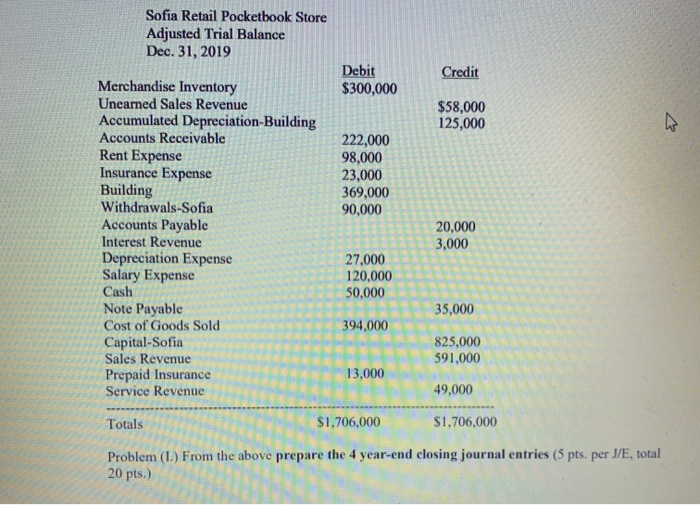

Question: Sofia Retail Pocketbook Store Adjusted Trial Balance Dec. 31, 2019 Debit $300,000 Credit $58,000 125,000 Merchandise Inventory Unearned Sales Revenue Accumulated Depreciation-Building Accounts Receivable Rent

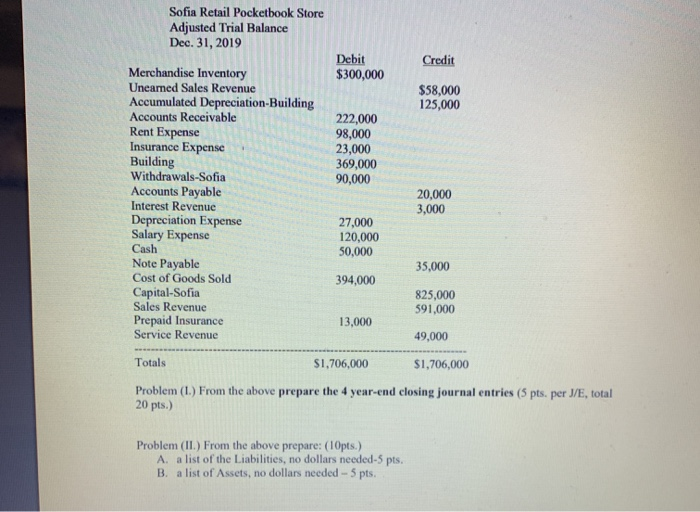

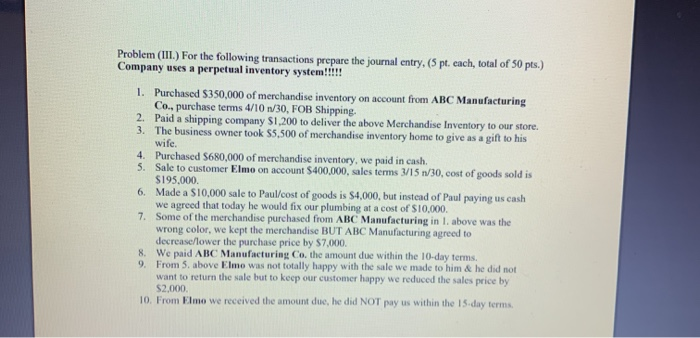

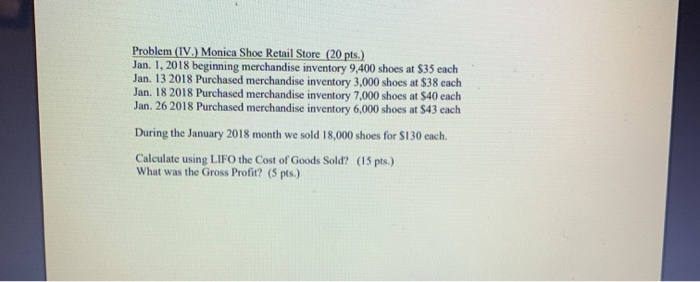

Sofia Retail Pocketbook Store Adjusted Trial Balance Dec. 31, 2019 Debit $300,000 Credit $58,000 125,000 Merchandise Inventory Unearned Sales Revenue Accumulated Depreciation-Building Accounts Receivable Rent Expense Insurance Expense Building Withdrawals-Sofia Accounts Payable Interest Revenue Depreciation Expense Salary Expense Cash Note Payable Cost of Goods Sold Capital-Sofia Capital-Sofia 222,000 98,000 23,000 369,000 90,000 20.000 3,000 27.000 120,000 35.000 95.000 825,000 591.000 SAICS Revenue Prepaid Insurance Service Revenue 49,000 Totals ,706,000 $1,706,000 repare the 4 year-end closing journal entries (5 pts. per J/E, total Problem (1.) From the ab 20 pts.) Sofia Retail Pocketbook Store Adjusted Trial Balance Dec. 31, 2019 Debit $300,000 Credit $58,000 125,000 222,000 98,000 23,000 369,000 90,000 Merchandise Inventory Uneamed Sales Revenue Accumulated Depreciation-Building Accounts Receivable Rent Expense Insurance Expense Building Withdrawals-Sofia Accounts Payable Interest Revenue Depreciation Expense Salary Expense Cash Note Payable Cost of Goods Sold Capital-Sofia Sales Revenue Prepaid Insurance Service Revenue 20,000 3,000 27,000 120,000 50,000 35,000 394,000 825,000 591,000 13,000 49,000 Totals $1,706,000 $1,706,000 Problem (L.) From the above prepare the 4 year-end closing journal entries (5 pts. per J/E, total 20 pts.) Problem (II.) From the above prepare: 10pts.) A. a list of the Liabilities, no dollars needed-5 pts. B. a list of Assets, no dollars needed - 5 pts. Problem (III.) For the following transactions prepare the journal entry. (5 pt. cach, total of 50 pts.) Company uses a perpetual inventory system!!!!! 1. Purchased $350,000 of merchandise inventory on account from ABC Manufacturing Co.. purchase terms 4/10 n/30, FOB Shipping. 2. Paid a shipping company $1,200 to deliver the above Merchandise Inventory to our store. 3. The business owner took 55,500 of merchandise inventory home to give as a gift to his wife. 4. Purchased S680,000 of merchandise inventory, we paid in cash. 5. Sale to customer Elmo on account $400,000, sales terms 3/15 n/30, cost of goods sold is $195.000 6. Made a $10,000 sale to Paul/cost of goods is $4,000, but instead of Paul paying us cash we agreed that today he would fix our plumbing at a cost of S10,000 7. Some of the merchandise purchased from ABC Manufacturing in l. above was the wrong color, we kept the merchandise BUT ABC Manufacturing agreed to decrease/lower the purchase price by S7.000. 8. We paid ABC Manufacturing Co, the amount due within the 10-day terms. 9. From 5. above Elmo was not totally happy with the sale we made to him & he did not want to return the sale but to keep our customer happy we reduced the sales price by $2,000. 10. From Elmo we received the amount duo, he did NOT pay us within the 15 day terms. Problem (IV.) Monica Shoe Retail Store (20 pts.) Jan. 1. 2018 beginning merchandise inventory 9,400 shoes at $35 each Jan. 13 2018 Purchased merchandise inventory 3.000 shoes at $38 cach Jan. 18 2018 Purchased merchandise inventory 7,000 shoes at $40 each Jan. 26 2018 Purchased merchandise inventory 6,000 shoes at $43 cach During the January 2018 month we sold 18,000 shoes for S130 each. Calculate using LIFO the Cost of Goods Sold? (15 pts.) What was the Gross Profit? (5 pts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts