Question: solution? Assignment 6 Q-6-6. What change would you expect in internal rate of return (IRR) if Gatsby reevaluates the salvage value on the new equipment

solution?

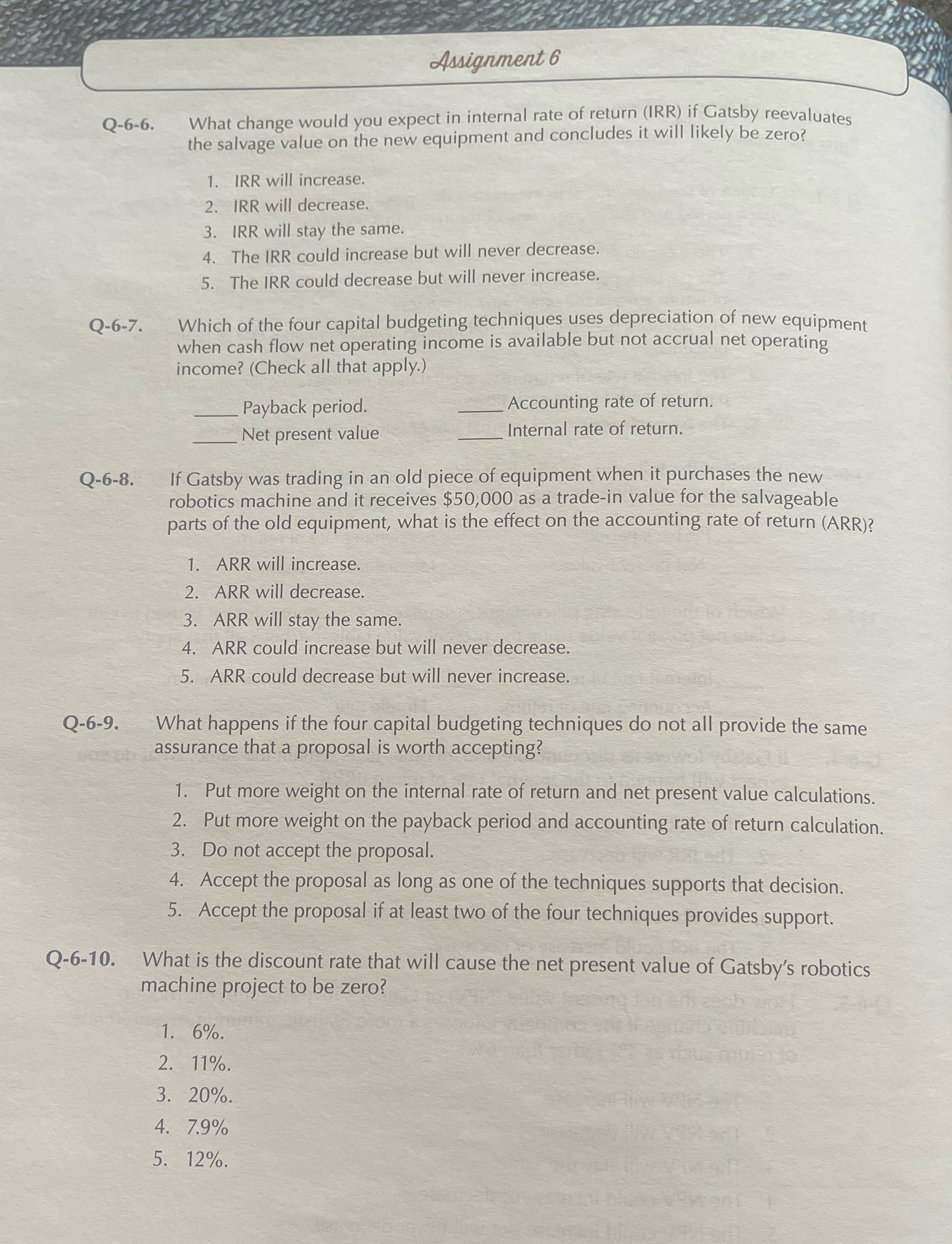

Assignment 6 Q-6-6. What change would you expect in internal rate of return (IRR) if Gatsby reevaluates the salvage value on the new equipment and concludes it will likely be zero? 1. IRR will increase. 2. IRR will decrease. 3. IRR will stay the same. 4. The IRR could increase but will never decrease. 5. The IRR could decrease but will never increase. Q-6-7. Which of the four capital budgeting techniques uses depreciation of new equipment when cash flow net operating income is available but not accrual net operating income? (Check all that apply.) Payback period. Accounting rate of return. Net present value Internal rate of return. Q-6-8. If Gatsby was trading in an old piece of equipment when it purchases the new robotics machine and it receives $50,000 as a trade-in value for the salvageable parts of the old equipment, what is the effect on the accounting rate of return (ARR)? 1. ARR will increase. 2. ARR will decrease. 3. ARR will stay the same. 4. ARR could increase but will never decrease. 5. ARR could decrease but will never increase. Q-6-9. What happens if the four capital budgeting techniques do not all provide the same assurance that a proposal is worth accepting? 1. Put more weight on the internal rate of return and net present value calculations. 2. Put more weight on the payback period and accounting rate of return calculation. 3. Do not accept the proposal. 4. Accept the proposal as long as one of the techniques supports that decision. 5. Accept the proposal if at least two of the four techniques provides support. Q-6-10. What is the discount rate that will cause the net present value of Gatsby's robotics machine project to be zero? 1. 6%. 2. 11%. 3. 20%. 4. 7.9% 5. 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts