Question: SoBee is considering two mutually exclusive capital budgeting projects, Project A and Project B, which have a cost of capital of 12%. The expected future

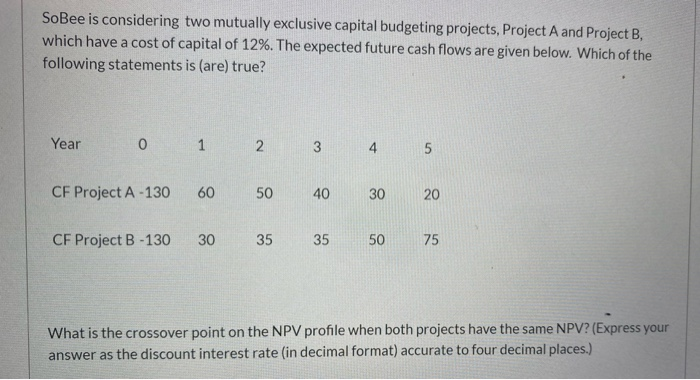

SoBee is considering two mutually exclusive capital budgeting projects, Project A and Project B, which have a cost of capital of 12%. The expected future cash flows are given below. Which of the following statements is (are) true? Year 0 1 2 3 4 5 CF Project A-130 60 50 40 30 20 CF Project B-130 30 35 35 50 75 What is the crossover point on the NPV profile when both projects have the same NPV? (Express your answer as the discount interest rate (in decimal format) accurate to four decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts