Question: sol Problem 7-22 Activity Rates and Activity-Based Management (LO2, LO3] Onassis Catering is a Greek company that provides passenges and crew meals to airlines operating

![sol Problem 7-22 Activity Rates and Activity-Based Management (LO2, LO3] Onassis Catering](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66fb2e710c702_45666fb2e709f83c.jpg)

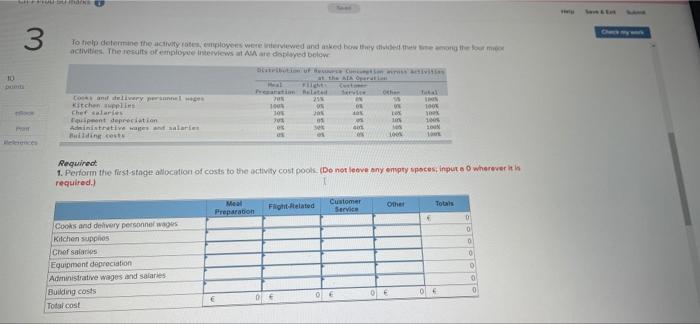

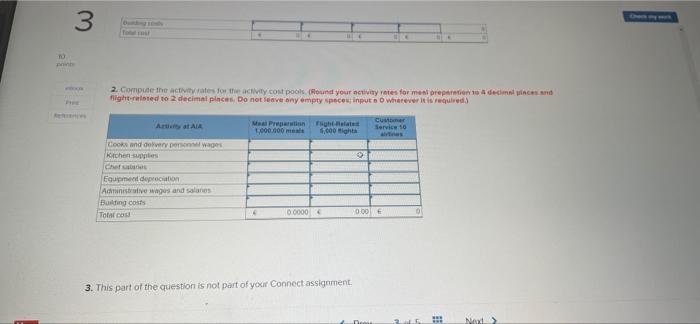

Problem 7-22 Activity Rates and Activity-Based Management (LO2, LO3] Onassis Catering is a Greek company that provides passenges and crew meals to airlines operating out of two international airports in Athens and Corfu. The operations at the two airports are managed separately, and top management believes that there may be benefits to greater sharing of information between the two operations. To better compare the two operations, an ABC system has been designed with the active participation of the managers at both airports. The ABC system is based on the following activity cost pools and activity measures: Activity Cest Pool Heal preparation Activity Measure Number of meals. umber of flights Flight related activities Customer service Humber of customers Other (costs of idle capacity and organization-sustaining costs) NA The operation at Athens International Airport (AIA) serves 1 million meals annually on 5,000 fights for 10 different airlines (Each airline is considered one customer) The annual cost of running the AIA airport operation, excluding only the costs of raw materials for meals, totals 4,193,000. (Note: The currency in Greece is the euro, denoted by ) Annual Cost of the AIA Operation Cooks and delivery personnel wages Kitchen supplies Chef salaries Equipment depreciation 3,300,000 45,500 270,000 105,000 262,5007 Administrative wages and salaries Building costs 210,000 4,193,000 Total cost Bank By 10 CAFFOL marks 3 P To help determine the activity rates, employees were interviewed and asked how they divided the time among the four mo activities. The results of employee Interviews at ASA are displayed below Distribution of Contiviti other Total at the ALA Operation Heal RIIGM Preparation Belated Mevic 70% 21% 100% ON 20% IN 54 Cooks and delivery personnel ages kitchen supplies Chef salaries THIN OR UN 100% 306 40% Lex 100% Equipment depreciation 70% 0505 100% 100 es 30% Administrative wages and salaries Building costs 40% 306 100% Os Os en 1000 100 Required: 1. Perform the first-stage allocation of costs to the activity cost pools. (Do not leave any empty spaces; input a 0 wherever it is required.) X Meal Preparation Fight-Related Customer Service Other Totals 16 Cooks and delivery personnel wages Kitchen supplies Chef salarios Equipment depreciation Administrative wages and salaries Building costs Total cost 0 06 0 0 0 0 0 0 0 TH S&st 3 To cust ook 2. Compute the activity rates for the activity cost pools, (Round your activity rates for meal preparation to & decimal pinces and flight-related to 2 decimal places. Do not leave any empty spaces; input a O wherever it is required.) Activity at AIA Meal Preparation 1.000.000 meals Fight-Related 5,000 fight Customer Service 10 Cooks and delivery personnel wages Kitchen supplies Chef salaries Equipment depreciation Administrative wages and salaries Building costs 4 0.0000 Total cost 3. This part of the question is not part of your Connect assignment. 10 print 0.00 # Next >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts