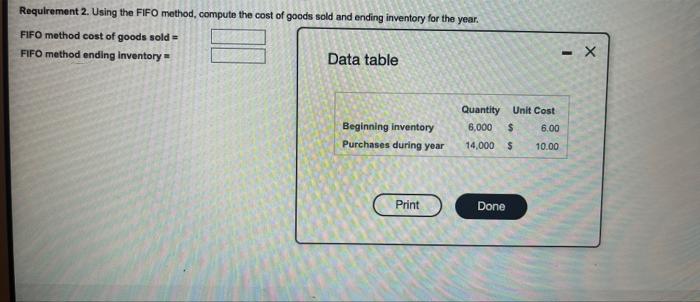

Question: sold 18,100 units during the year Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. FIFO

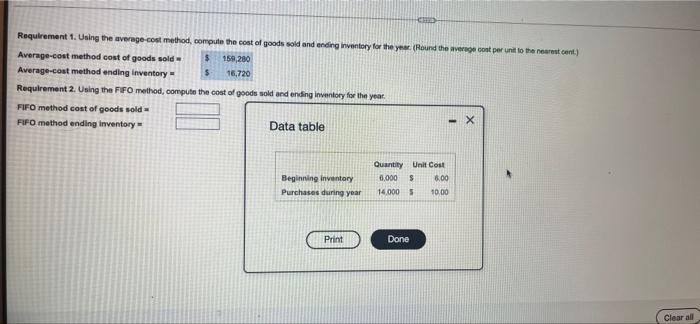

Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. FIFO method cost of goods sold = FIFO method ending Inventory Data table - X Beginning inventory Purchases during year Quantity Unit Cost 6,000 $ 6.00 14.000 $ 10.00 Print Done Requirement 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. (Round the average cont per unit to the nearest Average-cost method cost of goods sold $ 159,280 Average-cost method ending Inventory 16,720 Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year FIFO method cost of goods sold FIFO method ending inventory Data table Beginning inventory Purchases during year Quantity Unit Cout 6,000 S 8.00 14.000 10.00 Print Done Clear all Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year. FIFO method cost of goods sold = FIFO method ending Inventory Data table - X Beginning inventory Purchases during year Quantity Unit Cost 6,000 $ 6.00 14.000 $ 10.00 Print Done Requirement 1. Using the average-cost method, compute the cost of goods sold and ending inventory for the year. (Round the average cont per unit to the nearest Average-cost method cost of goods sold $ 159,280 Average-cost method ending Inventory 16,720 Requirement 2. Using the FIFO method, compute the cost of goods sold and ending inventory for the year FIFO method cost of goods sold FIFO method ending inventory Data table Beginning inventory Purchases during year Quantity Unit Cout 6,000 S 8.00 14.000 10.00 Print Done Clear all

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts