Question: Solid Footing OPJ Mini Project. I have been trying to do this but somewhere along the way i get a wrong calculation or I had

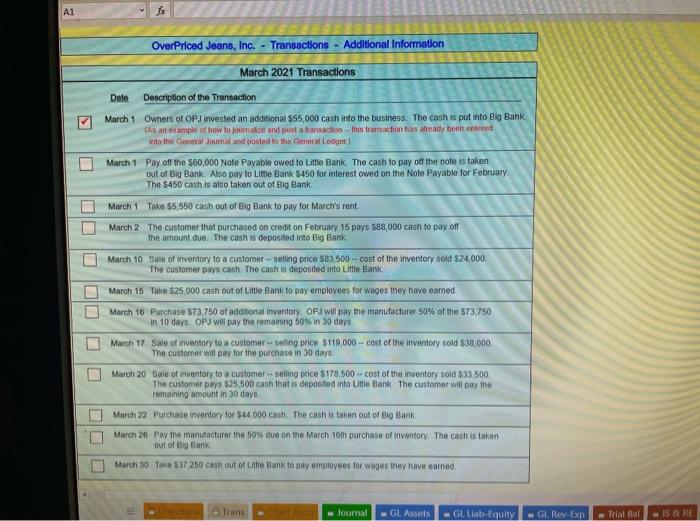

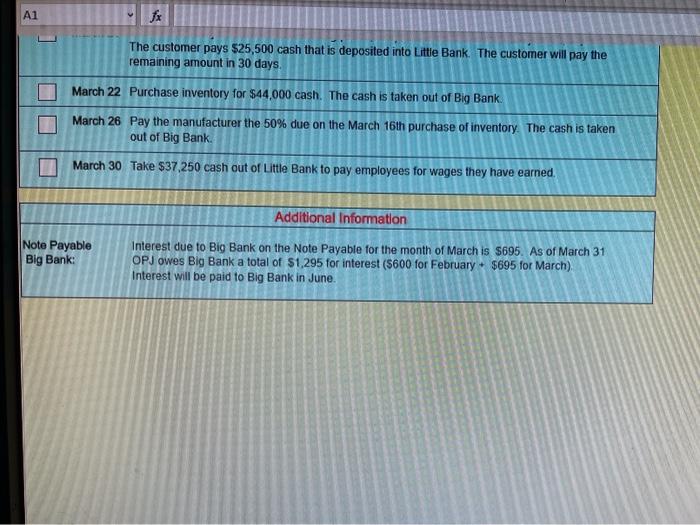

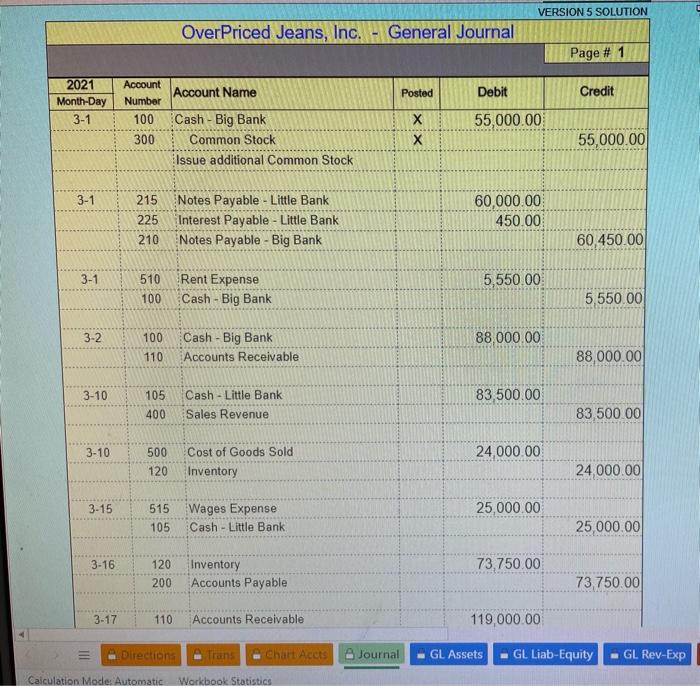

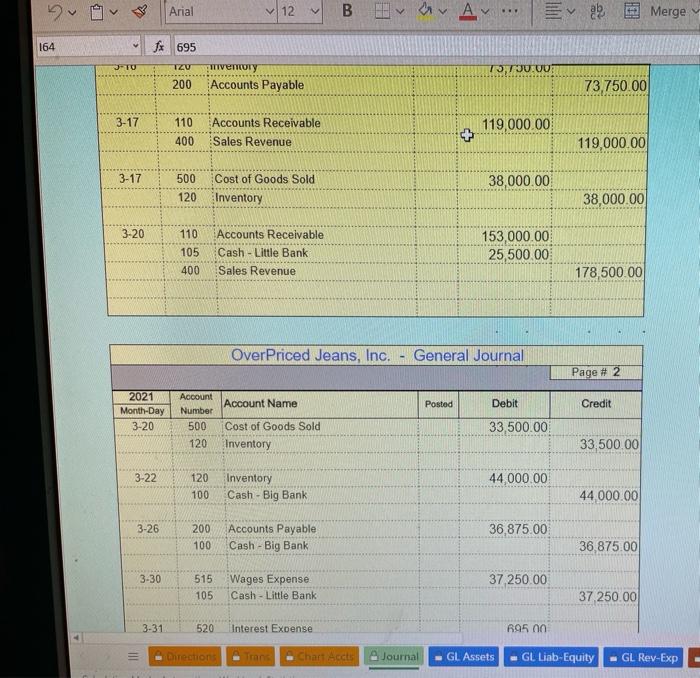

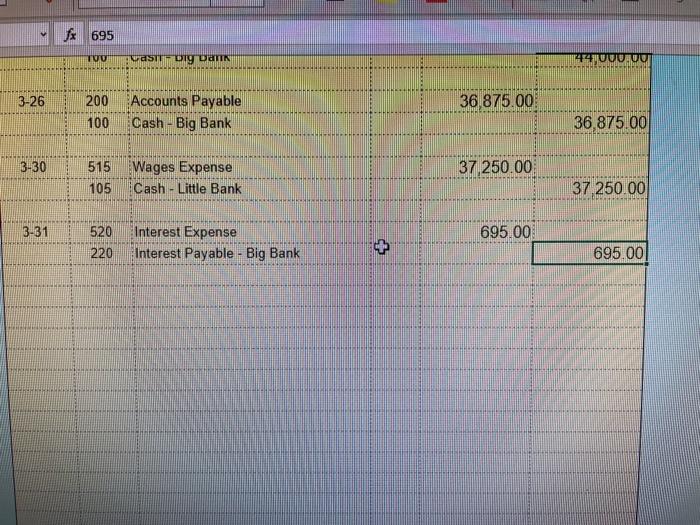

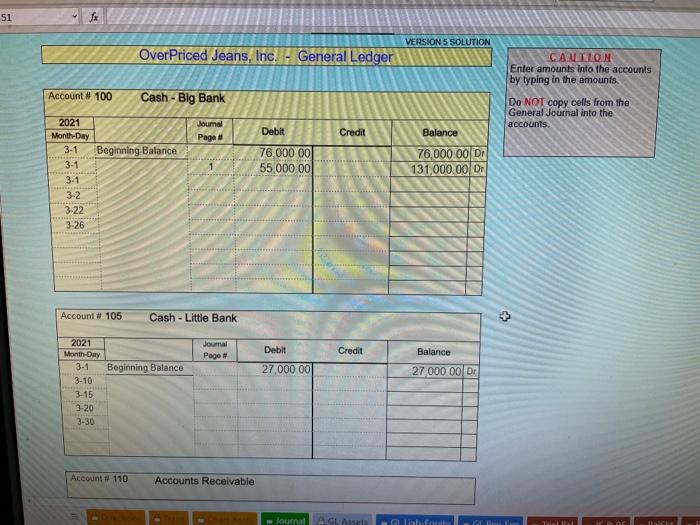

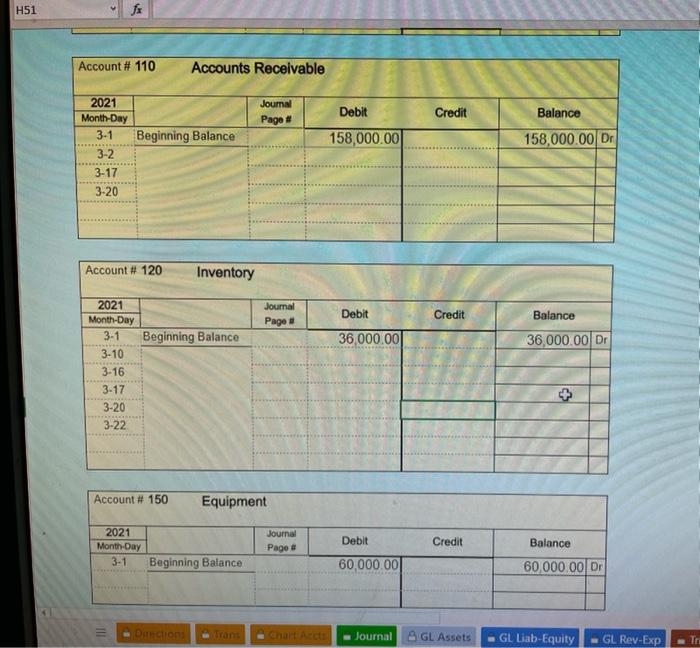

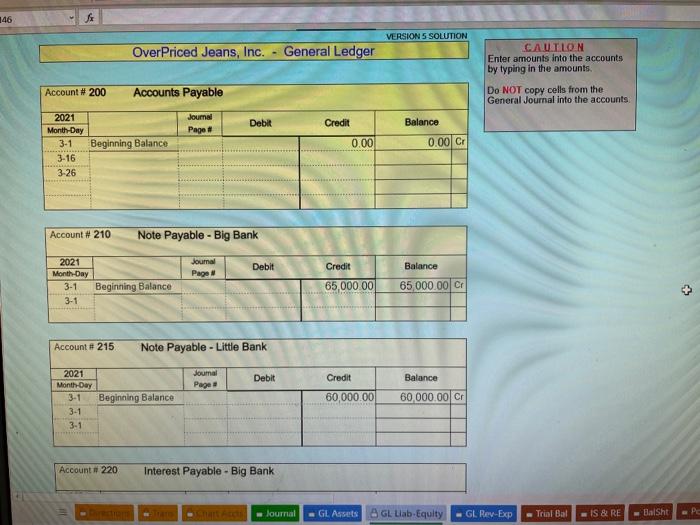

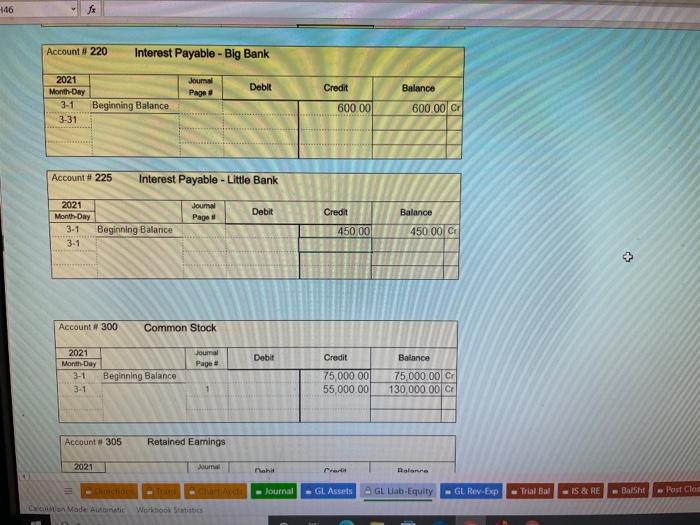

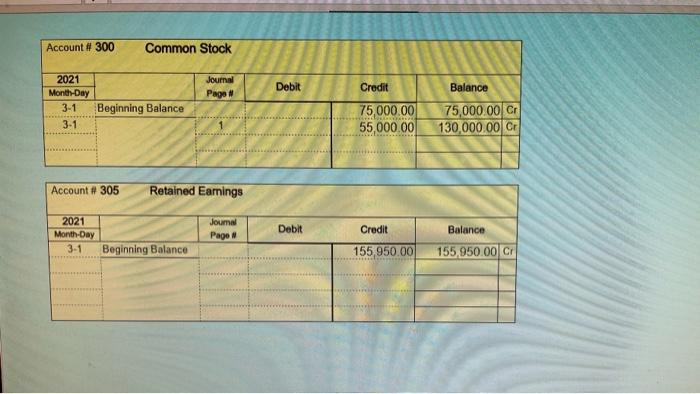

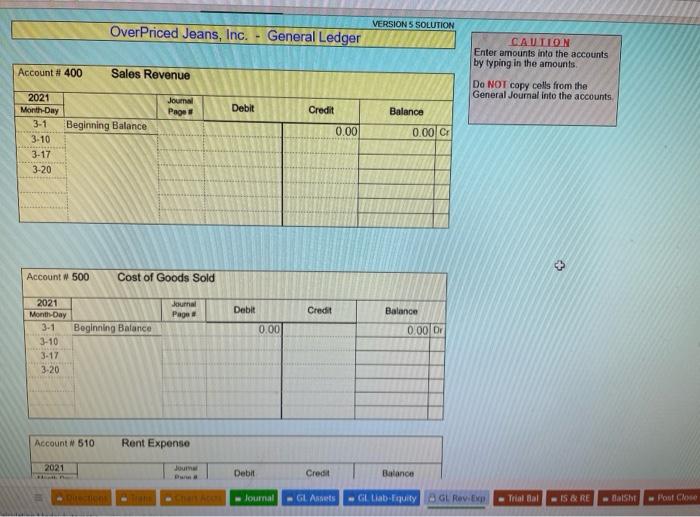

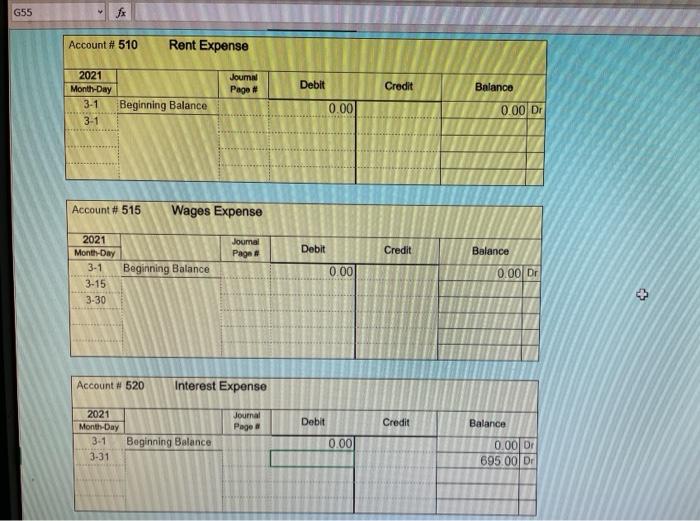

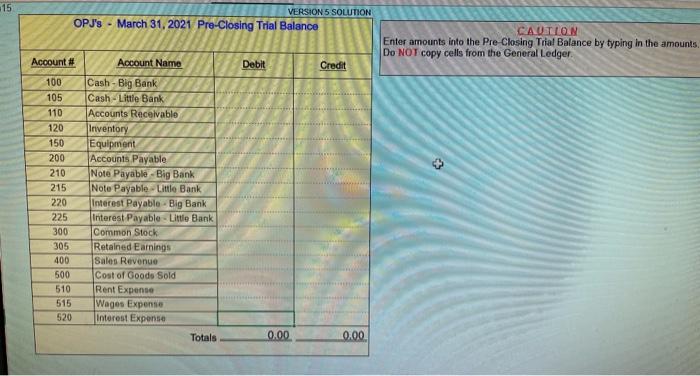

A1 13 OverPriced Jeans, Inc. - Transactions - Additional Information March 2021 Transactions Date Description of the Transaction March 1 Owners of OPJ invested an additional $55,000 cash into the business. The cash put into Big Bank (As an example of how to journal and post a transaction this transaction has already been entered into the General Journal and posted to the General Ledger March 1 Pay off the $60,000 Note Payablo owed to Little Bank. The cash to pay off the note is taken out of Big Bank. Also pay to Little Bank $450 for interest owed on the Note Payable for February The $450 cash is also taken out of Big Bank March 1 Take S5,550 cash out of Big Bank to pay for March's rent March 2 The customer that purchased on credit on February 15 pays $88,000 cash to pay off the amount due. The cash is deposited into Big Bank March 10 Sule of Inventory to a customer-selling price $83,500 - cost of the inventory sold $24.000 The customer pays cash The cash is deposited into Little Bank March 15 Take $25.000 cash out of Little Bank to pay employees for wages they have earned DIO March 16 Purchase 573,750 of additional inventory. OPJ will pay the manufacturer 50% of the 573,750 in 10 days. OPJ will pay the remaining 50% in 30 days March 17 Sale of inventory to a customer-selling price $119,000 -- cost of the inventory sold $38,000 The customer will pay for the purchase in 30 days OLD March 20 Sale of inventory to a customer-selling price 5178.500 - cost of the inventory sold 533 500 The customer pays $25,500 cash that is deposited into Little Bank The customer will pay the remaining amount in 30 days March 22 Purchase inventory for $44.000 cash The cash is taken out of Big Bank March 20 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Taxe $37.250 cash out of Little Bank to pay employees for wages they have earned Trans - Journal - GLAS GL Lab Equity HGL Rev.Exp Triallal IS ARE Al fx The customer pays $25,500 cash that is deposited into Little Bank. The customer will pay the remaining amount in 30 days. March 22 Purchase inventory for $44,000 cash. The cash is taken out of Big Bank March 26 Pay the manufacturer the 50% due on the March 16th purchase of inventory. The cash is taken out of Big Bank March 30 Take $37,250 cash out of Little Bank to pay employees for wages they have earned. Additional Information Note Payable Big Bank: Interest due to Big Bank on the Note Payable for the month of March is $695. As of March 31 OPJ owes Big Bank a total of $1,295 for interest (5600 for February $695 for March) Interest will be paid to Big Bank in June. VERSION 5 SOLUTION Over Priced Jeans, Inc. General Journal Page # 1 Posted Debit Credit 2021 Month-Day 3-1 Account Account Name Number 100 Cash - Big Bank 300 Common Stock Issue additional Common Stock 55,000.00 55,000.00 3-1 215 225 Notes Payable - Little Bank Interest Payable - Little Bank Notes Payable - Big Bank 60,000.00 450.00 210 60,450.00 3-1 510 5,550.00 Rent Expense Cash - Big Bank 100 5,550.00 3-2 100 88,000.00 Cash - Big Bank Accounts Receivable 110 88,000.00 3-10 105 - 83,500.00 Cash - Little Bank Sales Revenue 400 83 500.00 3-10 24,000.00 500 120 Cost of Goods Sold Inventory 24,000.00 3-15 25,000.00 515 105 Wages Expense Cash - Little Bank 25,000.00 3-16 120 73,750.00 Inventory Accounts Payable 200 73,750.00 3-17 110 Accounts Receivable 119,000.00 TI Directions Tran Chart Acets Journal GL Assets GL Liab-Equity - GL Rev-Exp Calculation Mode: Automatic Workbook Statistics Arial 12 B a Av . 29 Merge 164 fx 695 memory 200 Accounts Payable TZU 7,TJU.UU 73,750.00 3-17 110 400 Accounts Receivable Sales Revenue 119,000.00 + 119,000.00 3-17 500 120 Cost of Goods Sold Inventory 38,000.00 38,000.00 3-20 110 105 Accounts Receivable Cash - Little Bank Sales Revenue 153,000.00 25,500.00 400 178,500.00 Over Priced Jeans, Inc. - General Journal Page # 2 Account Name Posted Debit Credit 2021 Month-Day 3-20 Account Number 500 120 33,500.00 Cost of Goods Sold Inventory 33,500.00 3-22 120 100 44,000.00 Inventory Cash - Big Bank 44.000.00 3-26 200 100 36,875.00 Accounts Payable Cash - Big Bank 36 875.00 3-30 515 105 Wages Expense Cash - Little Bank 37 250.00 37250.00 3-31 520 Interest Expense 695 00 = Direction Trans Chart Accts Journal GL Assets GL Liab-Equity - GL Rev-Exp fx 695 TUU vas Dig Unik 144 UUU UUTI HHHHHHH 3-26 36,875.00 200 100 Accounts Payable Cash - Big Bank 36.875.00 HHH1 3-30 37 250.00 515 105 Wages Expense Cash - Little Bank 37 250.00 3-31 695.00 520 220 Interest Expense Interest Payable - Big Bank + 695.00 51 Jx VERSION 5 SOLUTION Over Priced Jeans, Inc. General Ledger CAUILON Enter amounts into the accounts by typing in the amounts Account # 100 Cash - Big Bank - Do NOT copy cells from the General Journal into the accounts Journal Page Debit Credit Balance Beginning Balance 2021 Month-Day 3-1 3-1 3-1 3-2 3-22 3-26 76,000.00 55 000 00 76,000.00 DI 131,000.00 Dr Account W 105 Cash - Little Bank 2021 Month-Day Journal Page Debit Credit Balance 3-1 Beginning Balance 27,000.00 27,000.00 Dr 3-10 3-15 3-20 3-30 Account 110 Accounts Receivable Journal GLA Silah Ft H51 fx Account # 110 Accounts Receivable Journal Page # Debit Credit Balance Beginning Balance 158,000.00 158,000.00 DE 2021 Month-Day 3-1 3-2 3-17 3-20 Account # 120 Inventory 2021 Month-Day 3-1 Journal Page Debit Credit Balance Beginning Balance 36000.00 36,000.00 DI 3-10 3-16 3-17 3-20 3-22 Account # 150 Equipment Journal Page 8 Debit 2021 Month-Day 3-1 Beginning Balance Credit Balance 60,000.00 60,000.00 Dr TIL Duchon Trans Chart Arct Journal GL Assets GL Lab-Equity - GL. Rev-Exp 146 VERSION 5 SOLUTION Over Priced Jeans, Inc. - General Ledger CAUTLON Enter amounts into the accounts by typing in the amounts. Account # 200 Accounts Payable Do NOT copy cells from the General Journal into the accounts Journal Page # Debit Credit Balance 2021 Month-Day 3-1 Beginning Balance 3-16 3-26 0.00 0.00 CE Account # 210 Note Payable - Big Bank Journal Page Debit Credit Balance 2021 Month Day Beginning Balance 3-1 3-1 65,000 00 65,000.00 Account # 215 Note Payable - Little Bank Journal Page 1 Debit Credit 2021 Month-Day 3-1 3-1 3-1 Balance 60,000.00 CP Beginning Balance 60,000.00 Account # 220 Interest Payable - Big Bank lournal GL Assets AGL Lab Equity GL Rev-Exp Triol Bal IS & RE BalSht PE 746 fx Account # 220 Interest Payable - Big Bank Jouma Page 3 Debit Credit Balance 2021 Month-Day 3-1 Beginning Balance 3-31 600.00 600.00 C Account #225 Interest Payable - Little Bank Journal Page Debit Credit Balance 2021 Month-Day 3-1 3-1 Beginning Balance 450.00 450.00 CE + Account # 300 Common Stock Journal Page Debit 2021 Month Day 3-1 3-1 Beginning Balance Credit 75,000.00 55,000.00 Balance 75 000.00 C 130,000.00 1 Account # 305 Retained Earnings 2021 um haha nalara hochot - Journal GL Assets 8 GL Lab Equity GL Rev Exp Trial Bar IS & RE - Balisht Post Close Di Made Autistic Wchool Statistics Account # 300 Common Stock Journal Page Debit Credit Balance 2021 Month-Day 3-1 3-1 Beginning Balance 75,000.00 55,000.00 75,000.00 Cr 130,000.00 Cr Account # 305 Retained Earings 2021 Month-Day 3-1 Jouma Page Debit Credit Balance Beginning Balance 155,950.00 155,950.00 CM VERSION 5 SOLUTION Over Priced Jeans, Inc. General Ledger CAUTION Enter amounts into the accounts by typing in the amounts Account # 400 Sales Revenue Do NOT copy cells from the General Journal into the accounts Journal Page 1 Debit Credit Balance 2021 Month-Day 3-1 Beginning Balance 3-10 3-17 3-20 0.00 0.00 CE $ Account W 500 Cost of Goods Sold khal Page 1 Debit Credit Balance Beginning Balance 0.00 0.000 2021 Month-Day 3-1 3-10 3-17 3-20 Account 510 Rent Expenso 2021 Joum D Debit Credit Balance Journal GL Ants Gl Lab Equity 3 GL Rev.bg Trial Bal IS BRE Bash out Close G55 Account # 510 Rent Expense 2021 Month-Day 3-1 Jouma Pago # Debit Credit Balance Beginning Balance 0.00 0.00 DI 3-1 Account # 515 Wages Expense Journal Page Debit Credit Balance 2021 Month-Day 3-1 Beginning Balance 3-15 3-30 0.00 0.00 Dr + 4 --- Account # 520 Interest Expense Journal Page 8 Credit Balance 2021 Month-Day 3-1 3-31 Debit 0.00 Beginning Balance 0.00 DI 695 00 DI -15 VERSION 5 SOLUTION OPJ's - March 31, 2021 Pre-Closing Trial Balance CAUTION Enter amounts into the Pre Closing Trial Balance by typing in the amounts Do NOT copy cells from the General Ledger | Account # Account Name Debit Credit 100 105 110 120 150 200 210 215 220 225 300 305 400 500 510 515 520 Cash - Big Bank Cash - Little Bank Accounts Receivable Inventory Equipment Accounts Payable Note Payable - Big Bank Note Payable Little Bank Interest Payable Big Bank Interest Payable - Little Bank Common Stock Retained Earnings Sales Revenue Cost of Goods Sold Rent Expense Wages Expense Interest Expense Totals 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts