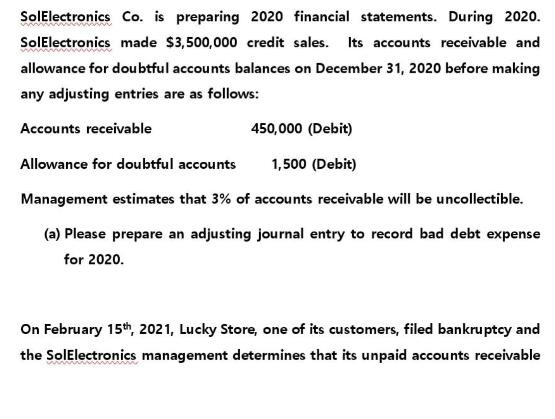

Question: SolElectronics Co. is preparing 2020 financial statements. During 2020. SolElectronics made $3,500,000 credit sales. Its accounts receivable and allowance for doubtful accounts balances on

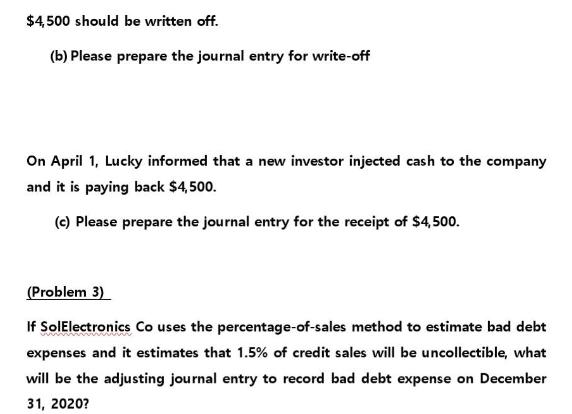

SolElectronics Co. is preparing 2020 financial statements. During 2020. SolElectronics made $3,500,000 credit sales. Its accounts receivable and allowance for doubtful accounts balances on December 31, 2020 before making any adjusting entries are as follows: Accounts receivable 450,000 (Debit) Allowance for doubtful accounts 1,500 (Debit) Management estimates that 3% of accounts receivable will be uncollectible. (a) Please prepare an adjusting journal entry to record bad debt expense for 2020. On February 15th, 2021, Lucky Store, one of its customers, filed bankruptcy and the SolElectronics management determines that its unpaid accounts receivable $4,500 should be written off. (b) Please prepare the journal entry for write-off On April 1, Lucky informed that a new investor injected cash to the company and it is paying back $4,500. (c) Please prepare the journal entry for the receipt of $4,500. (Problem 3) If SolElectronics Co uses the percentage-of-sales method to estimate bad debt expenses and it estimates that 1.5% of credit sales will be uncollectible, what will be the adjusting journal entry to record bad debt expense on December 31, 2020?

Step by Step Solution

3.41 Rating (151 Votes )

There are 3 Steps involved in it

2a Under percentageofreceivable method or aging of receivables method estimated bad debt at the end ... View full answer

Get step-by-step solutions from verified subject matter experts