Question: Solution and computation PROBLEM 6-5 Comprehensive You have been asked by a client to audit the financial statements of Half-Hearted Company for the first time.

Solution and computation

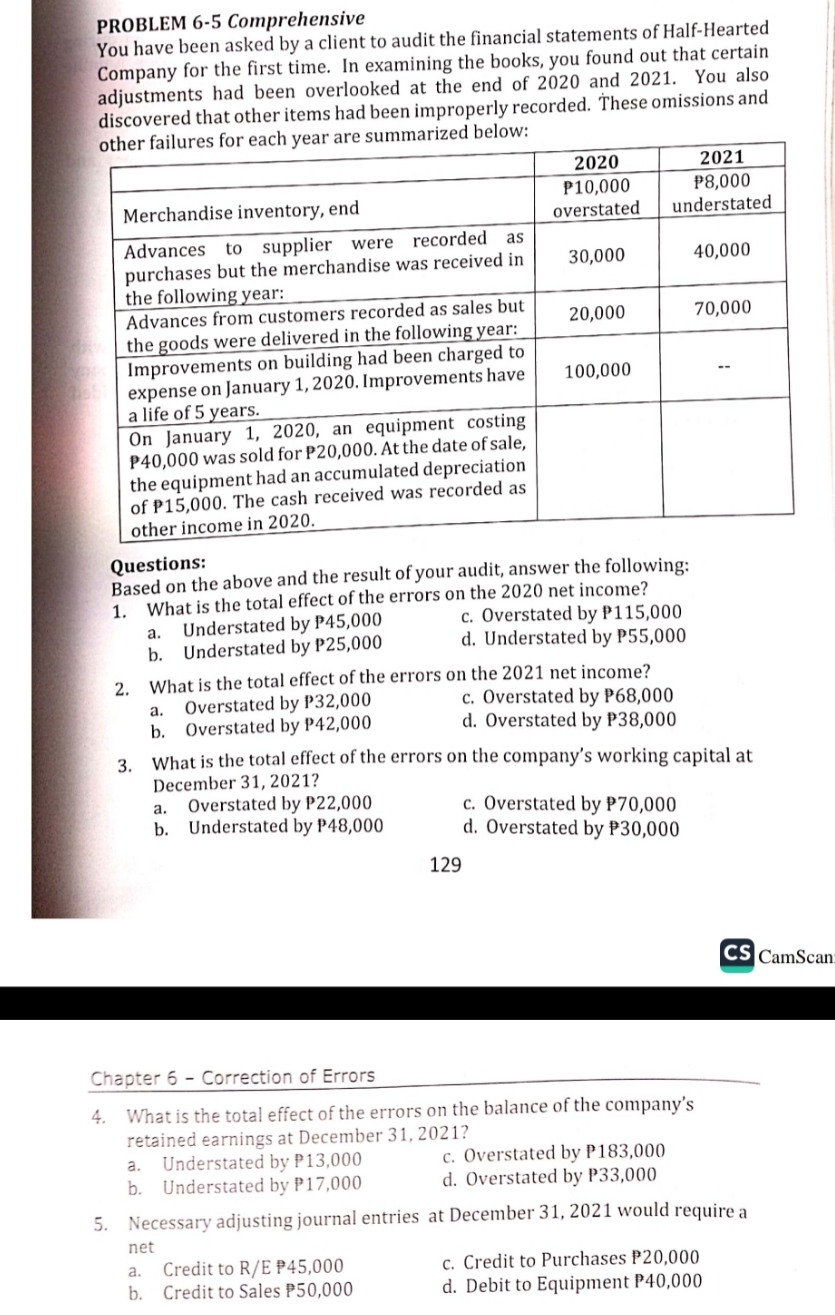

PROBLEM 6-5 Comprehensive You have been asked by a client to audit the financial statements of Half-Hearted Company for the first time. In examining the books, you found out that certain adjustments had been overlooked at the end of 2020 and 2021. You also discovered that other items had been improperly recorded. These omissions and other failures for each year are summarized below: 2020 2021 P10,000 P8,000 Merchandise inventory, end overstated understated Advances to supplier were recorded as purchases but the merchandise was received in 30,000 40,000 the following year: Advances from customers recorded as sales but 20,000 70,000 the goods were delivered in the following year: Improvements on building had been charged to expense on January 1, 2020. Improvements have 100,000 a life of 5 years. On January 1, 2020, an equipment costing P40,000 was sold for P20,000. At the date of sale, the equipment had an accumulated depreciation of P15,000. The cash received was recorded as other income in 2020. Questions: Based on the above and the result of your audit, answer the following: 1. What is the total effect of the errors on the 2020 net income? a. Understated by P45,000 c. Overstated by P115,000 b. Understated by P25,000 d. Understated by P55,000 2. What is the total effect of the errors on the 2021 net income? a. Overstated by P32,000 c. Overstated by P68,000 b. Overstated by P42,000 d. Overstated by P38,000 3. What is the total effect of the errors on the company's working capital at December 31, 2021? a. Overstated by P22,000 b. Understated by P48,000 c. Overstated by P70,000 d. Overstated by P30,000 129 CS CamScan Chapter 6 - Correction of Errors 4. What is the total effect of the errors on the balance of the company's retained earnings at December 31, 2021? a. Understated by P13,000 c. Overstated by P183,000 b. Understated by P17,000 d. Overstated by P33,000 5. Necessary adjusting journal entries at December 31, 2021 would require a net a. Credit to R/E P45,000 c. Credit to Purchases P20,000 b. Credit to Sales P50,000 d. Debit to Equipment P40,000