Question: Social Security Benefits ( LO 2 . 1 6 ) received $ 3 0 , 0 0 0 in tax - exempt interest income and

Social Security Benefits LO

received $ in taxexempt interest income and has no AGI deductions.

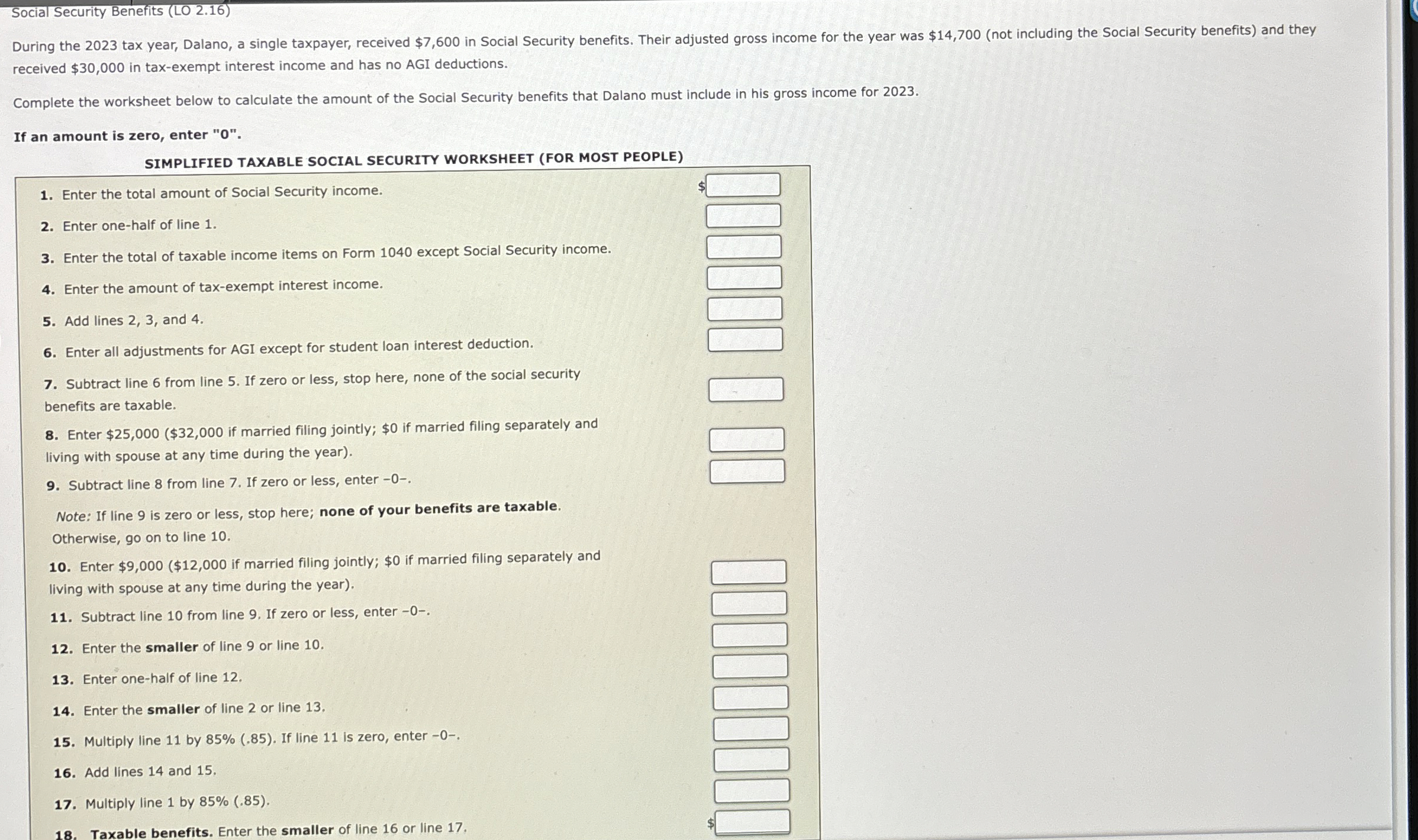

Complete the worksheet below to calculate the amount of the Social Security benefits that Dalano must include in his gross income for

If an amount is zero, enter

SIMPLIFIED TAXABLE SOCIAL SECURITY WORKSHEET FOR MOST PEOPLE

Enter the total amount of Social Security income.

Enter onehalf of line

Enter the total of taxable income items on Form except Social Security income.

Enter the amount of taxexempt interest income.

Add lines and

Enter all adjustments for AGI except for student loan interest deduction.

Subtract line from line If zero or less, stop here, none of the social security

benefits are taxable.

Enter $ $ if married filing jointly; $ if married filing separately and

living with spouse at any time during the year

Subtract line from line If zero or less, enter

Note: If line is zero or less, stop here; none of your benefits are taxable.

Otherwise, go on to line

Enter $ $ if married filing jointly; $ if married filing separately and

living with spouse at any time during the year

Subtract line from line If zero or less, enter

Enter the smaller of line or line

Enter onehalf of line

Enter the smaller of line or line

Multiply line by If line is zero, enter

Add lines and

Multiply line by

Taxable benefits. Enter the smaller of line or line

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock