Question: Solid Footing 15e Chapter 10 Accounting Cycle Project 15 July 2023 begin{tabular}{|r|} hline Lenny's Lawn Service, Inc. - General Ledger hline end{tabular} begin{tabular}{|l|l|l|l|r|r|r|} hline

Solid Footing 15e Chapter 10 Accounting Cycle Project 15 July 2023

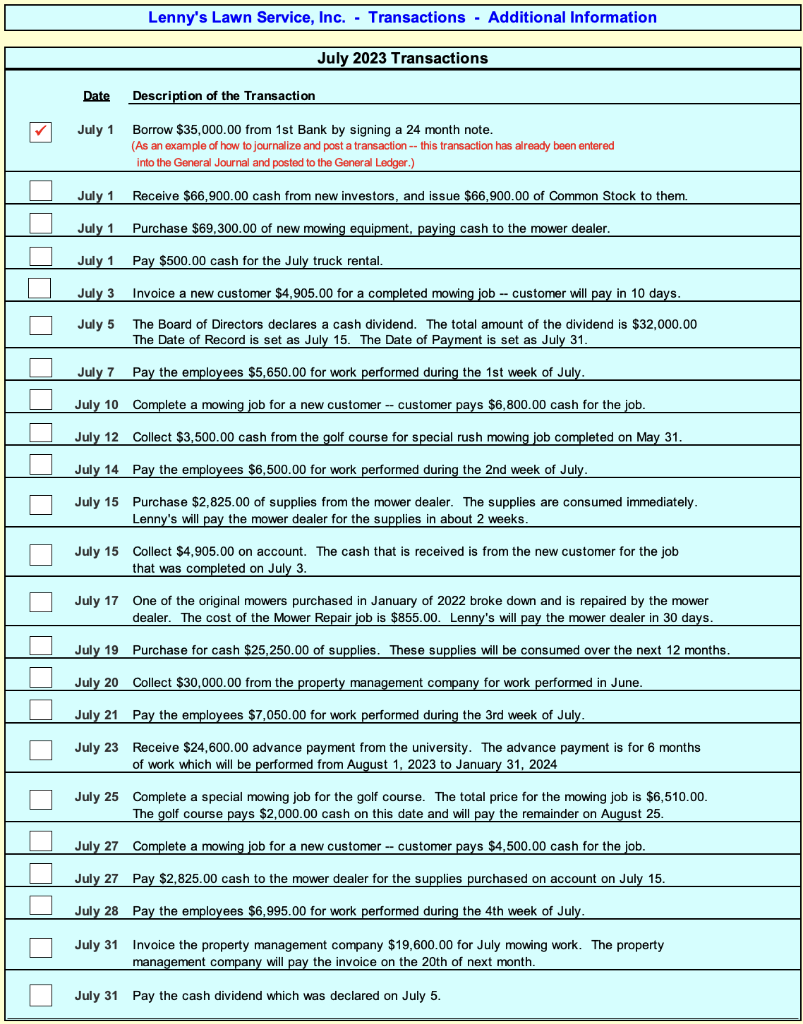

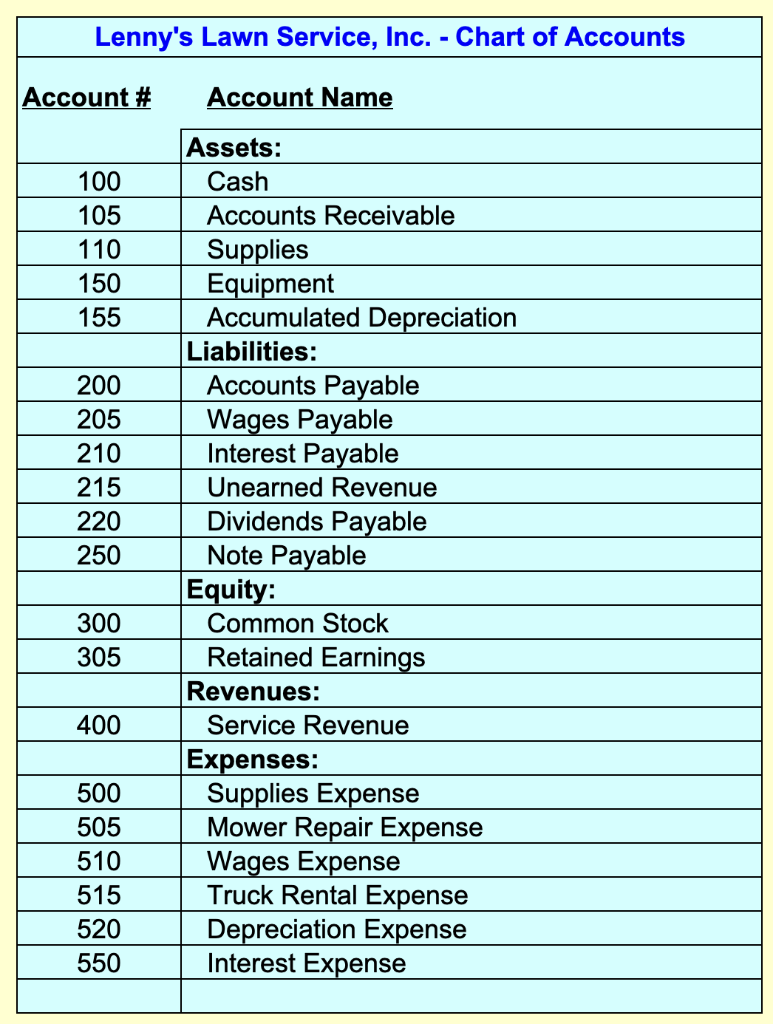

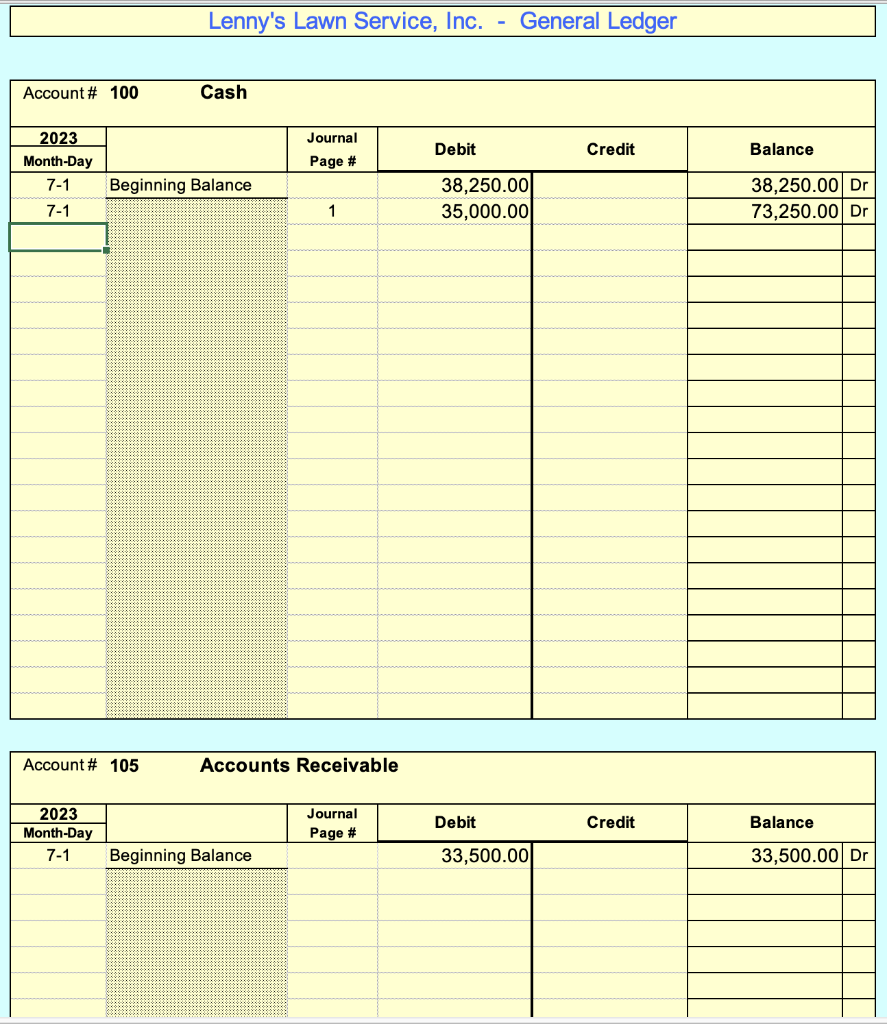

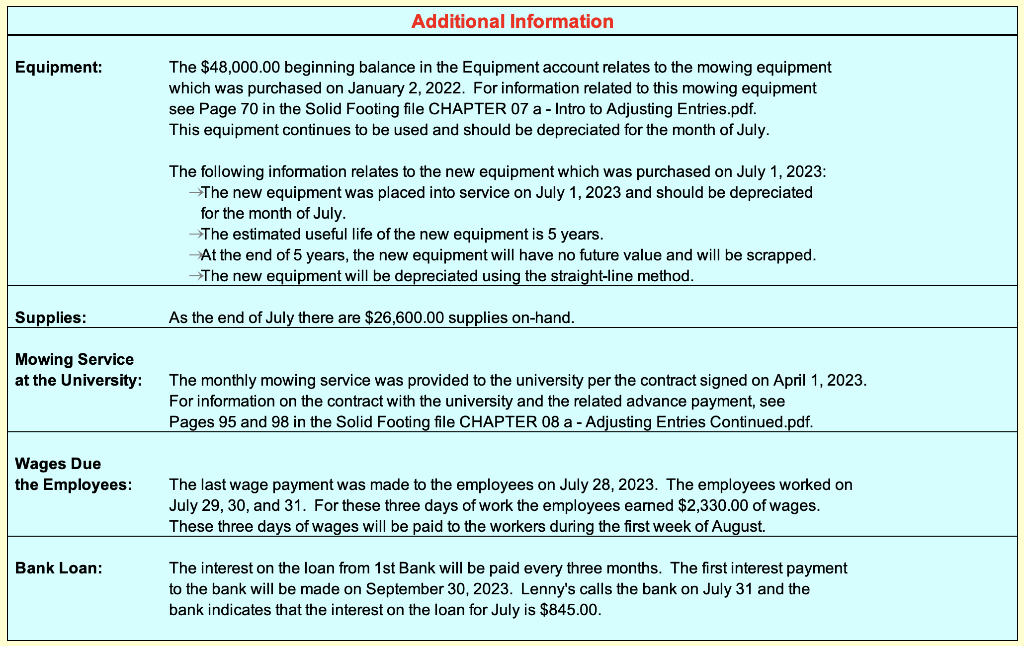

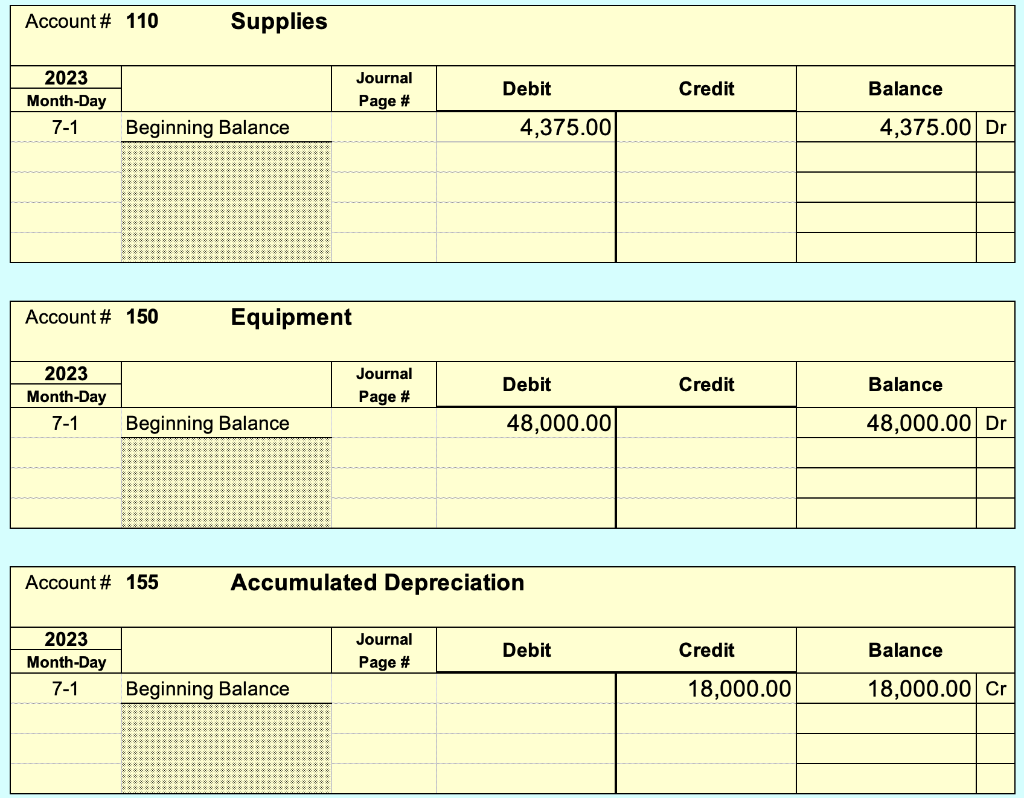

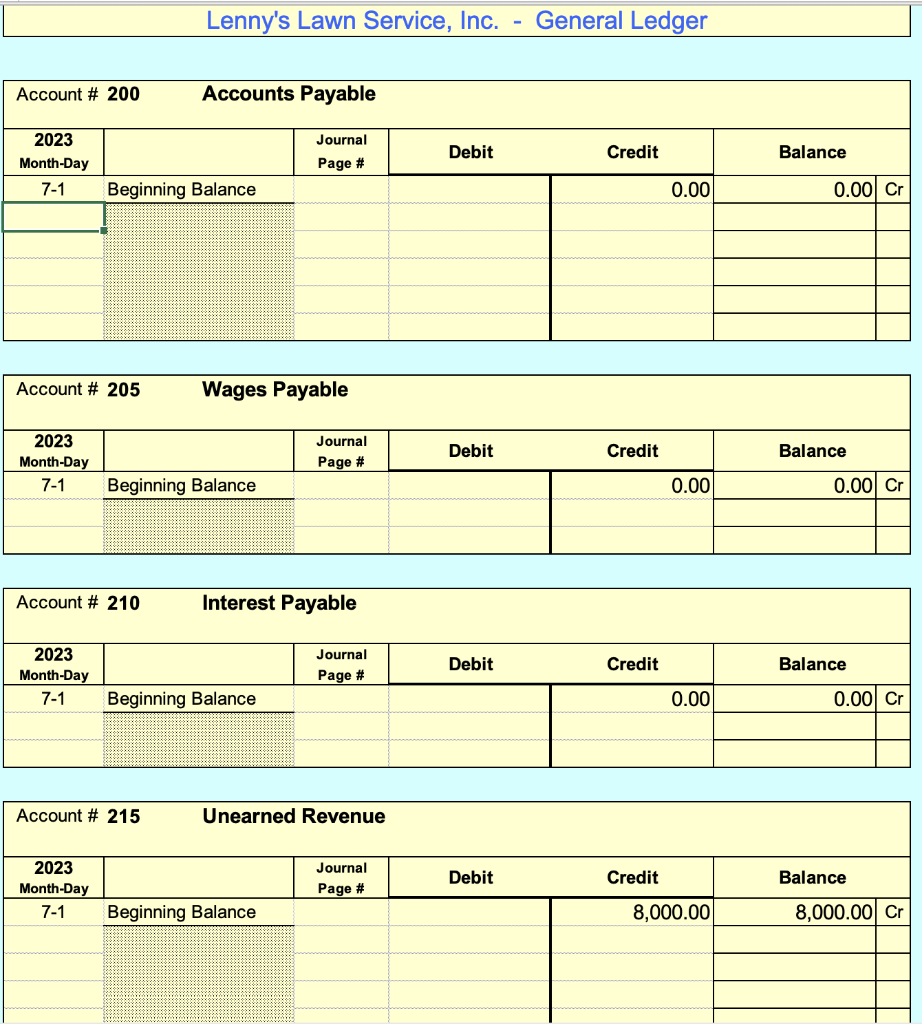

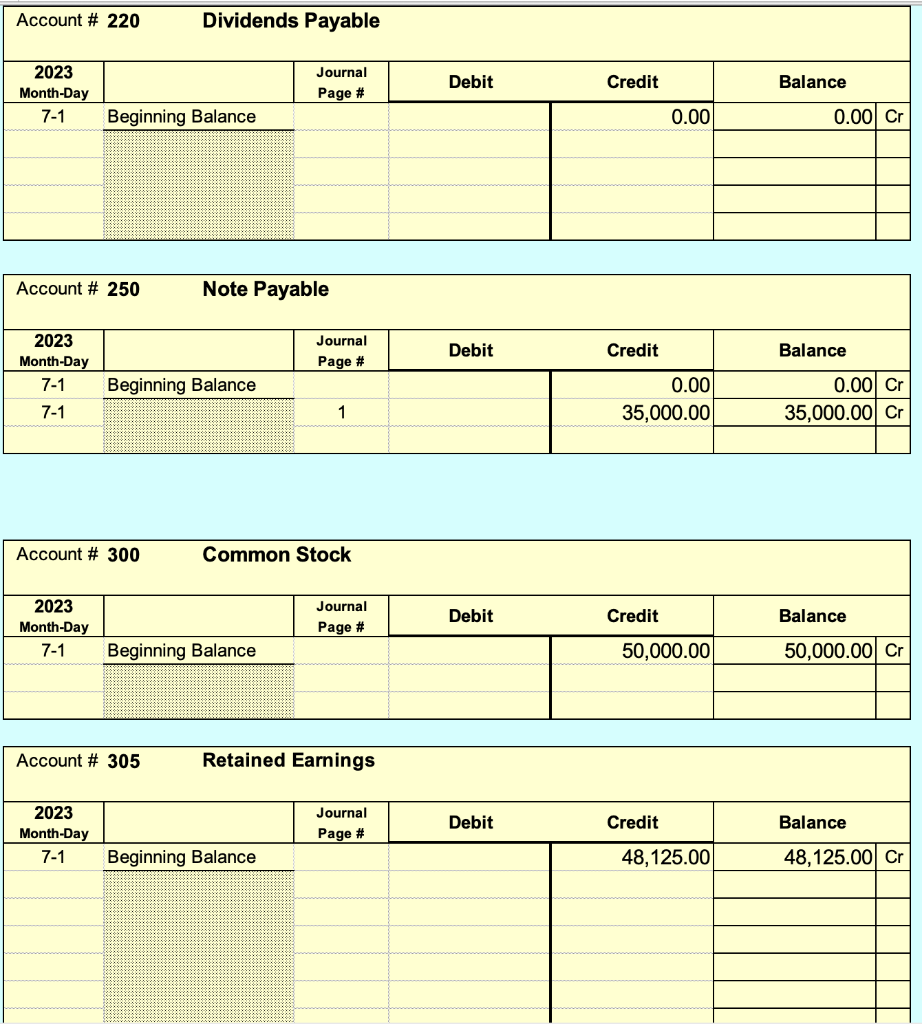

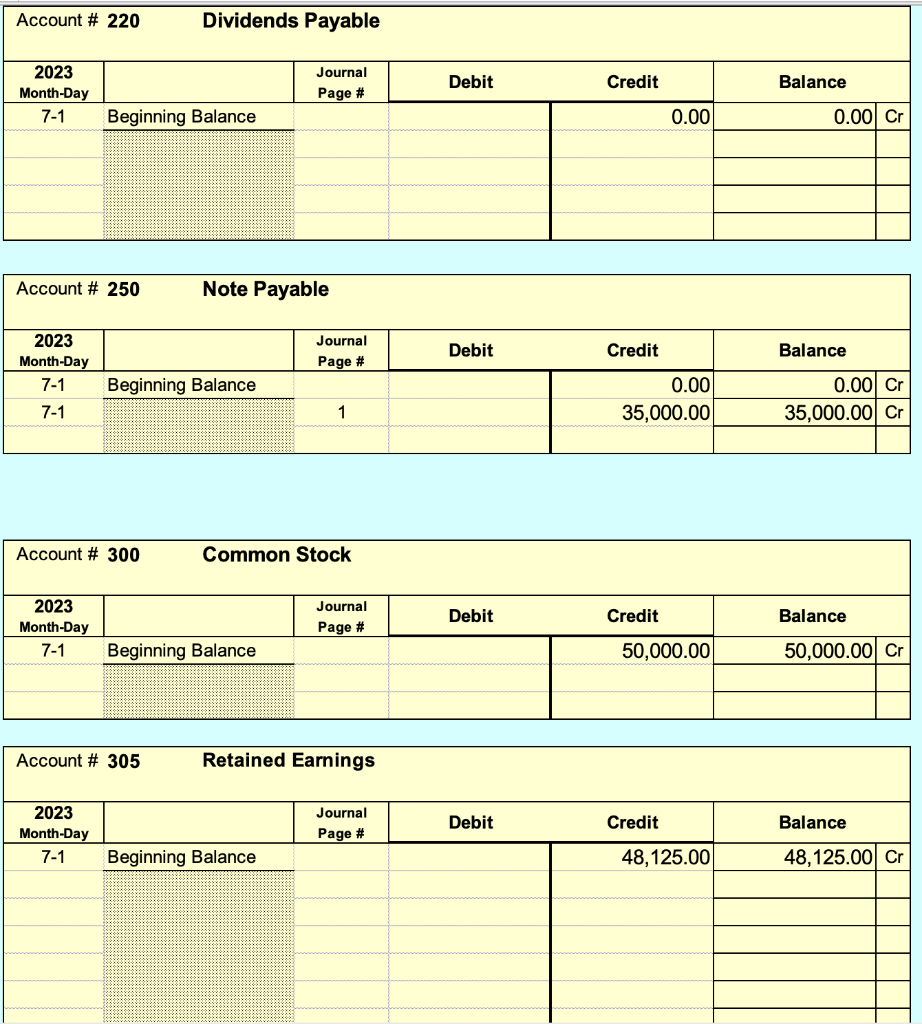

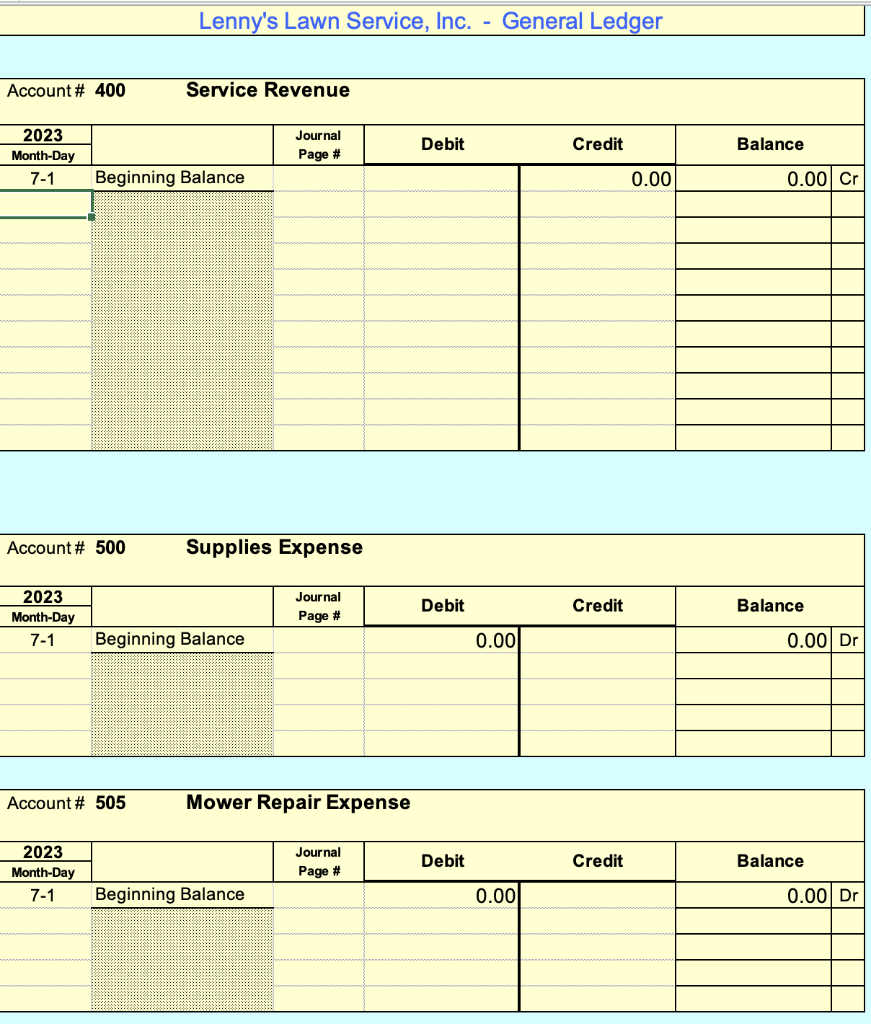

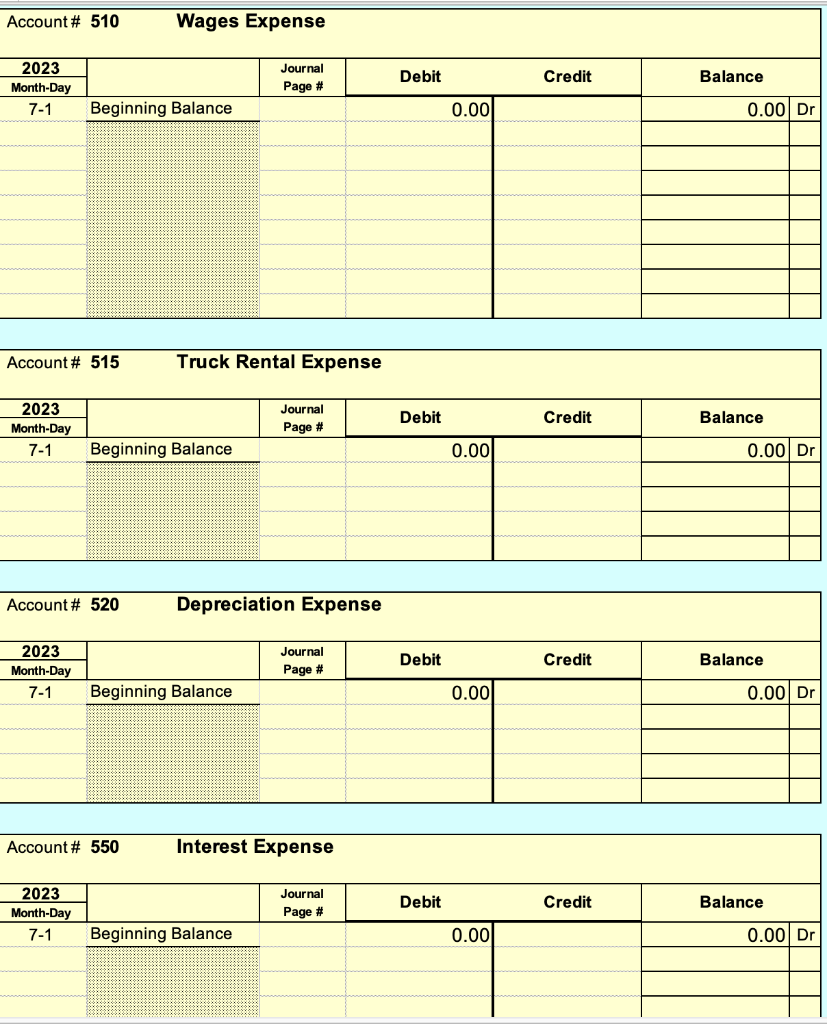

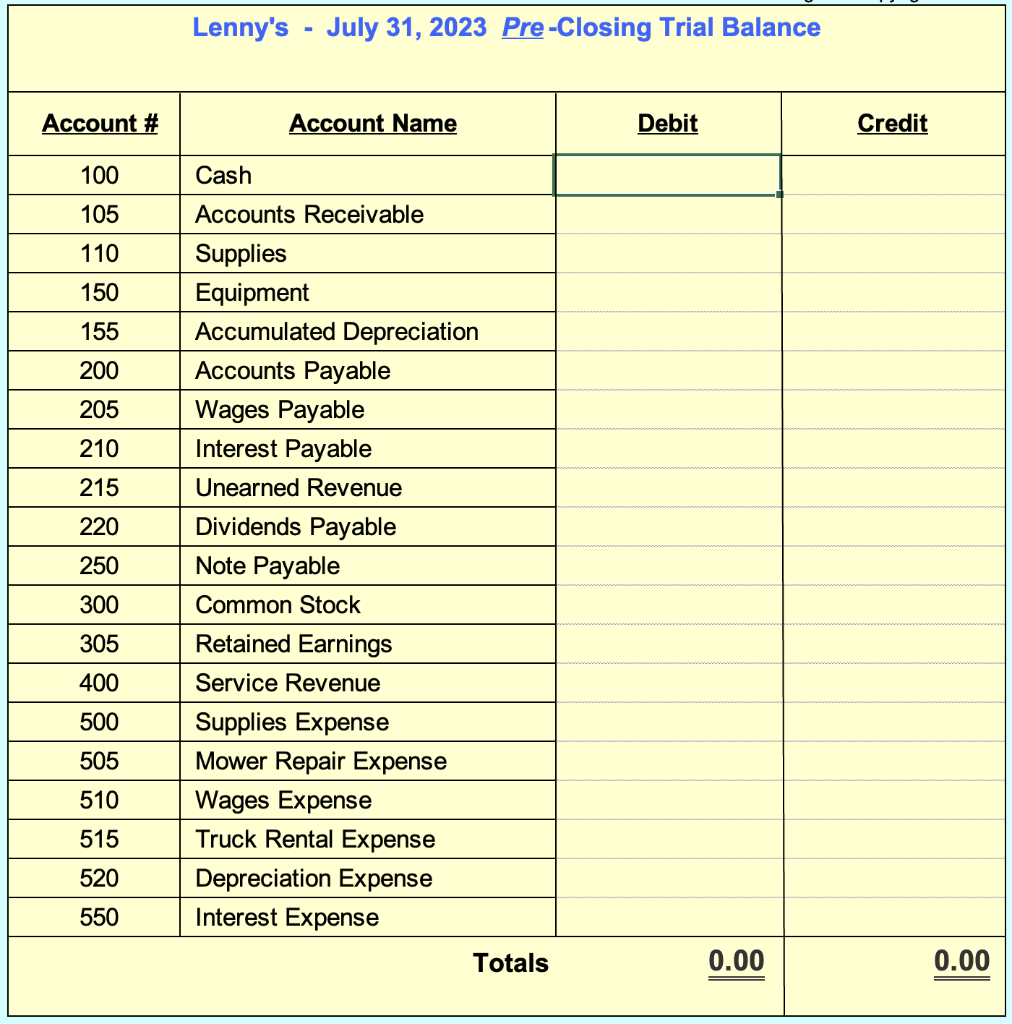

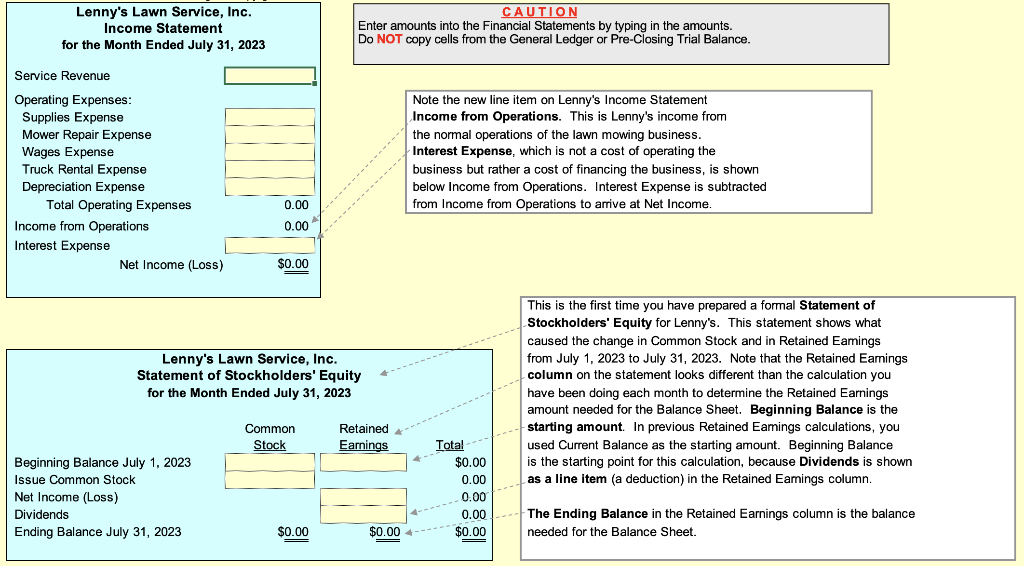

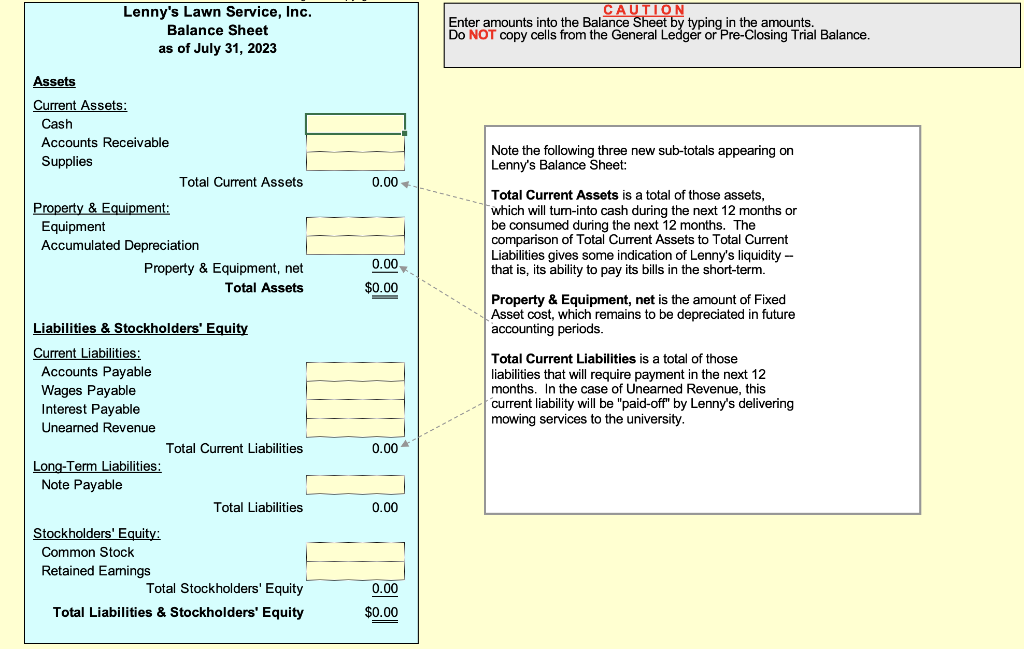

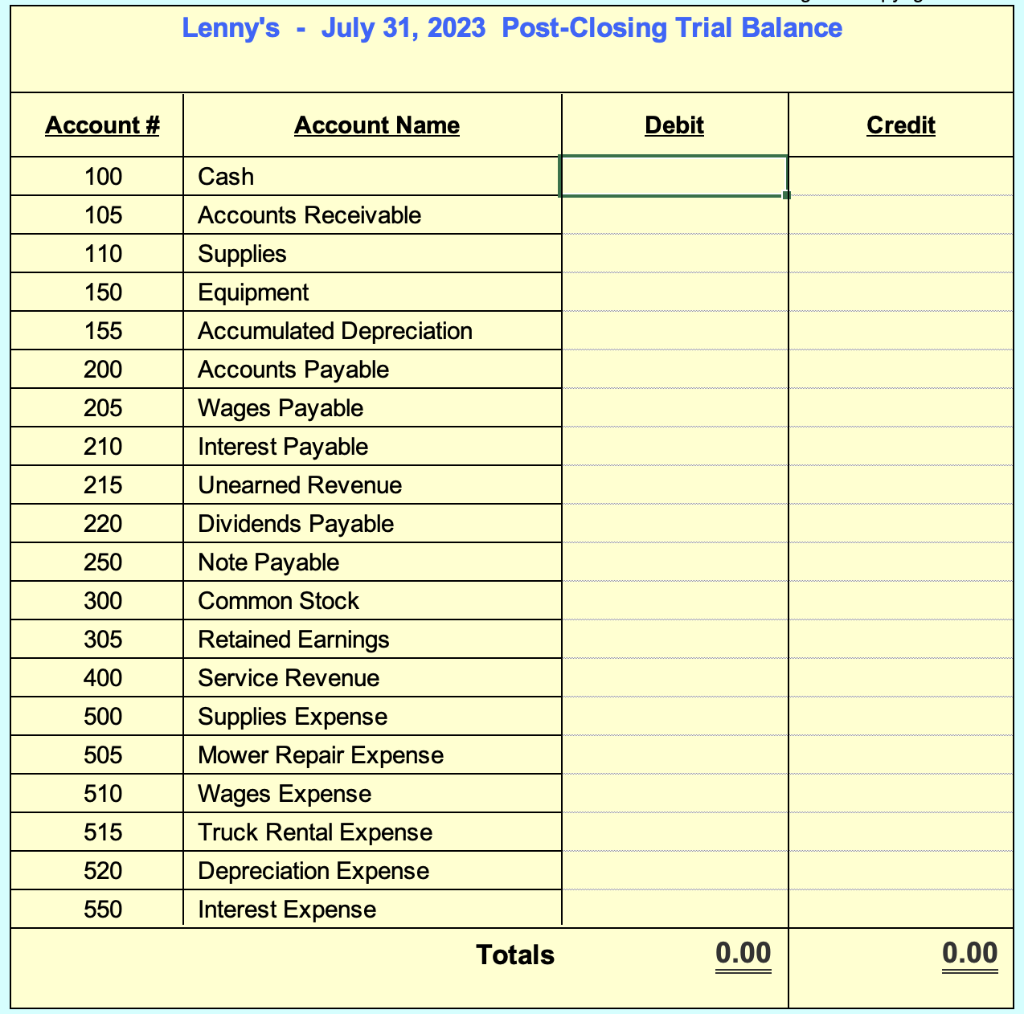

\begin{tabular}{|r|} \hline Lenny's Lawn Service, Inc. - General Ledger \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|r|r|r|} \hline \multicolumn{2}{|l|}{ Account \# 205 Wages Payable } \\ \hline \begin{tabular}{c|c|c|c|c|} \hline 2023 \\ Month-Day \end{tabular} & JournalPage# & Debit & Credit & Balance \\ \hline 71 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Account \# 210 Interest Payable } \\ \hline \begin{tabular}{c|c|c|c|c|} \hline 2023 \\ Month-Day \end{tabular} & JournalPage# & Debit & Credit & Balance \\ \hline 71 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|r|r|r|} \hline \multicolumn{2}{|c|}{ Account \# 300 Common Stock } & Credit & Balance \\ \hline 2023Month-Day & JournalPage# & Debit & Coly \\ \hline 71 & Beginning Balance & & & 50,000.00 & 50,000.00 & Cr \\ \hline \end{tabular} Lenny's Lawn Service, Inc. - General Ledger \begin{tabular}{|l|l|r|r|r|r|r|} \hline Account \# 500 Supplies Expense \\ \hline \end{tabular} Account \# 505 Mower Repair Expense Account \# 550 Interest Expense Enter amounts into the Balance Sheet by typing in the amounts. Do NOT copy cells from the General Ledger or Pre-Closing Trial Balance. Note the following three new sub-totals appearing on Lenny's Balance Sheet: Total Current Assets is a total of those assets, which will turn-into cash during the next 12 months or be consumed during the next 12 months. The comparison of Total Current Assets to Total Current Liabilities gives some indication of Lenny's liquidity that is, its ability to pay its bills in the short-term. Property \& Equipment, net is the amount of Fixed Asset cost, which remains to be depreciated in future accounting periods. Total Current Liabilities is a total of those liabilities that will require payment in the next 12 months. In the case of Unearned Revenue, this current liability will be "paid-off" by Lenny's delivering mowing services to the university. \begin{tabular}{|r|} \hline Lenny's Lawn Service, Inc. - General Ledger \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|r|r|r|} \hline \multicolumn{2}{|l|}{ Account \# 205 Wages Payable } \\ \hline \begin{tabular}{c|c|c|c|c|} \hline 2023 \\ Month-Day \end{tabular} & JournalPage# & Debit & Credit & Balance \\ \hline 71 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|} \hline \multicolumn{2}{|l|}{ Account \# 210 Interest Payable } \\ \hline \begin{tabular}{c|c|c|c|c|} \hline 2023 \\ Month-Day \end{tabular} & JournalPage# & Debit & Credit & Balance \\ \hline 71 & Beginning Balance & & & 0.00 & 0.00 & Cr \\ \hline & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|l|c|c|r|r|r|} \hline \multicolumn{2}{|c|}{ Account \# 300 Common Stock } & Credit & Balance \\ \hline 2023Month-Day & JournalPage# & Debit & Coly \\ \hline 71 & Beginning Balance & & & 50,000.00 & 50,000.00 & Cr \\ \hline \end{tabular} Lenny's Lawn Service, Inc. - General Ledger \begin{tabular}{|l|l|r|r|r|r|r|} \hline Account \# 500 Supplies Expense \\ \hline \end{tabular} Account \# 505 Mower Repair Expense Account \# 550 Interest Expense Enter amounts into the Balance Sheet by typing in the amounts. Do NOT copy cells from the General Ledger or Pre-Closing Trial Balance. Note the following three new sub-totals appearing on Lenny's Balance Sheet: Total Current Assets is a total of those assets, which will turn-into cash during the next 12 months or be consumed during the next 12 months. The comparison of Total Current Assets to Total Current Liabilities gives some indication of Lenny's liquidity that is, its ability to pay its bills in the short-term. Property \& Equipment, net is the amount of Fixed Asset cost, which remains to be depreciated in future accounting periods. Total Current Liabilities is a total of those liabilities that will require payment in the next 12 months. In the case of Unearned Revenue, this current liability will be "paid-off" by Lenny's delivering mowing services to the university

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts