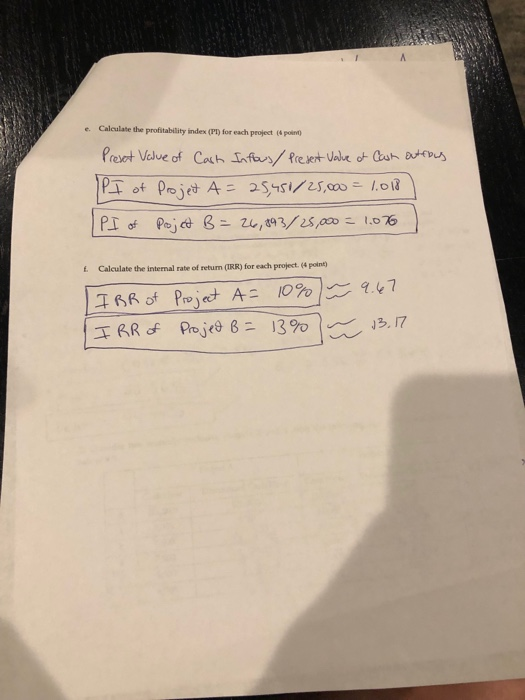

Question: So Ive conpleted everything, but if someone cam break down how to get 2(f). For example, if all you need is the financial calculator, what

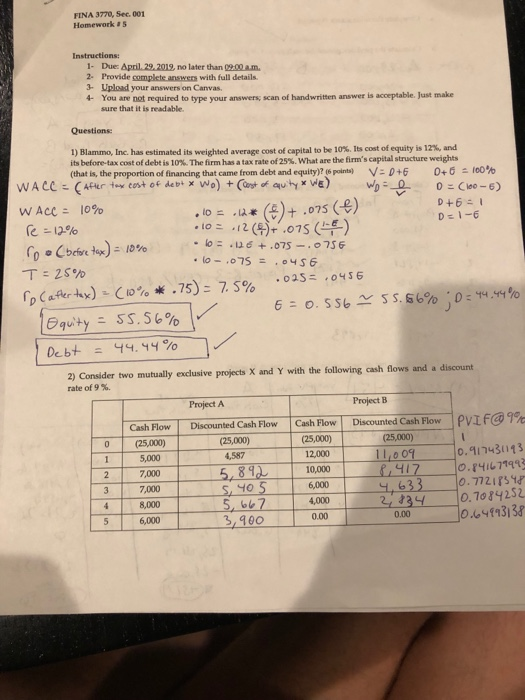

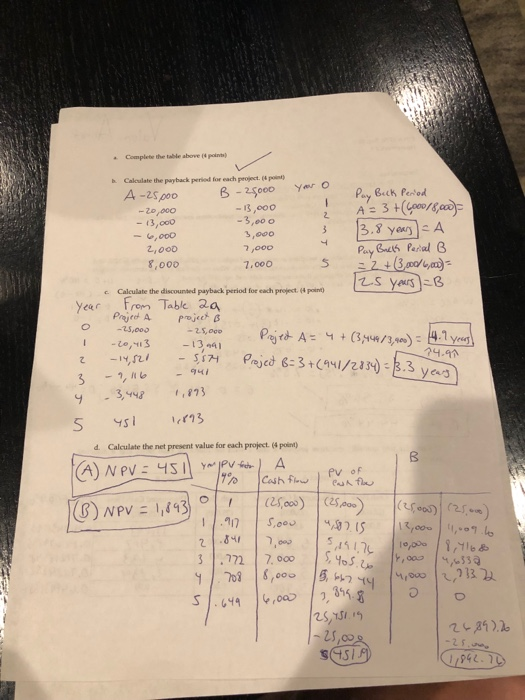

FINA 3770, Sec. 001 Homework #5 1- Due April.29.2019, no later than 09.00 a.m 2 Provide complete answers with full details 3- Upload your answers on Canvas. 4- You are not required to type your answers, scan of handwritten answer is acceptable. Jast make sure that it is readable Questions 1) Blamino, Inc. has estimated its weighted average cost of capital tobe 10%. Its cost of equity is 12%. its before-tax cost of debt is l 0%. The firm has a tax rate of 25%what are the firm's capital structure weights (that is, the proportion of financing that came from debt and equity)?(6 points) V: 0 +5 0+ d-10% and .lo:.u6 o.cbcfve tox)-10% .oas- .$6 .ferhv)-(0%*.75): 2.5% 2) Consider two mutually exclusive projects X and Y with the following cash flows and a discount rate of 9%. Project A Project B Cash Flow Discounted Cash Flow Cash Flow Discounted Cash Flow (25,000) 5,000 (25,000) 4,587 (25,000) 12,000 0.41 4313 7,000 8,000 6,000 6,000 4,000 0.00 340.7084252 04413 3,400 0.00 h le above.. pants Cmplete the Calculate the payback period for each peoject. (4 pont A -25p00 200o -13,000 3,00 0 s,oco -2,000 - 13,o00 2,0oD 8,000 7,000 status -03 c Calculate the discounted payback period for each project. (4 point yer Fron Table 3a -1341 ?4.9 d. Calculate the net present value for each project. 4 point) Pv of e. Calculate the profitablity index (PI) for each peoject ( point t. Calculate the internal rate of return (RR) for each project. (4 point)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts