Question: Solution: E F G H IN 0 Www che tutorial, then complete the workshet, placing the question marks bow with formules Required: (a) Based on

Solution:

Solution:

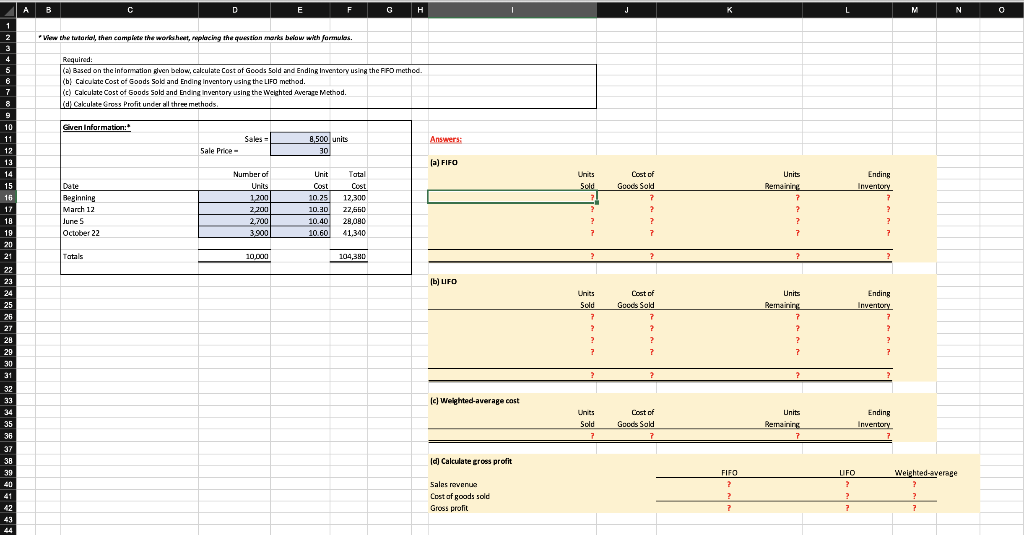

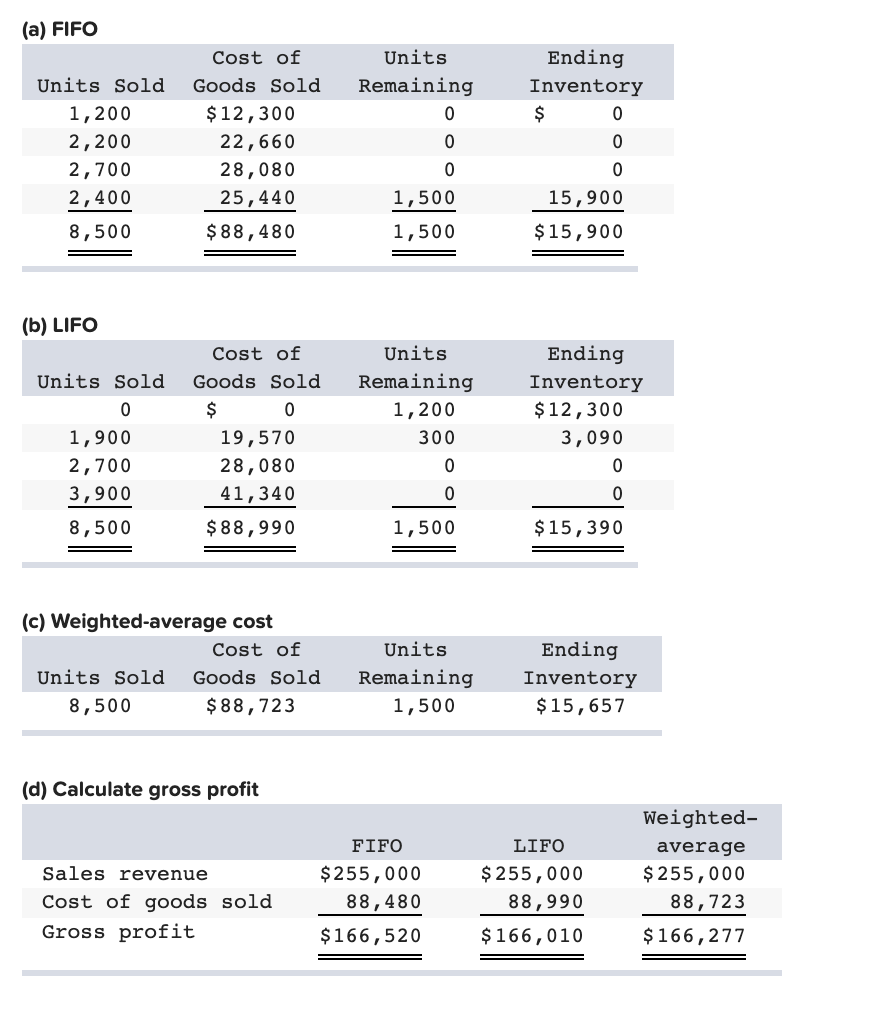

E F G H IN 0 Www che tutorial, then complete the workshet, placing the question marks bow with formules Required: (a) Based on the information given below, calculate Cost of Goods sold and Ending inventory using the FIFO method. (b) Calculate Cost of Goods Sold and Ending Inventory using the LIFO method. (c) Calculate Cost of Goods Sold and Ending inventory using the weighted average Method. d) Cakulate Gross Profit under all three methods Given Information: Sales 8.500 units Answers Sale Price la) FIFO Number of Units Units Sold Cost of Goods Sold Units Remaining Ending Inventory 1.2001 Unit Cost 10.25 10.30 10.40 10.60 Beginning March 12 Jures October 22 Total Cost 12,300 22,650 28.090 41.340 22011 2,700 3,900 Totals 10.000 104,380 (b) LIFO Units Sold Coat of Goods Sold Units Remaining Ending Inventory c) Weighted average cast Units Ending Units Sold Cost of Goods Sold Idi Calculate gross profit FIFO Weighted average Sales revenue Cost of goods sold Gross prolit Units Remaining Ending Inventory $ (a) FIFO Cost of Units Sold Goods Sold 1,200 $ 12,300 2,200 22,660 2,700 28,080 2,400 25,440 8,500 $ 88,480 1,500 1,500 15,900 $ 15,900 (b) LIFO Cost of Units Sold Goods Sold $ 0 1,900 19,570 2,700 28,080 3,900 41,340 8,500 $ 88,990 Units Remaining 1,200 300 0 Ending Inventory $ 12,300 3,090 0 0 0 1,500 $ 15,390 (c) Weighted average cost Cost of Units Sold Goods Sold 8,500 $88,723 Units Remaining 1,500 Ending Inventory $15,657 (d) Calculate gross profit Sales revenue Cost of goods sold Gross profit FIFO $255,000 88,480 $ 166,520 LIFO $ 255,000 88,990 $ 166,010 Weighted- average $ 255,000 88,723 $ 166,277 E F G H IN 0 Www che tutorial, then complete the workshet, placing the question marks bow with formules Required: (a) Based on the information given below, calculate Cost of Goods sold and Ending inventory using the FIFO method. (b) Calculate Cost of Goods Sold and Ending Inventory using the LIFO method. (c) Calculate Cost of Goods Sold and Ending inventory using the weighted average Method. d) Cakulate Gross Profit under all three methods Given Information: Sales 8.500 units Answers Sale Price la) FIFO Number of Units Units Sold Cost of Goods Sold Units Remaining Ending Inventory 1.2001 Unit Cost 10.25 10.30 10.40 10.60 Beginning March 12 Jures October 22 Total Cost 12,300 22,650 28.090 41.340 22011 2,700 3,900 Totals 10.000 104,380 (b) LIFO Units Sold Coat of Goods Sold Units Remaining Ending Inventory c) Weighted average cast Units Ending Units Sold Cost of Goods Sold Idi Calculate gross profit FIFO Weighted average Sales revenue Cost of goods sold Gross prolit Units Remaining Ending Inventory $ (a) FIFO Cost of Units Sold Goods Sold 1,200 $ 12,300 2,200 22,660 2,700 28,080 2,400 25,440 8,500 $ 88,480 1,500 1,500 15,900 $ 15,900 (b) LIFO Cost of Units Sold Goods Sold $ 0 1,900 19,570 2,700 28,080 3,900 41,340 8,500 $ 88,990 Units Remaining 1,200 300 0 Ending Inventory $ 12,300 3,090 0 0 0 1,500 $ 15,390 (c) Weighted average cost Cost of Units Sold Goods Sold 8,500 $88,723 Units Remaining 1,500 Ending Inventory $15,657 (d) Calculate gross profit Sales revenue Cost of goods sold Gross profit FIFO $255,000 88,480 $ 166,520 LIFO $ 255,000 88,990 $ 166,010 Weighted- average $ 255,000 88,723 $ 166,277

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts