Question: So this problem is a bit difficult to start. It requires solution work with a series (possibly a Taylor Series or Maclaurin Series). There are

So this problem is a bit difficult to start. It requires solution work with a series (possibly a Taylor Series or Maclaurin Series). There are also other possibly ways to solve the problem by using real world practical applications. I would like #3 [a,b,c] solved any kind of way with with detailed solutions to give me a general idea of how this problem works. Legible handwriting would be much appreciated so that I can understand the solution fully.

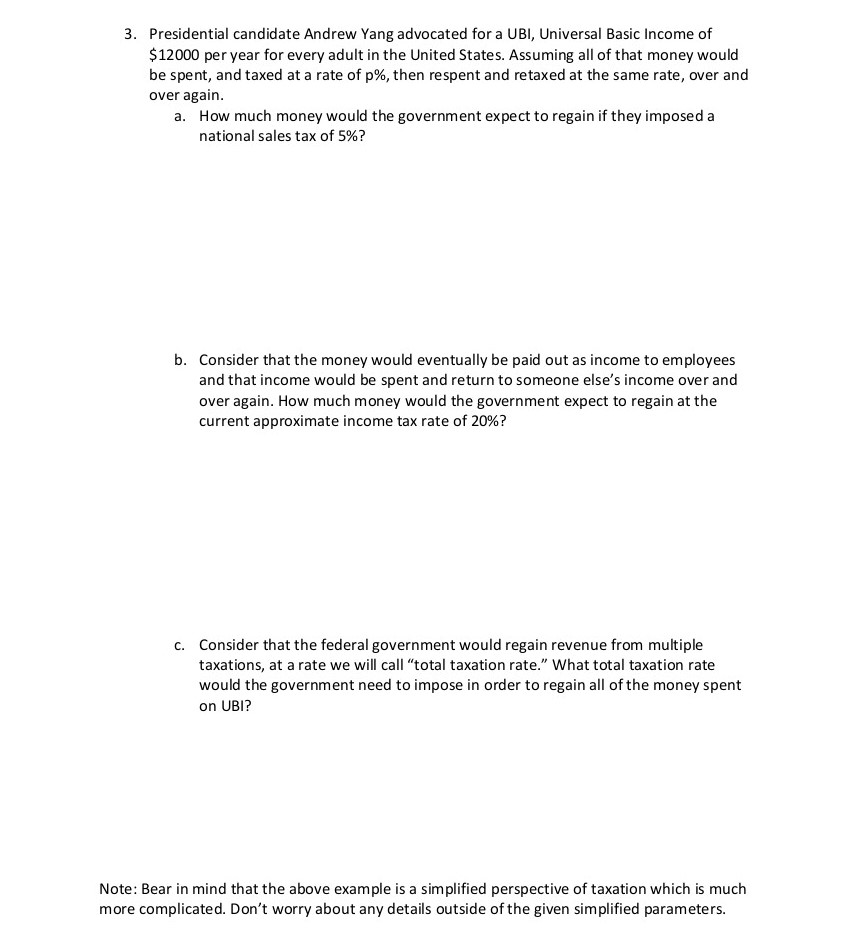

3. Presidential candidate Andrew Yang advocated for a UBI, Universal Basic Income of $12000 per year for every adult in the United States. Assuming all of that money would be spent, and taxed at a rate of p%, then respent and retaxed at the same rate, over and over again. a. How much money would the government expect to regain if they imposed a national sales tax of 5%? b. Consider that the money would eventually be paid out as income to employees and that income would be spent and return to someone else's income over and over again. How much money would the government expect to regain at the current approximate income tax rate of 20%? C. Consider that the federal government would regain revenue from multiple taxations, at a rate we will call total taxation rate." What total taxation rate would the government need to impose in order to regain all of the money spent on UBI? Note: Bear in mind that the above example is a simplified perspective of taxation which is much more complicated. Don't worry about any details outside of the given simplified parameters. 3. Presidential candidate Andrew Yang advocated for a UBI, Universal Basic Income of $12000 per year for every adult in the United States. Assuming all of that money would be spent, and taxed at a rate of p%, then respent and retaxed at the same rate, over and over again. a. How much money would the government expect to regain if they imposed a national sales tax of 5%? b. Consider that the money would eventually be paid out as income to employees and that income would be spent and return to someone else's income over and over again. How much money would the government expect to regain at the current approximate income tax rate of 20%? C. Consider that the federal government would regain revenue from multiple taxations, at a rate we will call total taxation rate." What total taxation rate would the government need to impose in order to regain all of the money spent on UBI? Note: Bear in mind that the above example is a simplified perspective of taxation which is much more complicated. Don't worry about any details outside of the given simplified parameters

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts