Question: solution and answer to all the posted problems complete solution DEPRECIATION AND DEPLETTON 5. Board, September 192 was bought for po 30.000 six years ago.

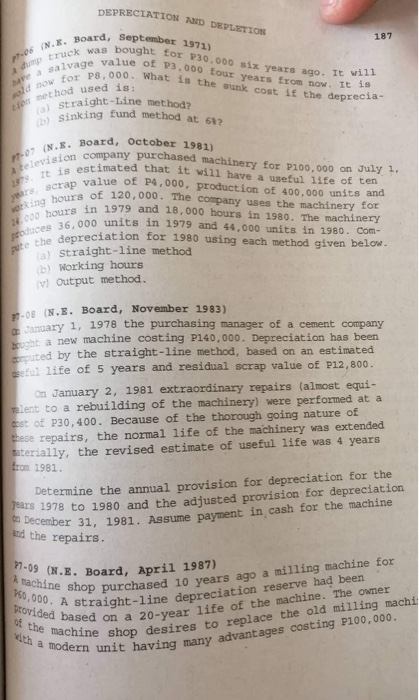

DEPRECIATION AND DEPLETTON 5. Board, September 192 was bought for po 30.000 six years ago. It will p.06 (N. . um truck value of 3.000 four years from now. It 15 P8,000. What is the sunk cost1f the deprecia e salvage ad now for Pe method used is: straight-Line method? sinking fund method at 612 Sink 07 (N.E. Board television co It is estin yours scrap val, working hours of 1000 hours proces 36,000 IN.E. Board, October 1981) a company purchased machinery for P100,000 on July 1. estimated that it will have a useful life of ten value of $4,000, production of 400,000 units and urs of 120,000. The company uses the machinery for s in 1979 and 18,000 hours in 1980. The machinery 6.000 units in 1979 and 44,000 units in 1980. Com- depreciation for 1980 using each method given below. pute the de Straight-line method b) Working hours v) Output method. 08 (N.E. Board, November 1983) muary 1, 1978 the purchasing manager of a cement company eht a new machine costing P140,000. Depreciation has been ated by the straight-line method, based on an estimated Betul life of 5 years and residual scrap value of P12,800. on January 2, 1981 extraordinary repairs (almost equi- Talent to a rebuilding of the machinery) were performed at a tost of P30,400. Because of the thorough going nature of these repairs, the normal life of the machinery was extended Baterially, the revised estimate of useful life was 4 years from 1981. Determine the annual provision for depreciation for the drs 1978 to 1980 and the adjusted provision for depreciation ecember 31, 1981. Assume payment in cash for the machine December 31, and the repairs. og (N.E. Board, April 1987) machine shop pul 10,000. A stra provided based on of the machines th a modern uni shop purchased 10 years ago a milling machine for A straight-line depreciation reserve had been ased on a 20-year life of the machine. The owner de shop desires to replace the old milling machi unit having many advantages costing P100,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts