Question: So Question # 2 has already been completed but is needed to answer question #3. Only need help with #3 2) Your 4 suppliers offer

So Question # 2 has already been completed but is needed to answer question #3. Only need help with #3

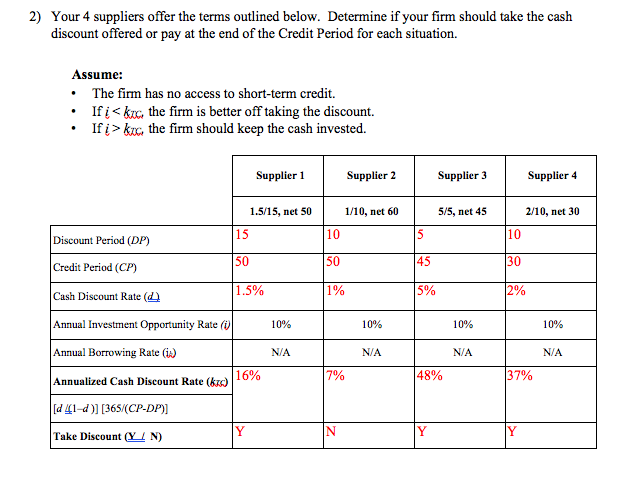

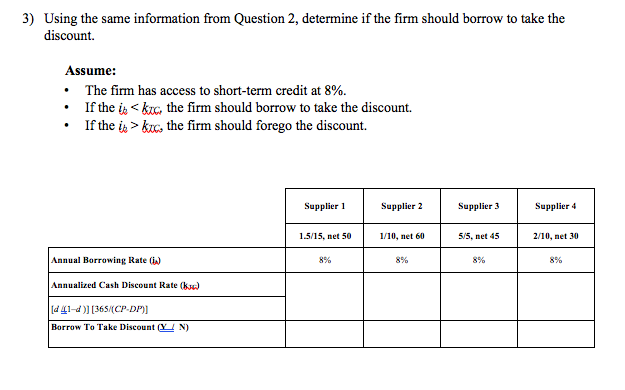

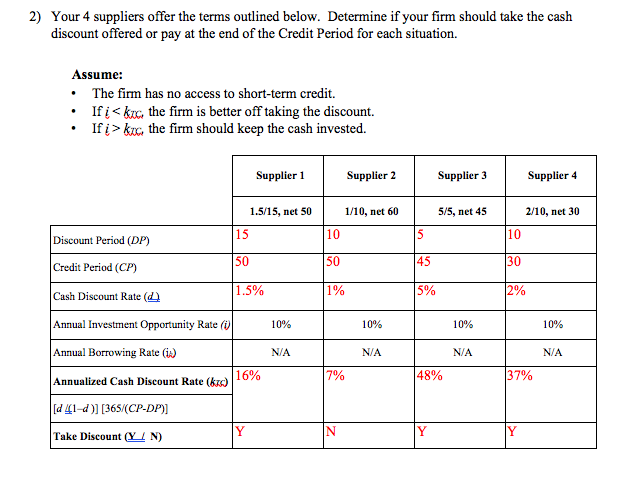

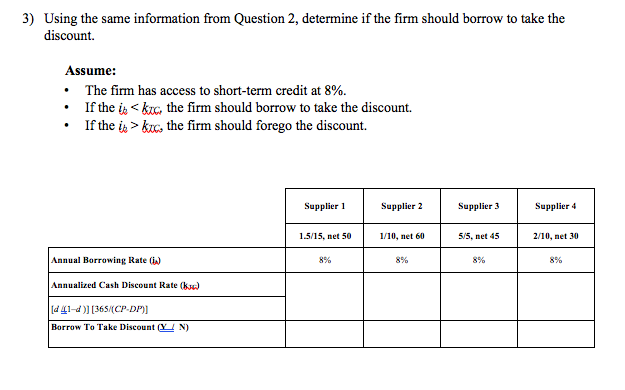

2) Your 4 suppliers offer the terms outlined below. Determine if your firm should take the cash discount offered or pay at the end of the Credit Period for each situation. Assume: The firm has no access to short-term credit. If i kic, the firm should keep the cash invested. Supplier 1 Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 10 15 10 5 Discount Period (DP) 50 50 45 Credit Period (CP) 30 Cash Discount Rate 1.5% 1% 5% 2% Annual Investment Opportunity Rate (0) 10% 10% 10% 10% NA N/A N/A N/A 7% 48% 37% Annual Borrowing Rate (is) 16% Annualized Cash Discount Rate (bs) d 41-d 2] [365 (CP-DP)] Y Take Discount (Y/N) N Y 3) Using the same information from Question 2, determine if the firm should borrow to take the discount Assume: The firm has access to short-term credit at 8%. If the is kxo, the firm should forego the discount. Supplier 1 Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 Annual Borrowing Rate (1) 8% 8% 8% 8% Annualized Cash Discount Rate (k.) [241-2)][365/(CP-DP) Borrow To Take Discount ( YN) 2) Your 4 suppliers offer the terms outlined below. Determine if your firm should take the cash discount offered or pay at the end of the Credit Period for each situation. Assume: The firm has no access to short-term credit. If i kic, the firm should keep the cash invested. Supplier 1 Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 10 15 10 5 Discount Period (DP) 50 50 45 Credit Period (CP) 30 Cash Discount Rate 1.5% 1% 5% 2% Annual Investment Opportunity Rate (0) 10% 10% 10% 10% NA N/A N/A N/A 7% 48% 37% Annual Borrowing Rate (is) 16% Annualized Cash Discount Rate (bs) d 41-d 2] [365 (CP-DP)] Y Take Discount (Y/N) N Y 3) Using the same information from Question 2, determine if the firm should borrow to take the discount Assume: The firm has access to short-term credit at 8%. If the is kxo, the firm should forego the discount. Supplier 1 Supplier 2 Supplier 3 Supplier 4 1.5/15, net 50 1/10, net 60 5/5, net 45 2/10, net 30 Annual Borrowing Rate (1) 8% 8% 8% 8% Annualized Cash Discount Rate (k.) [241-2)][365/(CP-DP) Borrow To Take Discount ( YN)