Question: So far things are going well for you as a graduate analyst at the specialist valuation firm. One your colleagues Glenn asks for your advice

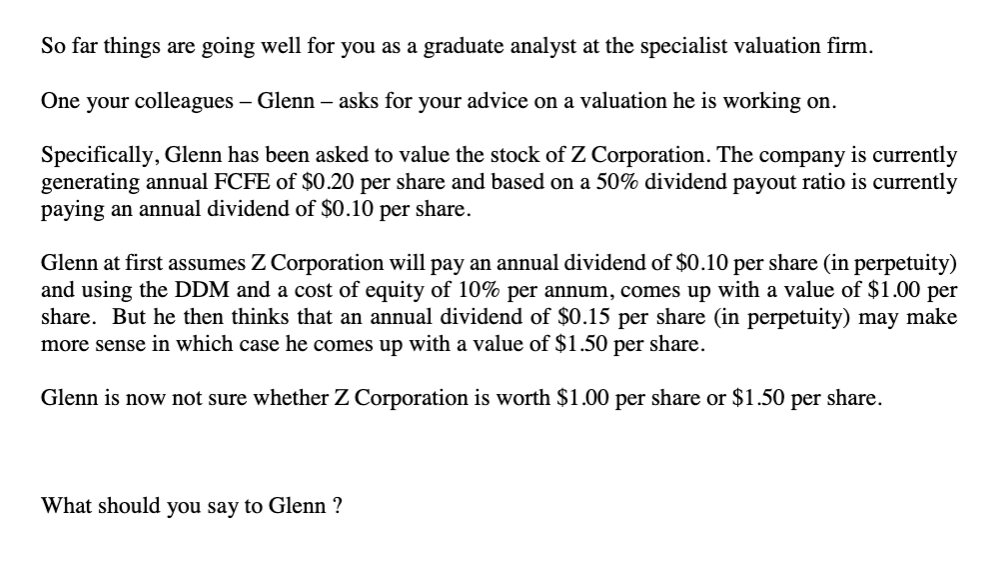

So far things are going well for you as a graduate analyst at the specialist valuation firm. One your colleagues Glenn asks for your advice on a valuation he is working on. Specifically, Glenn has been asked to value the stock of Z Corporation. The company is currently generating annual FCFE of $0.20 per share and based on a 50% dividend payout ratio is currently paying an annual dividend of $0.10 per share. Glenn at first assumes Z Corporation will pay an annual dividend of $0.10 per share in perpetuity) and using the DDM and a cost of equity of 10% per annum, comes up with a value of $1.00 per share. But he then thinks that an annual dividend of $0.15 per share (in perpetuity) may make more sense in which case he comes up with a value of $1.50 per share. Glenn is now not sure whether Z Corporation is worth $1.00 per share or $1.50 per share. What should you say to Glenn

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts