Question: Sold 2 2 robots for $ 8 2 5 0 each on account, terms 2 / 1 0 , n / 3 0 , FOB

Sold robots for $ each on account, terms n FOB Shipping Point, the company uses FIFO to find the cost of goods sold. Record the sales revenue first.

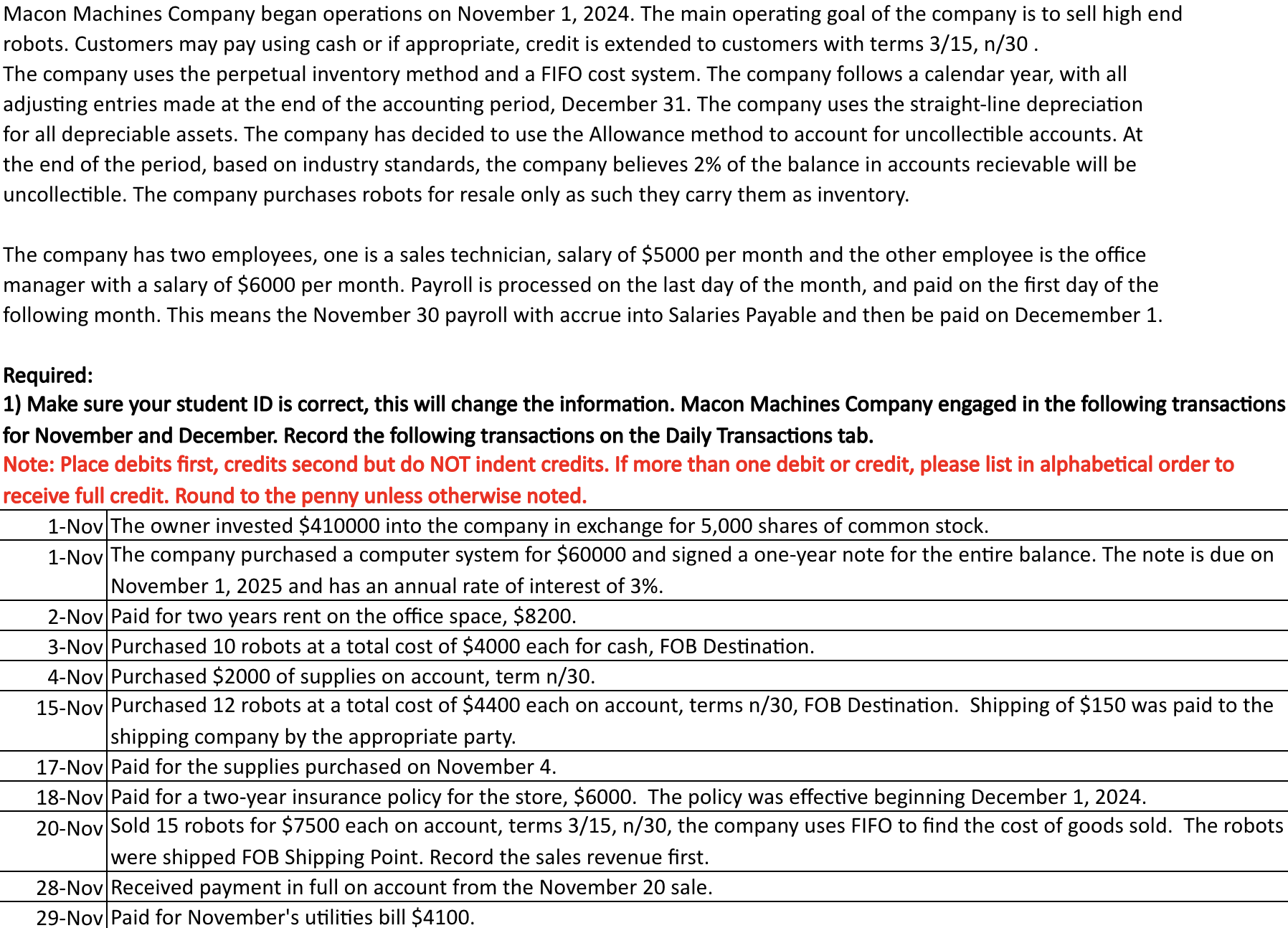

I have tried and Nothing is working. Please help me Also if you could do the last one dec st that would be very slay

Prepared payroll for the month of November, the first payroll for the company. Record the Salares Expense entry first. The tax

rates are as follows:

Federal Income Tax Rate

NC State Income Tax Rate

FICA Tax Rate

Unemployment Tax Rate on the first $ of each employees earnings per year.

The company borrowed $ from Bank of America by signing a year, note. The note requires annual payments of

$ beginning December

Sold robots for $ each on account, terms n FOB Shipping Point, the company uses FIFO to find the cost of

goods sold. Record the sales revenue first.

Prepared payroll for the month of December, the first payroll for the company. Record the Salaries Expense entry first. The

tax rates are as follows:

Federal Income Tax Rate

NC State Income Tax Rate

FICA Tax Rate

Unemployment Tax Rate on the first $ of each employees earnings per year.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock