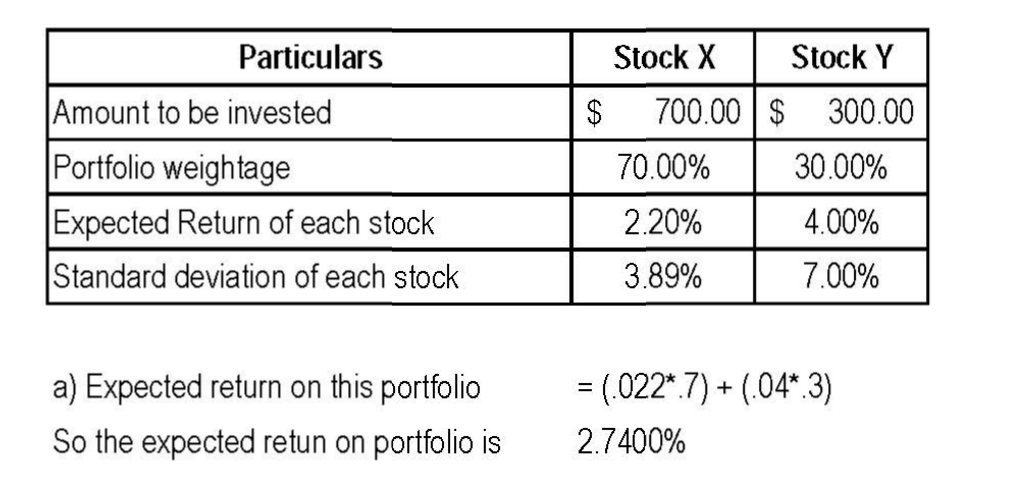

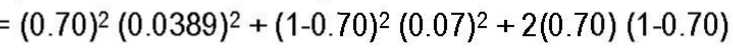

and for the equation so far I have :

I'm just confused on how to get the Cov(Ra,Rb). Please explain the steps you took to complete the equation to figure out what the standard deviation of the portfolio is!

I'm just confused on how to get the Cov(Ra,Rb). Please explain the steps you took to complete the equation to figure out what the standard deviation of the portfolio is!

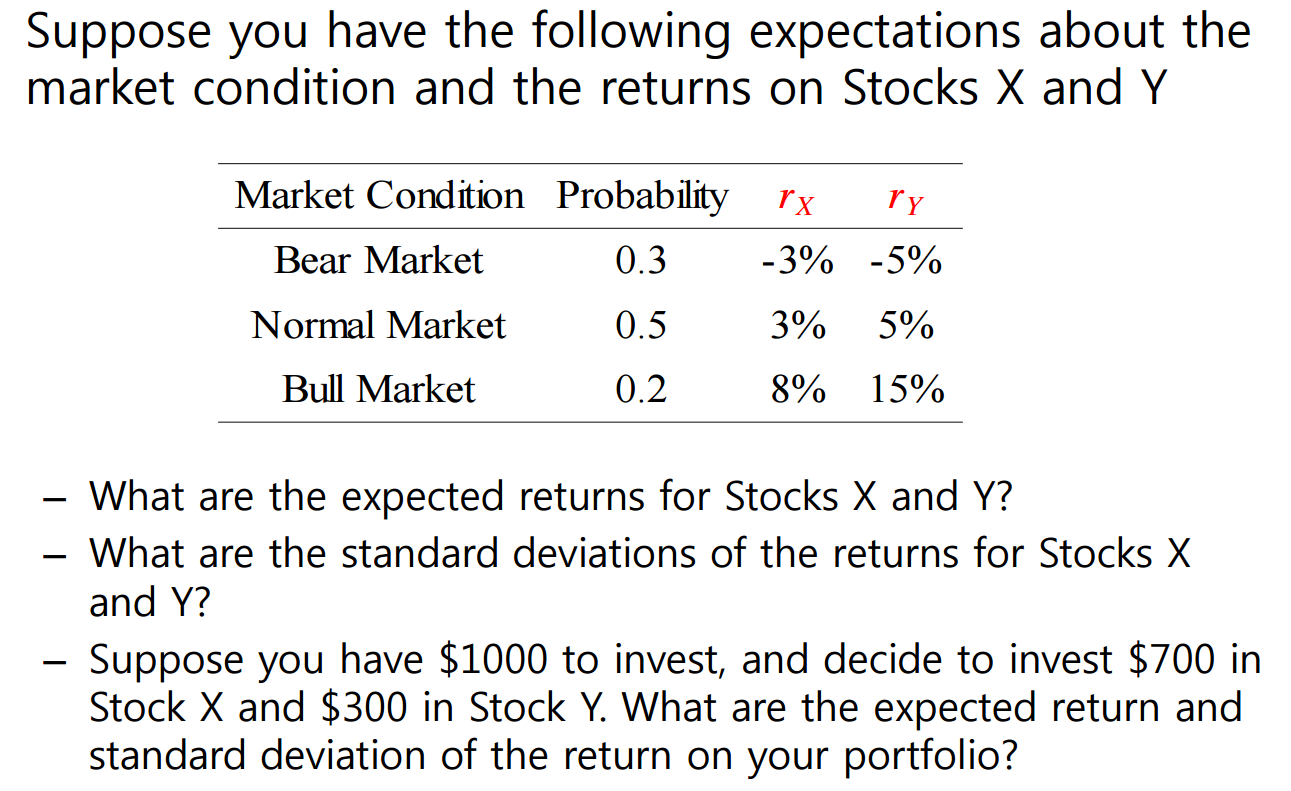

Suppose you have the following expectations about the market condition and the returns on Stocks X and Y Market Condition Probability Tx ry Bear Market Normal Market Bull Market 0.3-3% 0.5 3% 0.2 8% -5% 5% 15% What are the expected returns for Stocks X and Y? What are the standard deviations of the returns for Stocks X and Y? Suppose you have $1000 to invest, and decide to invest $700 in Stock X and $300 in Stock Y. What are the expected return and standard deviation of the return on your portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts