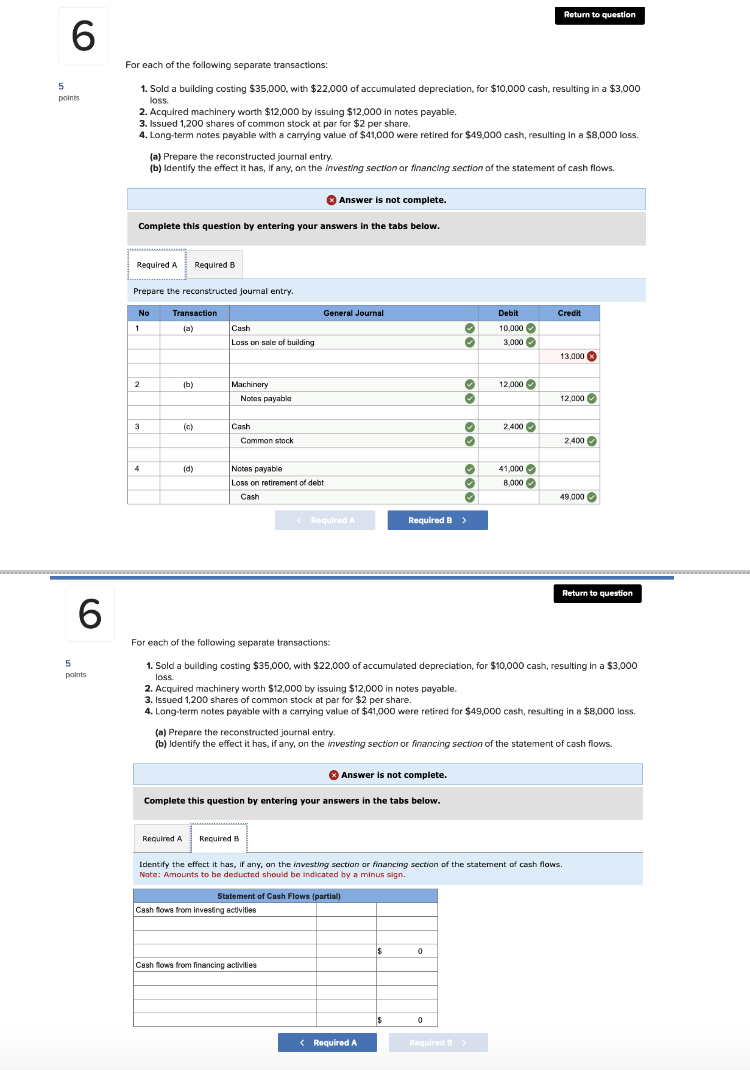

Question: Sold a building costing $ 3 5 , 0 0 0 , with $ 2 2 , 0 0 0 of accumulated depreciation, for $

Sold a building costing $ with $ of accumulated depreciation, for $ cash, resulting in a $

loss.

Acquired machinery worth $ by issuing $ in notes payable.

Issued shares of common stock at par for $ per share.

Longterm notes payable with a carrying value of $ were retired for $ cash, resulting in a $ loss.

a Prepare the reconstructed journal entry.

b Identify the effect it has, if any, on the investing section or financing section of the statement of cash flows.

Answer is not complete.

Complete this question by entering your answers in the tabs below.

Identify the effect it has, if any, on the investing section ar financing section of the statement of cash flows.

Note: Amounts to be deducted should be indicated by a minus sign.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock