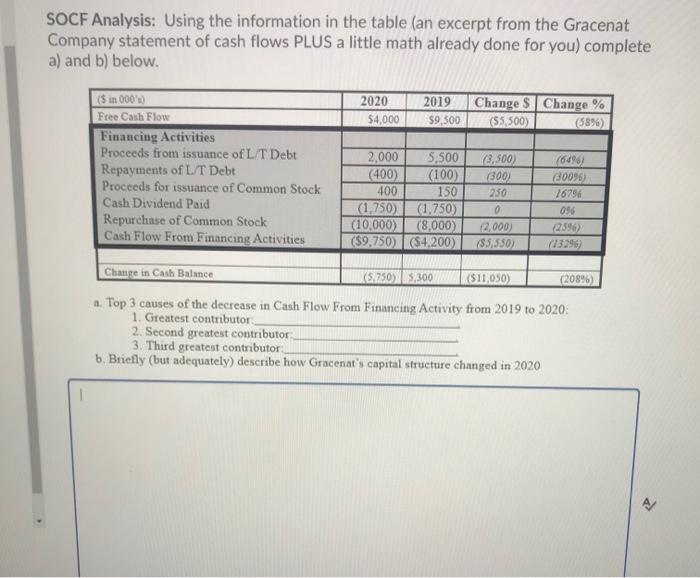

Question: SOCF Analysis: Using the information in the table (an excerpt from the Gracenat Company statement of cash flows PLUS a little math already done for

SOCF Analysis: Using the information in the table (an excerpt from the Gracenat Company statement of cash flows PLUS a little math already done for you) complete a) and b) below. 2020 2019 Change $Change % (55,500) (58%) $4,000 $9.500 (5 in 000) Free Cash Flow Financing Activities Proceeds from issuance of L T Debt Repayments of L/T Debt Proceeds for issuance of Common Stock Cash Dividend Paid Repurchase of Common Stock Cash Flow From Financing Activities (3,500) (300) 250 (64%) (30096) 16796 2,000 5,500 (400) (100) 400 150 (1,750) (1.750) (10,000) (8,000) ($9.750) K($4,200) 096 (2596) (2.000) (55,550) Change in Cash Balance 5.250X5,300 ($11,050) (2089) a. Top 3 causes of the decrease in Cash Flow From Financing Activity from 2019 to 2020: 1. Greatest contributor 2. Second greatest contributor 3. Third greatest contributor b. Briefly (but adequately) describe how Gracenat's capital structure changed in 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts