Question: solution? * Question 14 On April 22, 2020, Pharoah Enterprises purchased equipment for $134,700. The company expects to use the equipment for 12,000 working hours

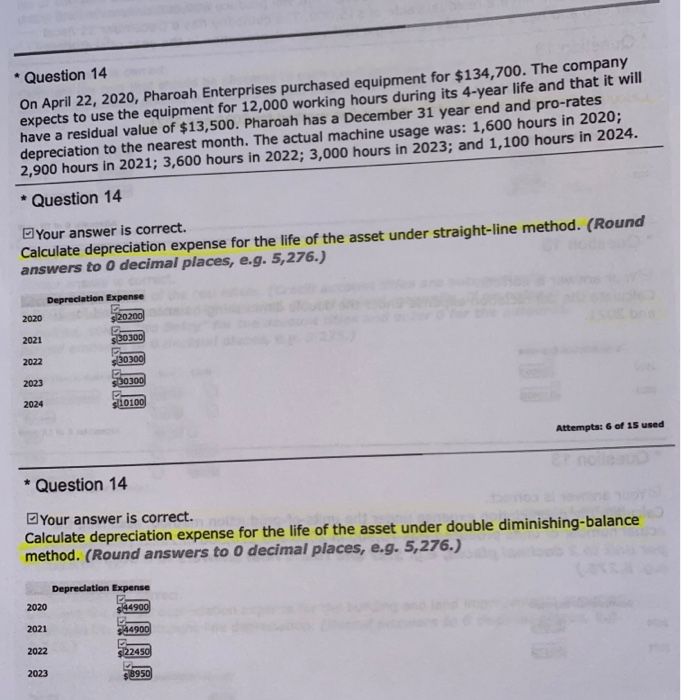

* Question 14 On April 22, 2020, Pharoah Enterprises purchased equipment for $134,700. The company expects to use the equipment for 12,000 working hours during its 4-year life and that it will have a residual value of $13,500. Pharoah has a December 31 year end and pro-rates depreciation to the nearest month. The actual machine usage was: 1,600 hours in 2020; 2,900 hours in 2021; 3,600 hours in 2022; 3,000 hours in 2023; and 1,100 hours in 2024. * Question 14 Your answer is correct. Calculate depreciation expense for the life of the asset under straight-line method. (Round answers to 0 decimal places, e.g. 5,276.) Depreciation Expense 2020 $ 20200 2021 530300 2022 30300 2023 svojo PE s10100 2024 Attempts: 6 of 15 used * Question 14 Your answer is correct. Calculate depreciation expense for the life of the asset under double diminishing-balance method. (Round answers to 0 decimal places, e.g. 5,276.) Depreciation Expense 2020 $144900 2021 S44900 2022 522450 2023 $8950

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts