Question: So the worksheet below I am working on simple interest and future value. Any help would be greatly appreciated. I already got problem 2 done

So the worksheet below I am working on simple interest and future value. Any help would be greatly appreciated. I already got problem 2 done already.

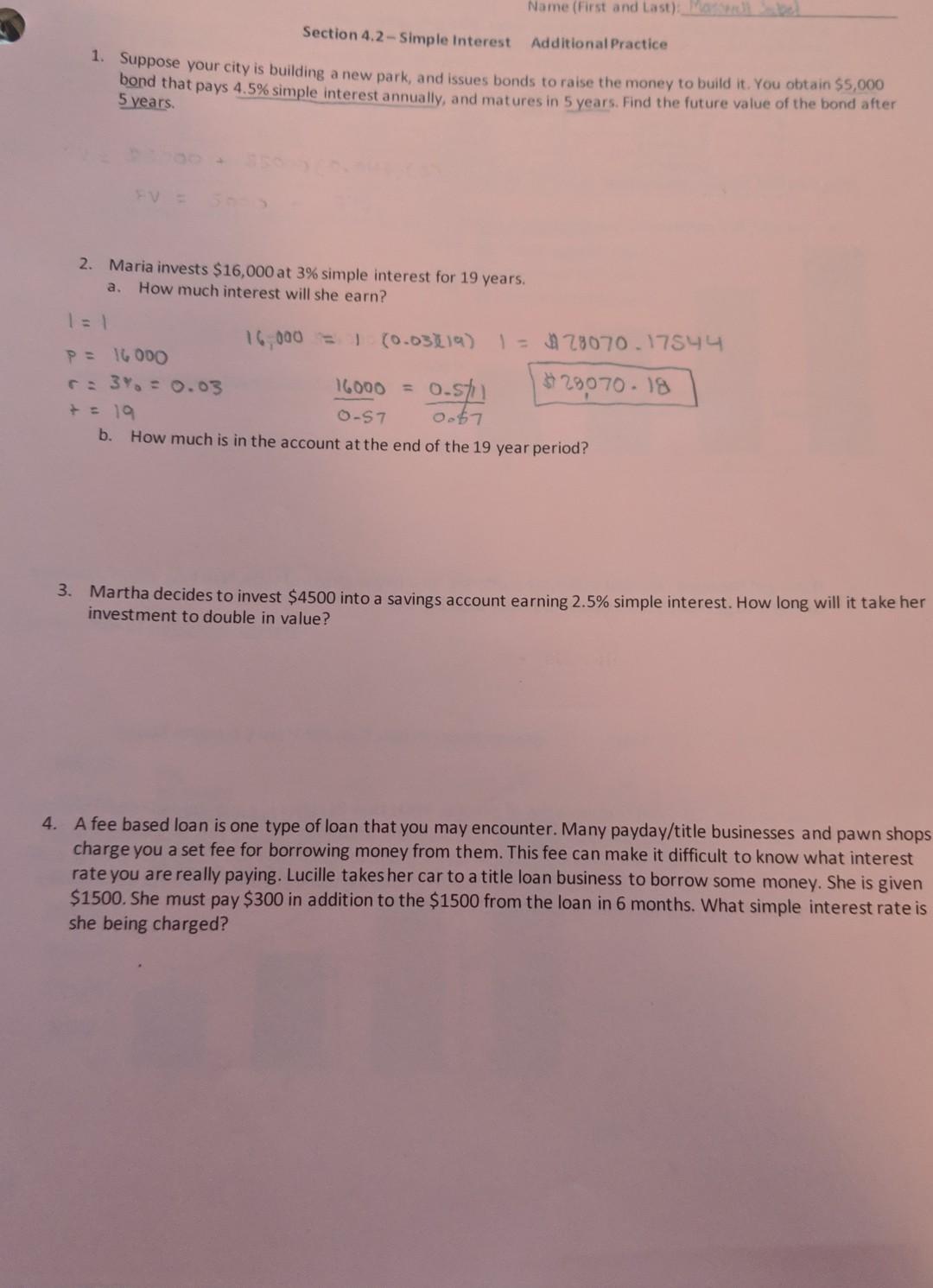

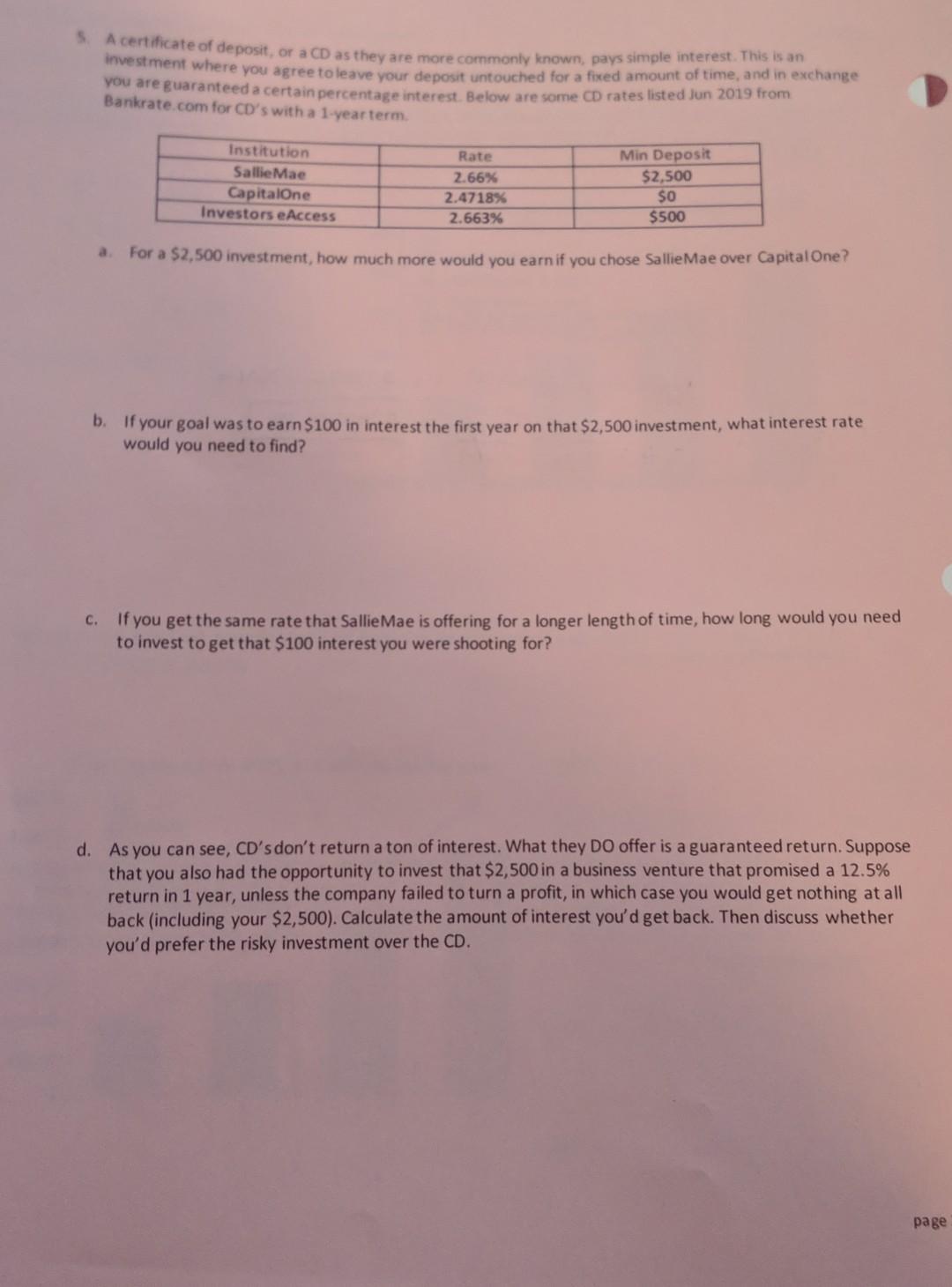

Name (First and last): Section 4.2- Simple interest Additional Practice 1. Suppose your city is building a new park, and issues bonds to raise the money to build it. You obtain $5,000 bond that pays 4.5% simple interest annually, and matures in 5 years. Find the future value of the bond after 5 years 2. Maria invests $16,000 at 3% simple interest for 19 years. a. How much interest will she earn? I=1 16,000 (0.03119) 1 = 28070.17544 P= 16000 C: 3. = 0.03 16000 = 0.stu $29070.18 +=19 0-57 b. How much is in the account at the end of the 19 year period? 0067 3. Martha decides to invest $4500 into a savings account earning 2.5% simple interest. How long will it take her investment to double in value? 4. A fee based loan is one type of loan that you may encounter. Many payday/title businesses and pawn shops charge you a set fee for borrowing money from them. This fee can make it difficult to know what interest rate you are really paying. Lucille takes her car to a title loan business to borrow some money. She is given $1500. She must pay $300 in addition to the $1500 from the loan in 6 months. What simple interest rate is she being charged? A certificate of deposit, or a CD as they are more commonly known, pays simple interest. This is an Investment where you agree to leave your deposit untouched for a fixed amount of time, and in exchange you are guaranteed a certain percentage interest. Below are some CD rates listed Jun 2019 from Bankrate.com for CD's with a 1-year term Institution Sallie Mae Capitalone Investors e Access Rate 2.66% 2.4718% 2.663% Min Deposit $2,500 SO $500 a For a $2,500 investment, how much more would you earn if you chose Sallie Mae over Capital One? b. If your goal was to earn $100 in interest the first year on that $2,500 investment, what interest rate would you need to find? c. If you get the same rate that Sallie Mae is offering for a longer length of time, how long would you need to invest to get that $100 interest you were shooting for? d. As you can see, CD's don't return a ton of interest. What they Do offer is a guaranteed return. Suppose that you also had the opportunity to invest that $2,500 in a business venture that promised a 12.5% return in 1 year, unless the company failed to turn a profit, in which case you would get nothing at all back (including your $2,500). Calculate the amount of interest you'd get back. Then discuss whether you'd prefer the risky investment over the CD. page

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts