Question: So X T o (a) (b) (c) (d) (e) (f) (g) (h) 80 60 50 100 120 40 12 25 70 66 60 100 130

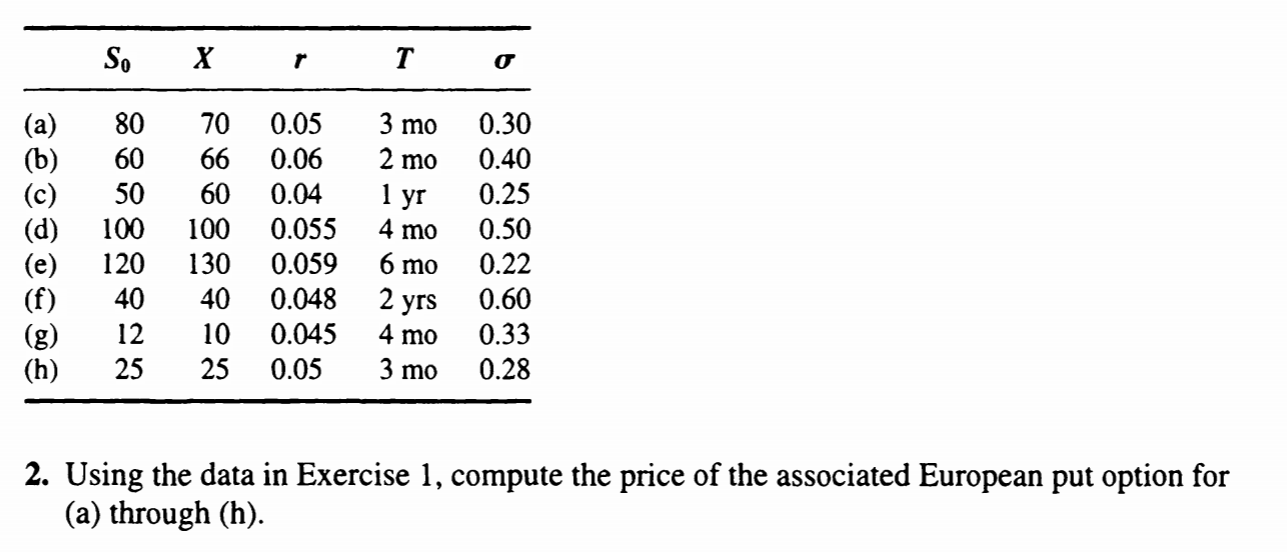

So X T o (a) (b) (c) (d) (e) (f) (g) (h) 80 60 50 100 120 40 12 25 70 66 60 100 130 40 10 25 0.05 0.06 0.04 0.055 0.059 0.048 0.045 3 mo 2 mo 1 yr 4 mo 6 mo 2 yrs 4 mo 3 mo 0.30 0.40 0.25 0.50 0.22 0.60 0.33 0.28 0.05 2. Using the data in Exercise 1, compute the price of the associated European put option for (a) through (h). So X T o (a) (b) (c) (d) (e) (f) (g) (h) 80 60 50 100 120 40 12 25 70 66 60 100 130 40 10 25 0.05 0.06 0.04 0.055 0.059 0.048 0.045 3 mo 2 mo 1 yr 4 mo 6 mo 2 yrs 4 mo 3 mo 0.30 0.40 0.25 0.50 0.22 0.60 0.33 0.28 0.05 2. Using the data in Exercise 1, compute the price of the associated European put option for (a) through (h)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts