Question: Sold the motorcycle Objective 6: The example above, we assumed that JUSED is using a Direct write-off method. Let's assume JUSED uses the Allowance method

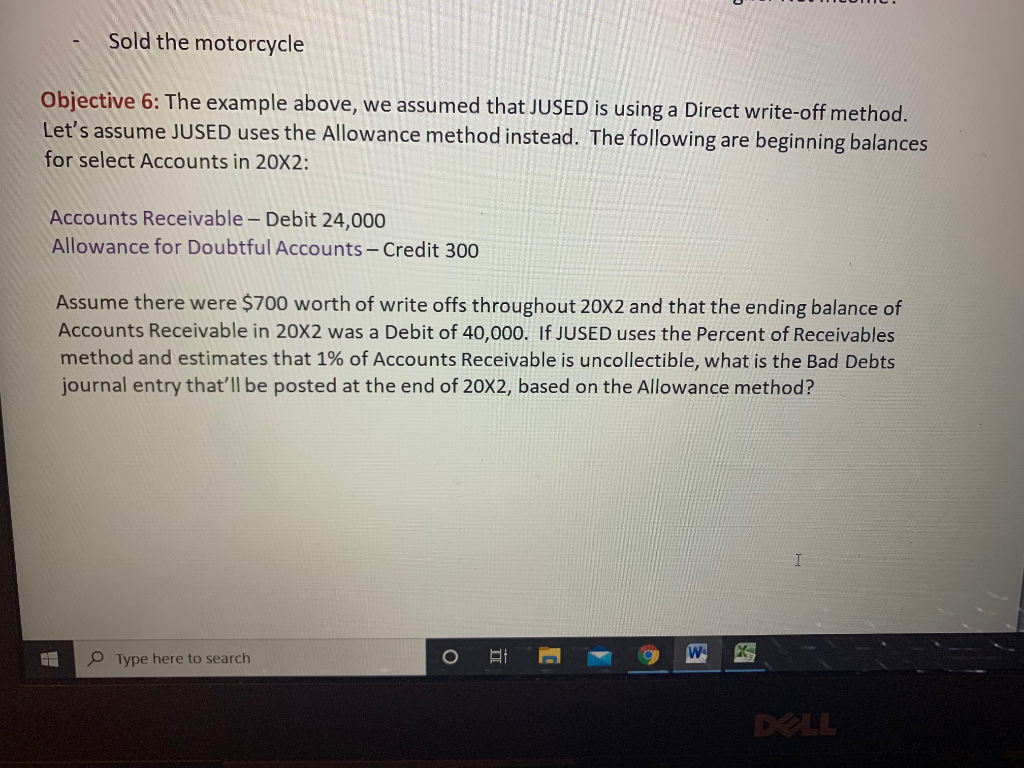

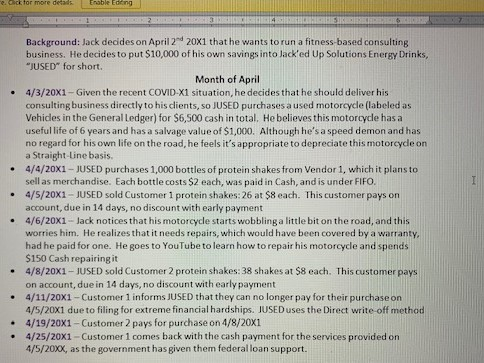

Sold the motorcycle Objective 6: The example above, we assumed that JUSED is using a Direct write-off method. Let's assume JUSED uses the Allowance method instead. The following are beginning balances for select Accounts in 20X2: Accounts Receivable - Debit 24,000 Allowance for Doubtful Accounts - Credit 300 Assume there were $700 worth of write offs throughout 20x2 and that the ending balance of Accounts Receivable in 20x2 was a Debit of 40,000. If JUSED uses the Percent of Receivables method and estimates that 1% of Accounts Receivable is uncollectible, what is the Bad Debts journal entry that'll be posted at the end of 20x2, based on the Allowance method? Type here to search DLL Background: Jack decides on April 2 20x1 that he wants to run a fitness based consulting business. He decides to put $10,000 of his own savings into lacked Up Solutions Energy Drinks, "JUSED" for short. Month of April 4/3/20X1-Given the recent COVID-XI situation, he decides that he should deliver his consulting business directly to his clients, so JUSED purchases a used motorcycle (labeled as Vehicles in the General Ledger) for $6,500 cash in total. He believes this motorcycle has a useful life of 6 years and has a salvage value of $1,000. Although he's a speed demon and has no regard for his own life on the road, he feels it's appropriate to depreciate this motorcycle on a Straight-Line basis. 4/4/20x1 - JUSED purchases 1,000 bottles of protein shakes from Vendor 1, which it plans to sell as merchandise. Each bottle costs $2 each, was paid in Cash, and is under FIFO 4/5/20X1 - JUSED sold Customer 1 protein shakes: 26 at $8 each. This customer pays on account, due in 14 days, no discount with early payment 4/6/20x1 - Jack notices that his motorcycle starts wobbling a little bit on the road, and this worries him. He realizes that it needs repairs, which would have been covered by a warranty had he paid for one. He goes to YouTube to learn how to repair his motorcycle and spends $150 Cash repairingit 4/8/20X1-JUSED sold Customer 2 protein shakes: 38 shakes at $8 each. This customer pays on account, due in 14 days, no discount with early payment 4/11/20X1 - Customer 1 informs JUSED that they can no longer pay for their purchase on 4/5/20X1 due to filing for extreme financial hardships. JUSED uses the Direct write off method 4/19/20X1 - Customer 2 pays for purchase on 4/8/20X1 4/25/20x1 - Customer 1 comes back with the cash payment for the services provided on 4/5/20XX, as the government has given them federal loan support. .

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts