Question: solutions for part A through D are attached. I only need part E and F thanks On January 1, 2020, Carter Company, a manufacturer, leases

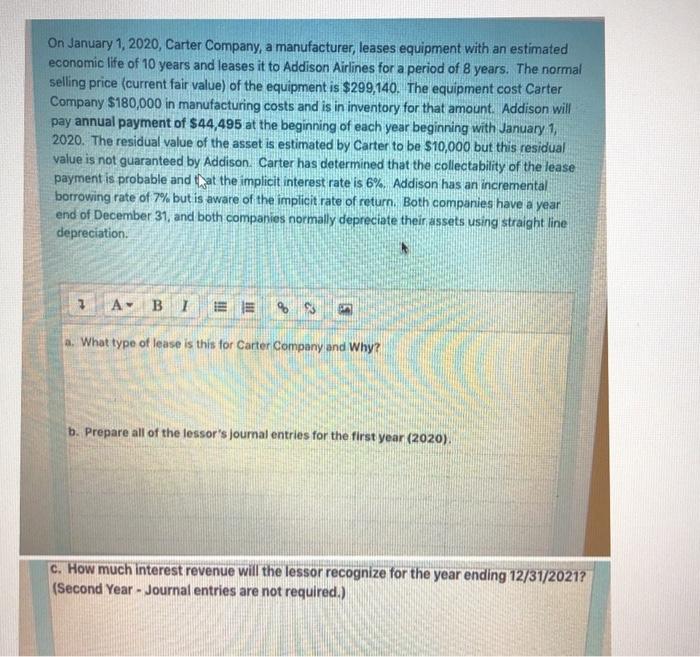

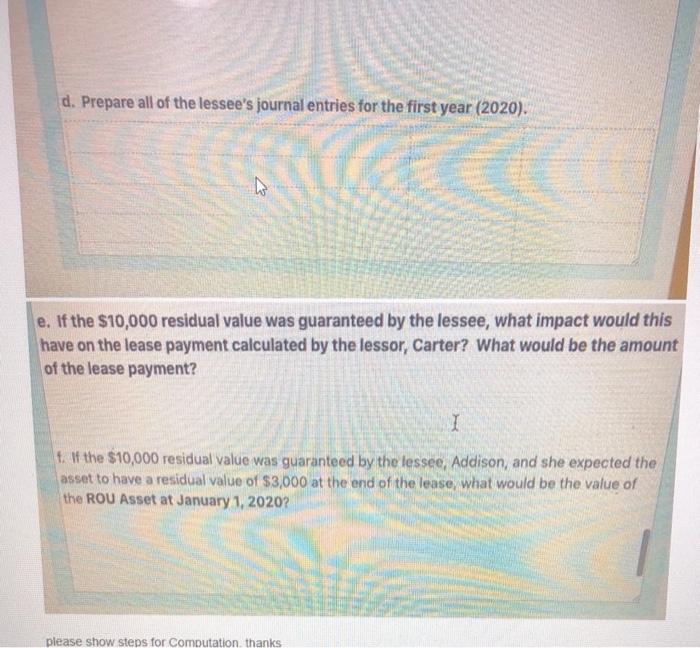

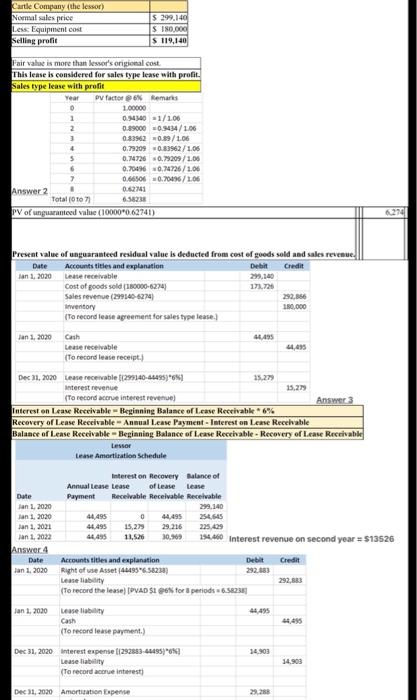

On January 1, 2020, Carter Company, a manufacturer, leases equipment with an estimated economic life of 10 years and leases it to Addison Airlines for a period of 8 years. The normal selling price (current fair value) of the equipment is $299,140. The equipment cost Carter Company $180,000 in manufacturing costs and is in inventory for that amount. Addison will pay annual payment of $44,495 at the beginning of each year beginning with January 1, 2020. The residual value of the asset is estimated by Carter to be $10,000 but this residual value is not guaranteed by Addison Carter has determined that the collectability of the lease payment is probable and at the implicit interest rate is 6%. Addison has an incremental borrowing rate of 7% but is aware of the implicit rate of return. Both companies have a year end of December 31, and both companies normally depreciate their assets using straight line depreciation. 7 A. BI E % a. What type of lease is this for Carter Company and Why? b. Prepare all of the lessor's journal entries for the first year (2020). c. How much interest revenue will the lessor recognize for the year ending 12/31/2021? (Second Year - Journal entries are not required.) d. Prepare all of the lessee's journal entries for the first year (2020). e. If the $10,000 residual value was guaranteed by the lessee, what impact would this have on the lease payment calculated by the lessor, Carter? What would be the amount of the lease payment? I 1. If the $10,000 residual value was guaranteed by the lessee, Addison, and she expected the asset to have a residual value of $3,000 at the end of the lease what would be the value of the ROU Asset at January 1, 2020? please show steps for Computation, thanks Carte Company (the lessor) Normal sales price Less Equipment cost Selling profit $ 299.140 SINO DOO S 119,140 Fair value is more than esser's ongional cost This lease is considered for sales type lease with profit Sales type leave with profit Year y factor Remarks 1.00000 1 0.94340 =1/100 2 2 0.89000 0.9434/1.06 3 0.83962 0.89/1.06 0.79209 0.83962/1.06 5 0.74726 0,79209 / 1.06 6 0.70496 0.74726/1.06 7 0.66506 0.70496/1.06 Answer 2 . 0.62761 Total 1007 6.58230 PV of unguaranteed value (10000*0,62741) Present value of unguaranteed residual value is deducted from cost of goods sold and sales revenue Date Accounts titles and explanation Debit Credit Jan 1, 2020 Leate receivable 29.140 Cost of goods sold 100000-6274 173.726 Sales revenue (299140-6214) 292,856 Inventory 180,000 To record lease agreement for sales type lease.) Jan 1, 2020 Cash 42495 Lease receivable 4,495 To record lease receipt.) Dec 31, 2020 Lease receivable (299140-46495)*681 15.27 Interest revenue 15,279 (To record core interest revenue) Answer 3 Interest on Lease Receivable Beginning Balance of Lease Receivable 6% Recovery of Lease Receivable Annual Lease Payment - Interest on Lease Receivable Balance of Lease Receivable - Beginning Balance of Lease Receivable - Recovery of Lease Reecivabile Lessor Lease Amortization Schedule Interest on Recovery Malance of Annual Lease Lease of Lease Lease Date Payment Receivable Receivable Receivable Jan 1, 2020 299,140 Jan 1, 2020 41,495 . 254,645 Jan 1, 2021 44.495 15,279 29.216 225,429 Jan 1, 2022 46,495 11.526 20,969 194440 Interest revenue on second year = 813526 Answer 4 Date Accounts titles and explanation Debit Credit Jan 1, 2020 Right of use Asset (46495*6.582383 Lease liability To record the lease) PPVAD $1 96for i periods > 6.58234 Jan 1, 2020 44495 Cash (To record fease payment Dec 31, 2020 Interest expense (292883-414958 14.303 Lease liability 14.903 (To record cu interest) Dec 31, 2020 Amortization Expense 29.288

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts