Question: solve 3., 4., 5., using hp10b calculator 3. A 25 -year, $1,000 par value bond has an 8.5% annual payment coupon. The bond currently sells

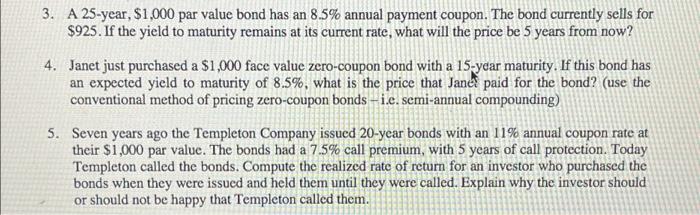

3. A 25 -year, $1,000 par value bond has an 8.5% annual payment coupon. The bond currently sells for $925. If the yield to maturity remains at its current rate, what will the price be 5 years from now? 4. Janet just purchased a $1,000 face value zero-coupon bond with a 15 -year maturity. If this bond has an expected yield to maturity of 8.5%, what is the price that Janet paid for the bond? (use the conventional method of pricing zero-coupon bonds - i.e. semi-annual compounding) 5. Seven years ago the Templeton Company issued 20 -year bonds with an 11% annual coupon rate at their $1,000 par value. The bonds had a 7.5% call premium, with 5 years of call protection. Today Templeton called the bonds. Compute the realized rate of return for an investor who purchased the bonds when they were issued and held them until they were called. Explain why the investor should or should not be happy that Templeton called them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts