Question: solution for this please Question 2 Positive Accounting Theory 20 Marks Samuela, a billionaire has a diversified investment portfolio with actual and expected returns ranging

solution for this please

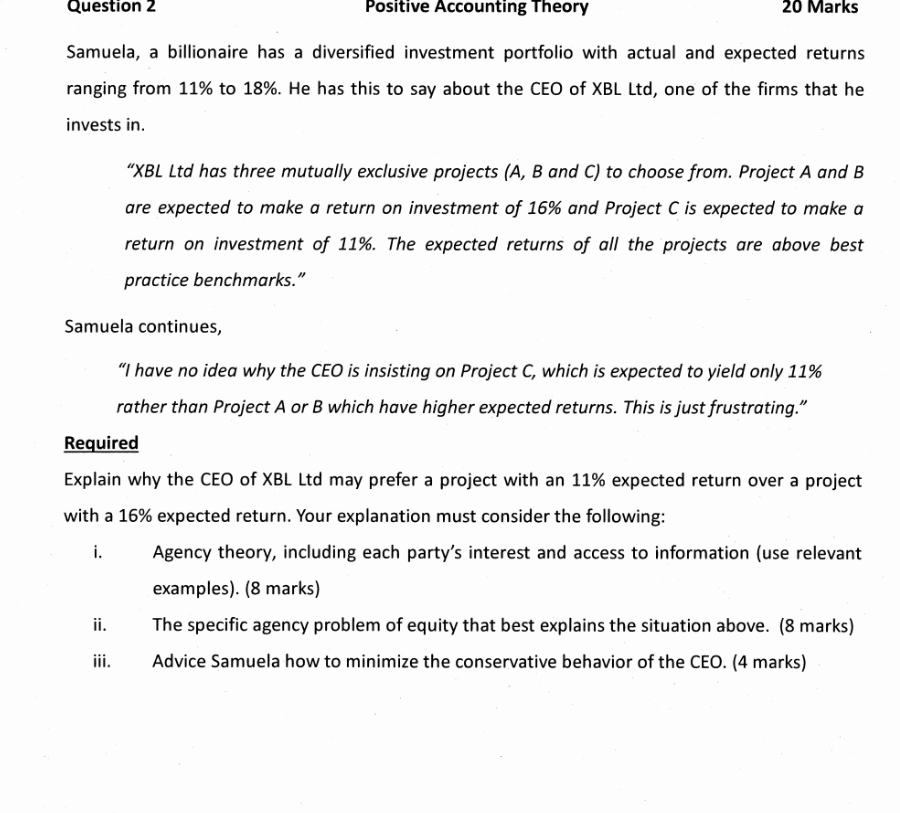

Question 2 Positive Accounting Theory 20 Marks Samuela, a billionaire has a diversified investment portfolio with actual and expected returns ranging from 11% to 18%. He has this to say about the CEO of XBL Ltd, one of the firms that he invests in. "XBL Ltd has three mutually exclusive projects (A, B and C) to choose from. Project A and B are expected to make a return on investment of 16% and Project C is expected to make a return on investment of 11%. The expected returns of all the projects are above best practice benchmarks." Samuela continues, "I have no idea why the CEO is insisting on Project C, which is expected to yield only 11% rather than Project A or B which have higher expected returns. This is just frustrating." Required Explain why the CEO of XBL Ltd may prefer a project with an 11% expected return over a project with a 16% expected return. Your explanation must consider the following: i. Agency theory, including each party's interest and access to information (use relevant examples). (8 marks) ii. The specific agency problem of equity that best explains the situation above. (8 marks) iii. Advice Samuela how to minimize the conservative behavior of the CEO. (4 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts