Question: Solarcell Corporation has $20,000 which it plans to invest in marketable securities. It is choosing between AT&T bonds which yield 11 percent, State of Florida

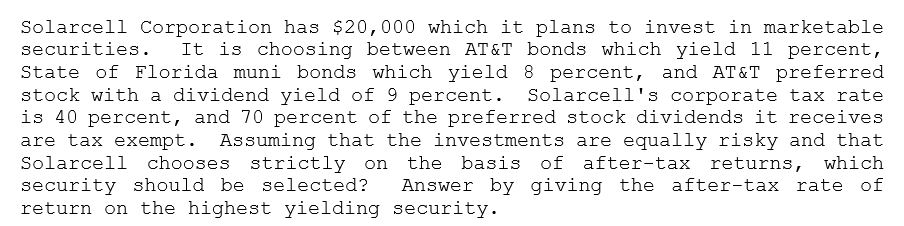

Solarcell Corporation has $20,000 which it plans to invest in marketable securities. It is choosing between AT&T bonds which yield 11 percent, State of Florida muni bonds which yield 8 percent, and AT&T preferred stock with a dividend yield of 9 percent. Solarcell's corporate tax rate is 40 percent, and 70 percent of the preferred stock dividends it receives are tax exempt. Assuming that the investments are equally risky and that Solarcell chooses strictly on the basis of after-tax returns, which security should be selected? Answer by giving the after-tax rate of return on the highest yielding security

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts