Question: Solution step by step L 0 7 - 1 P 7 - 4 0 . Allocating Service Department Costs: Direct and Step Methods; Department and

Solution step by step

L P Allocating Service Department Costs: Direct and Step Methods; Department and Plantwide Jordan Overhead Rates

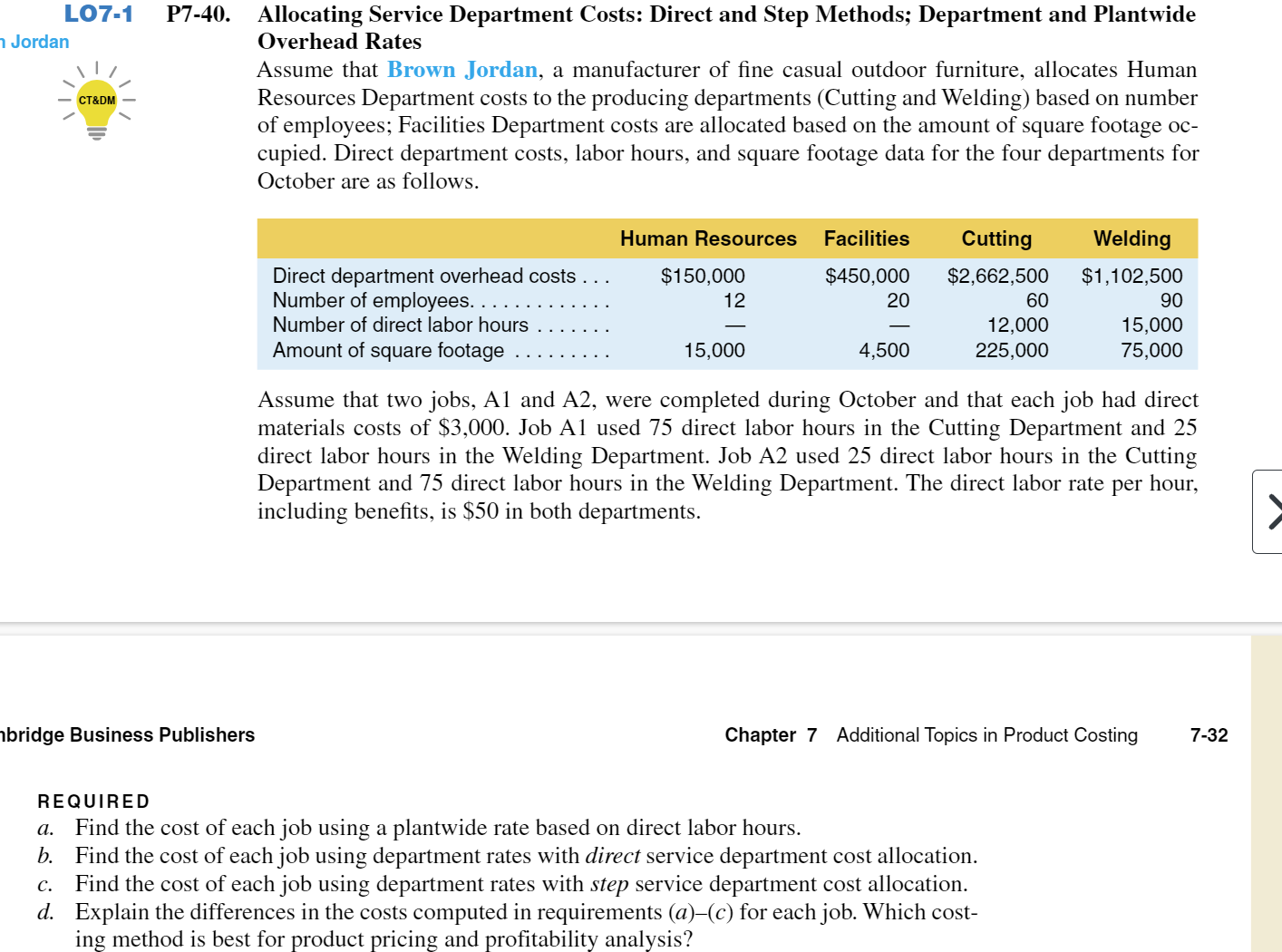

Assume that Brown Jordan, a manufacturer of fine casual outdoor furniture, allocates Human Resources Department costs to the producing departments Cutting and Welding based on number of employees; Facilities Department costs are allocated based on the amount of square footage occupied. Direct department costs, labor hours, and square footage data for the four departments for October are as follows.

Assume that two jobs, A and A were completed during October and that each job had direct materials costs of $ Job A used direct labor hours in the Cutting Department and direct labor hours in the Welding Department. Job A used direct labor hours in the Cutting Department and direct labor hours in the Welding Department. The direct labor rate per hour, including benefits, is $ in both departments.

REQUIRED

a Find the cost of each job using a plantwide rate based on direct labor hours.

b Find the cost of each job using department rates with direct service department cost allocation.

c Find the cost of each job using department rates with step service department cost allocation.

d Explain the differences in the costs computed in requirements ac for each job. Which costing method is best for product pricing and profitability analysis?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock