Question: solution on excel Question 2: - Alphanso Ltd. is planning to diversify its operations by exploring two new business opportunities. Opportunity Designer Sunglasses has an

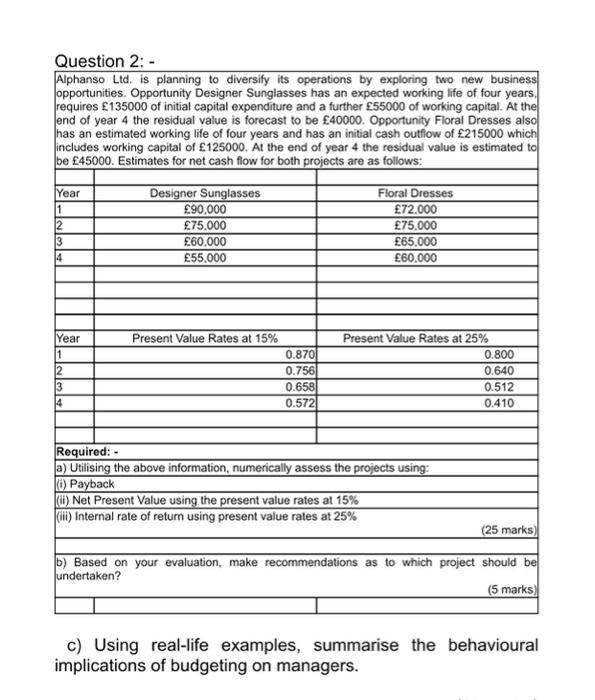

Question 2: - Alphanso Ltd. is planning to diversify its operations by exploring two new business opportunities. Opportunity Designer Sunglasses has an expected working life of four years, requires 135000 of initial capital expenditure and a further 55000 of working capital. At the end of year 4 the residual value is forecast to be 40000. Opportunity Floral Dresses also has an estimated working life of four years and has an initial cash outflow of 215000 which includes working capital of 125000. At the end of year 4 the residual value is estimated to be 45000. Estimates for net cash flow for both projects are as follows: Year 1 2 3 14 Designer Sunglasses 90,000 75.000 60.000 55,000 Floral Dresses 72.000 75.000 65,000 60,000 Present Value Rates at 15% Year 1 2 3 14 0.870 0.756 0.658 0.572 Present Value Rates at 25% 0.800 0.640 0.512 0.410 Required: - a) Utilising the above information, numerically assess the projects using: (0) Payback (6) Net Present Value using the present value rates at 15% (iii) Internal rate of return using present value rates at 25% (25 marks) b) Based on your evaluation, make recommendations as to which project should be undertaken? (5 marks c) Using real-life examples, summarise the behavioural implications of budgeting on managers

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts