Question: solution for part ii The following partial annual information is for shares that are components of the FTSE100 index. The following additional information may also

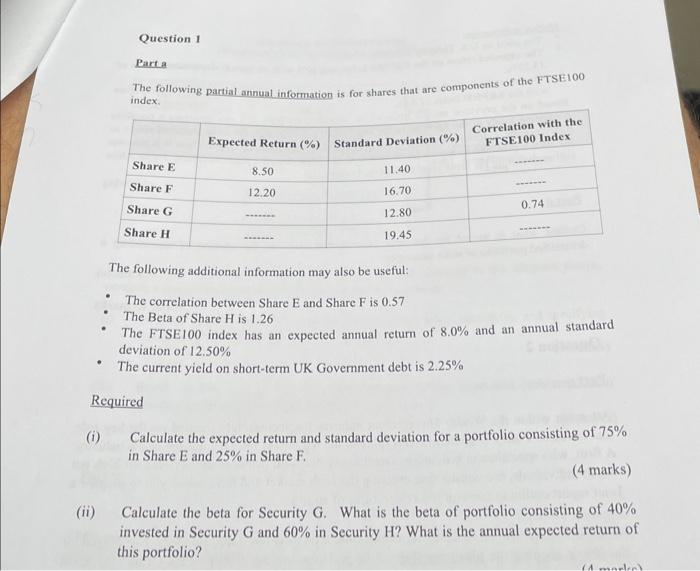

The following partial annual information is for shares that are components of the FTSE100 index. The following additional information may also be useful: - The correlation between Share E and Share F is 0.57 - The Beta of Share H is 1,26 - The FTSE100 index has an expected annual return of 8.0% and an annual standard deviation of 12.50% - The current yield on short-term UK Government debt is 2.25% Required (i) Calculate the expected return and standard deviation for a portfolio consisting of 75% in Share E and 25% in Share F. (4 marks) (ii) Calculate the beta for Security G. What is the beta of portfolio consisting of 40% invested in Security G and 60% in Security H? What is the annual expected return of this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts