Question: So what is the standard steps to solve this problem in order to get full score in the exam? And want make sure my answer

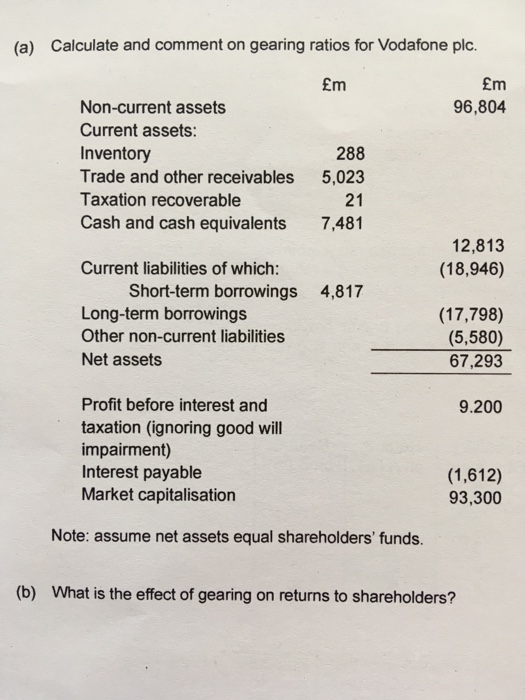

(a) Calculate and comment on gearing ratios for Vodafone plc. Em 96,804 Em Non-current assets Current assets: Inventory Trade and other receivables Taxation recoverable Cash and cash equivalents 288 5,023 21 7,481 12,813 (18,946) Current liabilities of which: Short-term borrowings 4,817 Long-term borrowings Other non-current liabilities Net assets (17,798) (5,580) 67,293 Profit before interest and taxation (ignoring good will impairment) Interest payable Market capitalisation 9.200 (1,612) 93,300 Note: assume net assets equal shareholders' funds. (b) What is the effect of gearing on returns to shareholders

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts