Question: Solar Energy Corp. has to value a project that will run for 3 years. The company has already spent $10 million on research and development

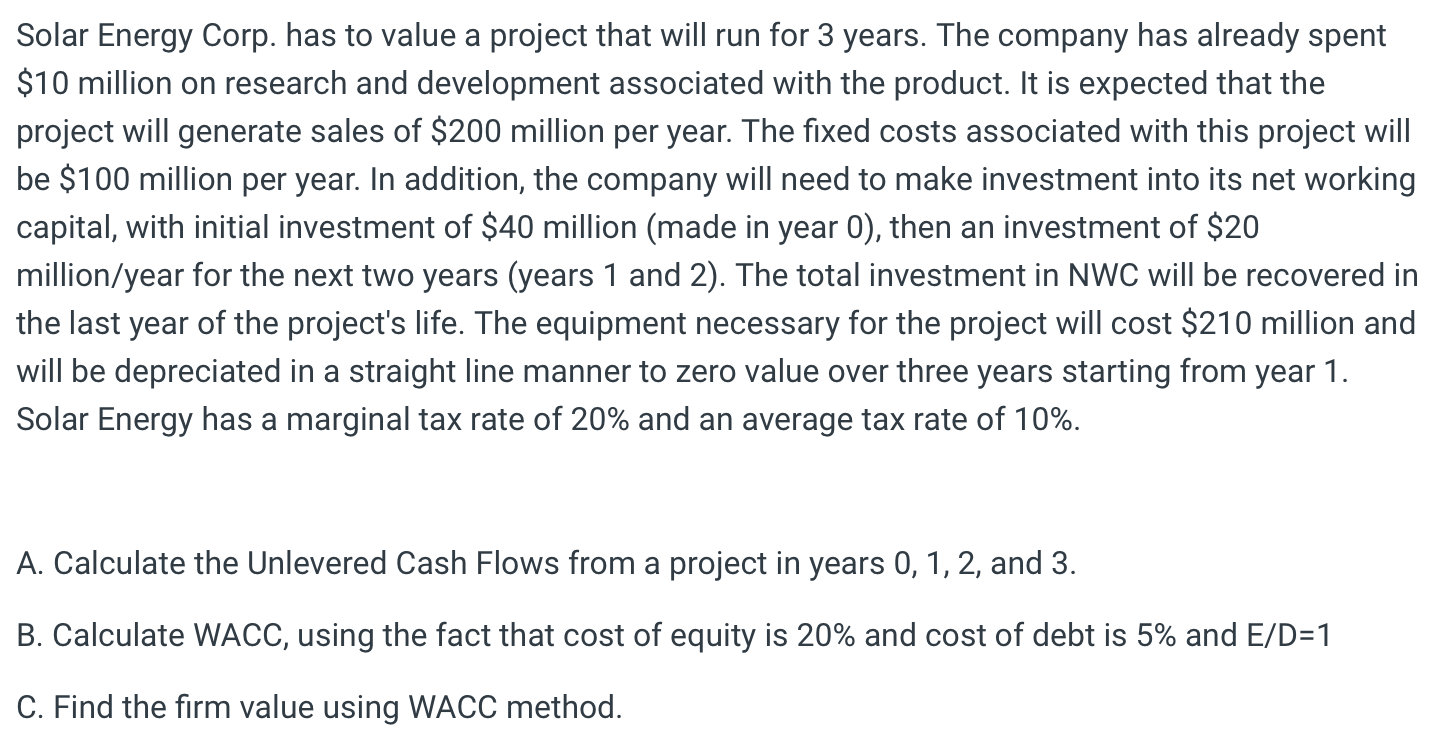

Solar Energy Corp. has to value a project that will run for 3 years. The company has already spent $10 million on research and development associated with the product. It is expected that the project will generate sales of $200 million per year. The fixed costs associated with this project will be $100 million per year. In addition, the company will need to make investment into its net working capital, with initial investment of $40 million (made in year 0), then an investment of $20 million/year for the next two years (years 1 and 2). The total investment in NWC will be recovered in the last year of the project's life. The equipment necessary for the project will cost $210 million and will be depreciated in a straight line manner to zero value over three years starting from year 1. Solar Energy has a marginal tax rate of 20% and an average tax rate of 10%. A. Calculate the Unlevered Cash Flows from a project in years 0, 1, 2, and 3. B. Calculate WACC, using the fact that cost of equity is 20% and cost of debt is 5% and E/D=1 C. Find the firm value using WACC method. Solar Energy Corp. has to value a project that will run for 3 years. The company has already spent $10 million on research and development associated with the product. It is expected that the project will generate sales of $200 million per year. The fixed costs associated with this project will be $100 million per year. In addition, the company will need to make investment into its net working capital, with initial investment of $40 million (made in year 0), then an investment of $20 million/year for the next two years (years 1 and 2). The total investment in NWC will be recovered in the last year of the project's life. The equipment necessary for the project will cost $210 million and will be depreciated in a straight line manner to zero value over three years starting from year 1. Solar Energy has a marginal tax rate of 20% and an average tax rate of 10%. A. Calculate the Unlevered Cash Flows from a project in years 0, 1, 2, and 3. B. Calculate WACC, using the fact that cost of equity is 20% and cost of debt is 5% and E/D=1 C. Find the firm value using WACC method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts