Question: Sofia has just started working and wants to start saving to buy a house. She is offered the following financing plan: For the next 2

Sofia has just started working and wants to start saving to buy a house. She is offered the following financing plan:

- For the next 2 years she will make monthly contributions of $10,000 at the end of each month.

- During the third year she will make bimonthly contributions of $20,000 at the end of each two-month period.

- During the fourth year she will make monthly contributions of $15,000 at the end of each month.

At the end of the accumulation period (4 years) she will get a mortgage to pay the remaining balance. The price of the house at the end of the accumulation period is $4,500,000. The mortgage has a 10-year term with quarterly payments due at the beginning of each period.

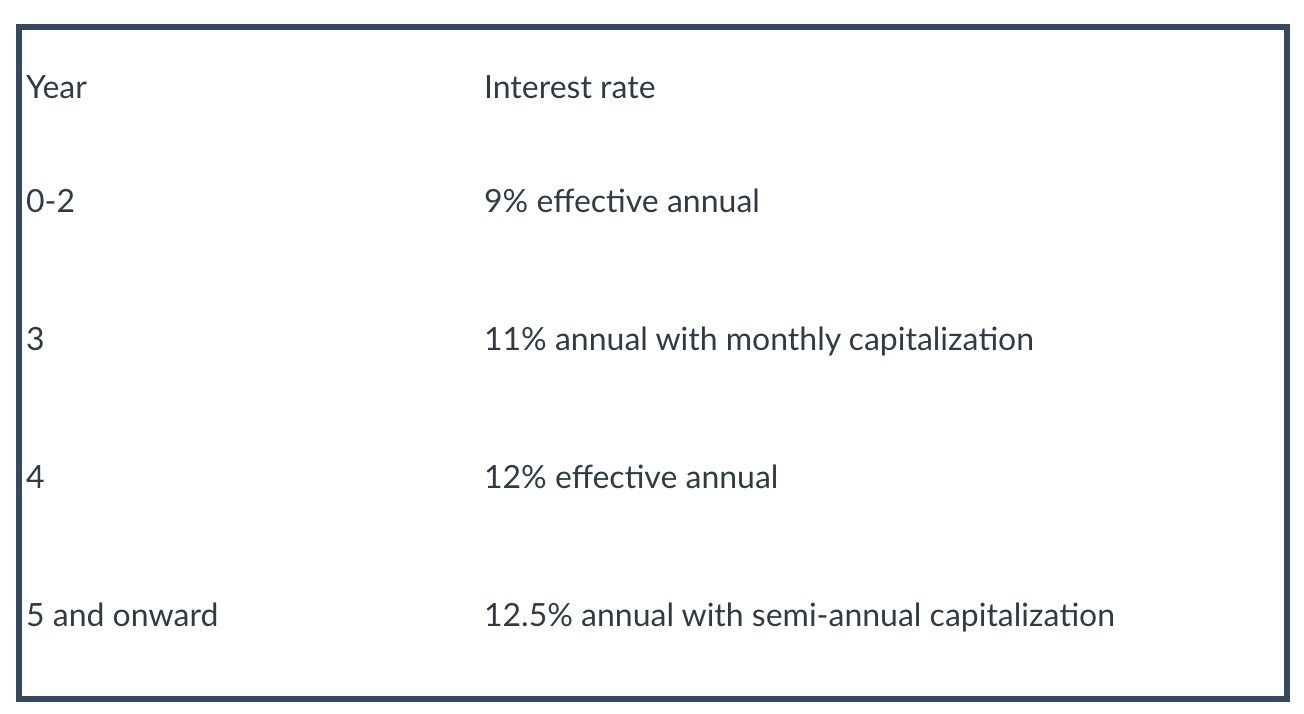

Interest rates are as follows:

Calculate the quarterly amount that Sofia will pay on the mortgage. $

Calculate the quarterly amount that Sofia will pay on the mortgage. $

Year Interest rate 0-2 9% effective annual 11% annual with monthly capitalization 12% effective annual 5 and onward 12.5% annual with semi-annual capitalization Year Interest rate 0-2 9% effective annual 11% annual with monthly capitalization 12% effective annual 5 and onward 12.5% annual with semi-annual capitalization

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts