Question: Solow model in continuous time. Consider the Solow model in continuous time with pro- duction function y = f(k) satisfying the usual properties, constant

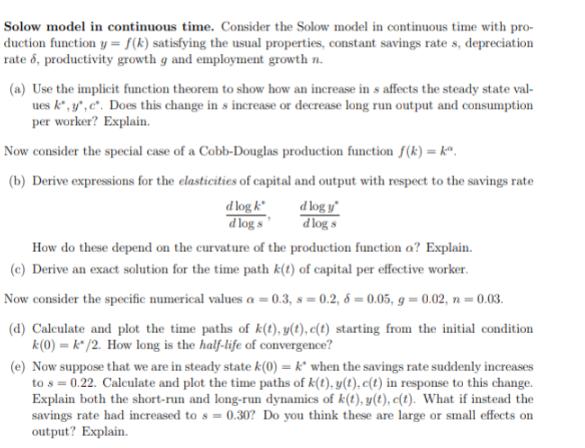

Solow model in continuous time. Consider the Solow model in continuous time with pro- duction function y = f(k) satisfying the usual properties, constant savings rate s, depreciation rate 8, productivity growth g and employment growth n. (a) Use the implicit function theorem to show how an increase in s affects the steady state val- ues k", y, e. Does this change in s increase or decrease long run output and consumption per worker? Explain. Now consider the special case of a Cobb-Douglas production function f(k)= k (b) Derive expressions for the elasticities of capital and output with respect to the savings rate dlog k dlog y dlog s dlog s How do these depend on the curvature of the production function a? Explain. (c) Derive an exact solution for the time path k(t) of capital per effective worker. Now consider the specific numerical values a=0.3, s=0.2, 6-0.05, g = 0.02, n = 0.03. (d) Calculate and plot the time paths of k(t), y(t), c(t) starting from the initial condition k(0) = k/2. How long is the half-life of convergence? (e) Now suppose that we are in steady state k(0) = k when the savings rate suddenly increases to s = 0.22. Calculate and plot the time paths of k(t). y(t).c(t) in response to this change. Explain both the short-run and long-run dynamics of k(t), y(t), c(t). What if instead the savings rate had increased to s= 0.30? Do you think these are large or small effects on output? Explain.

Step by Step Solution

There are 3 Steps involved in it

a To analyze how an increase in the savings rate s affects the steadystate values of capital per worker k and consumption per worker c we can use the implicit function theorem Lets denote the steadyst... View full answer

Get step-by-step solutions from verified subject matter experts