Question: solution - i can not understand how to arrive at this solution, please help Calculating cost of capital [LO 5] Rylstone Lid has commenced operations

![solution, please help Calculating cost of capital [LO 5] Rylstone Lid has](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/10/6703e16fc3be1_5676703e16f1fd6a.jpg) solution - i can not understand how to arrive at this solution, please help

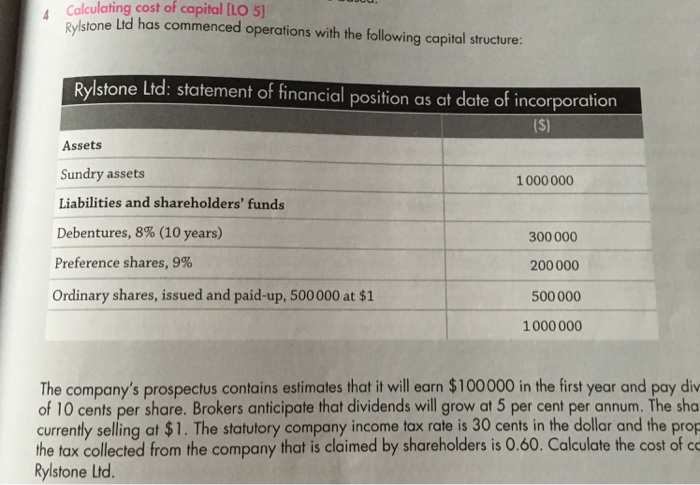

solution - i can not understand how to arrive at this solution, please help Calculating cost of capital [LO 5] Rylstone Lid has commenced operations with the following capital structure: Rylstone Ltd: statement of financial position as at date of incorporation ($) Assets Sundry assets 1000000 300 000 Liabilities and shareholders' funds Debentures, 8% (10 years) Preference shares, 9% Ordinary shares, issued and paid-up, 500 000 at $1 200 000 500 000 1000 000 The company's prospectus contains estimates that it will earn $100000 in the first year and pay div of 10 cents per share. Brokers anticipate that dividends will grow at 5 per cent per annum. The sha currently selling at $1. The statutory company income tax rate is 30 cents in the dollar and the prop the tax collected from the company that is claimed by shareholders is 0.60. Calculate the cost of co Rylstone Ltd. Emphasis Heading 1 Heading 2 HUDUL AUDDLC Aabbcc Heading 3 Heading 4 Heading 5 Heading 6 Aal Hea Styles The company should not undertake the expansion 4.Do* = T Pon (l-Telf) 0.10 1-03(1-0.12) K = 0.1257 Do*(1+g) Potg=0.182 ka = 0.08 (1 -0.12) 7.04 per cent Weight Cost Market value Weighted cost Ordinary shares $500 000 0.182 Preference shares 200 000 0.09 Debentures 300 000 0.0704 1 000 000 (a) Book values are used where market values are not available. 0.091 0.01800 0.02112 0.13012 of Solution manual to accompany as 12e by Bern Brown Easton, Howard and Pinder CMG Hill Education Authola 2015

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts