Question: SO I HAVE A VERY SIMPLE QUESTION FOR A TUTOR ON HERE. PROBLEMS FROM 1 - 3 I HAVE THE SET OF QUESTIONS UPLOADED AS

SO I HAVE A VERY SIMPLE QUESTION FOR A TUTOR ON HERE.

PROBLEMS FROM 1 - 3

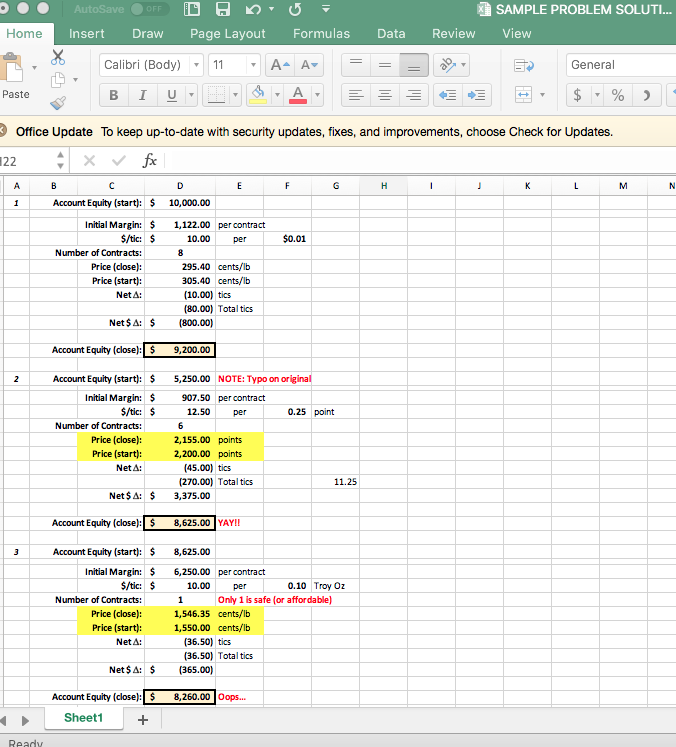

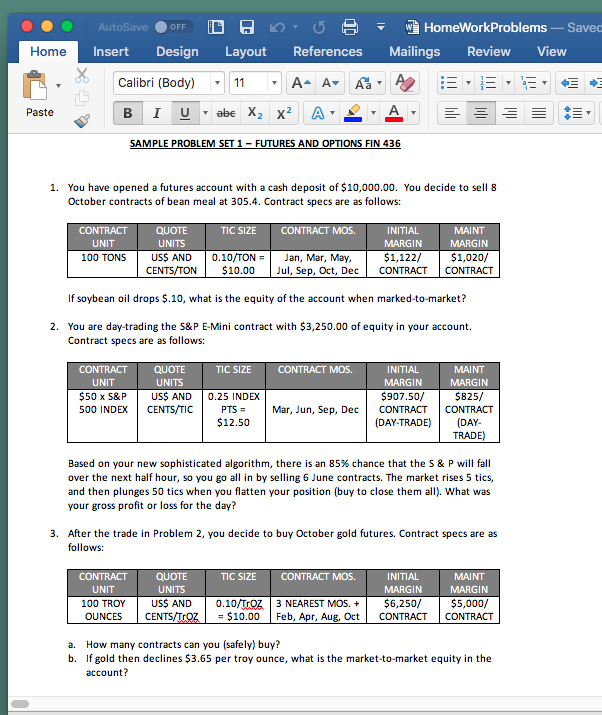

I HAVE THE SET OF QUESTIONS UPLOADED AS WELL AS THE ANSWERS ( IN EXCEL) TO THEM FROM 1 -3

I AM CONFUSED ON HOW TO GET THE NUMBERS HIGH LIGHTED IN THE YELLOW.

ALL YOU NEED TO DO IS SHOW ME HOW I CAN GET THE HIGHLIGHTED NUMBERS FOR QUESTION 2 AND 3 . WHICH ARE STATED BELOW IN YELLOW. ( AND ARE IN BOLD IN THIS SECTION )

HOW CAN YOU GET THESE PRICES IF ITS NOT GIVIN IN THE PROBLEM ????

IN QUESTION 2 . THERE IS A PRICE (CLOSE) = 2155 POINTS , (START) = 2,200

IN QUESTION 3 - THERE IS A PRICE ( CLOSE ) = 1546.35 , (START) = 1550

AutoSave () OFF *SAMPLE PROBLEM SOLUTI. Home Insert Draw Page Layout Formulas Data Review View Calibri (Body) 11 A- A General Paste B I UT A E $ % Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check for Updates. 22 X Vfx A B D E F G H K L M 1 Account Equity (start): $ 10,000.00 Initial Margin: |$ 1,122.00 per contract 5/tic: $ 10.00 per 50.01 Number of Contracts: Price (close): 295.40 cents/lb Price (start): 305.40 cents/lb Net A: [10.00) tics [80.00) Total tics Net S A: 5 [800.00 Account Equity (close): |$ 9,200.00 2 Account Equity (start): $ 5,250.00 NOTE: Typo on original Initial Margin: |$ 907.50 per contract S/tic: $ 12.50 per 0.25 point Number of Contracts: Price (close): 2,155.00 points Price (start): 2,200.00 points Net A: (45.00) tics (270.00) Total tics 11.25 Net S A: $ 3,375.00 Account Equity (close): $ 8, 625.00 YAY!! 3 Account Equity (start): $ 8,625.00 Initial Margin: |$ 6,250.00 per contract $/tic: $ 10.00 per 0.10 Troy Oz Number of Contracts: 1 Only 1 is safe (or affordable) Price (close): 1,546.35 cents/lb Price (start): 1,550.00 cents/lb NetA [36.50) tics (36.50) Total tics Net 5 A: $ (365.00) Account Equity (close): $ 8,260.00 Oops... Sheet1 +AutoSave (OFF w HomeWorkProblems - Save Home Insert Design Layout References Mailings Review View Calibri (Body) 11 A- A Aa E Paste B I U. abe X2 X2 A . 2. SAMPLE PROBLEM SET 1 - FUTURES AND OPTIONS FIN 436 1. You have opened a futures account with a cash deposit of $10,000.00. You decide to sell 8 October contracts of bean meal at 305.4. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN 100 TONS US5 AND 0.10/TON = Jan, Mar, May, $1,122/ 51,020/ CENTS/TON $10.00 Jul, Sep, Oct, Dec CONTRACT CONTRACT If soybean oil drops $.10, what is the equity of the account when marked-to-market? 2. You are day-trading the S&P E-Mini contract with $3,250.00 of equity in your account. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN $50 x 5&P USS AND 0.25 INDEX $907.50/ 5825/ 500 INDEX CENTS/TIC PTS = Mar, Jun, Sep, Dec CONTRACT CONTRACT $12.50 (DAY-TRADE) (DAY- TRADE) Based on your new sophisticated algorithm, there is an 85% chance that the S & P will fall over the next half hour, so you go all in by selling 6 June contracts. The market rises 5 tics, and then plunges 50 tics when you flatten your position (buy to close them all). What was your gross profit or loss for the day? 3. After the trade in Problem 2, you decide to buy October gold futures. Contract specs are as follows: CONTRACT QUOTE TIC SIZE CONTRACT MOS. INITIAL MAINT UNIT UNITS MARGIN MARGIN 100 TROY US$ AND 0.10/TroZ 3 NEAREST MOS. + $6,250/ $5,000/ OUNCES CENTS/TOOZ = $10.00 Feb, Apr, Aug, Oct CONTRACT CONTRACT a. How many contracts can you (safely) buy? b. If gold then declines $3.65 per troy ounce, what is the market-to-market equity in the account