Question: Solution in Excel only Question 1 (Total: 18 marks) A 1-year term insurance contract provides a death benefit of RM 100,000 payable at the end

Solution in Excel only

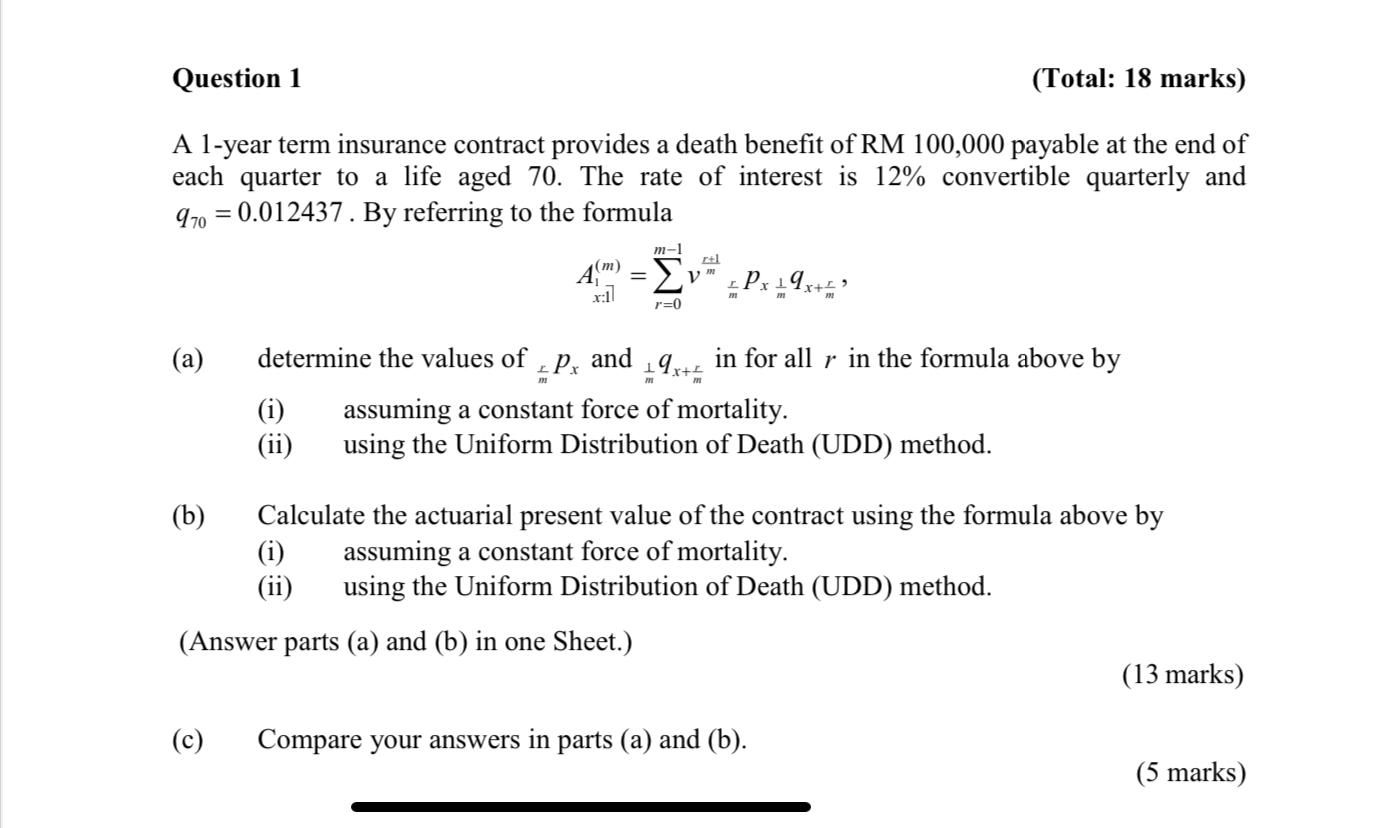

Question 1 (Total: 18 marks) A 1-year term insurance contract provides a death benefit of RM 100,000 payable at the end of each quarter to a life aged 70. The rate of interest is 12% convertible quarterly and 970=0.012437. By referring to the formula A(m) = m-1 V m LPX 19x+ x:17 m r=0 (a) determine the values of P and 19+ in for all r in the formula above by m m (i) assuming a constant force of mortality. (ii) using the Uniform Distribution of Death (UDD) method. (b) Calculate the actuarial present value of the contract using the formula above by (i) assuming a constant force of mortality. (ii) using the Uniform Distribution of Death (UDD) method. (Answer parts (a) and (b) in one Sheet.) (13 marks) (c) Compare your answers in parts (a) and (b). (5 marks) Question 1 (Total: 18 marks) A 1-year term insurance contract provides a death benefit of RM 100,000 payable at the end of each quarter to a life aged 70. The rate of interest is 12% convertible quarterly and 970=0.012437. By referring to the formula A(m) = m-1 V m LPX 19x+ x:17 m r=0 (a) determine the values of P and 19+ in for all r in the formula above by m m (i) assuming a constant force of mortality. (ii) using the Uniform Distribution of Death (UDD) method. (b) Calculate the actuarial present value of the contract using the formula above by (i) assuming a constant force of mortality. (ii) using the Uniform Distribution of Death (UDD) method. (Answer parts (a) and (b) in one Sheet.) (13 marks) (c) Compare your answers in parts (a) and (b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts