Question: solve 5.4 only , please show the formula for 5.4 a & b and detailed solution. The current value of a stock portfolio is $23

solve 5.4 only, please show the formula for 5.4 a & b and detailed solution.

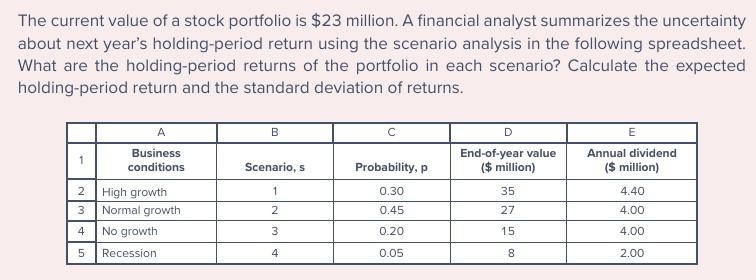

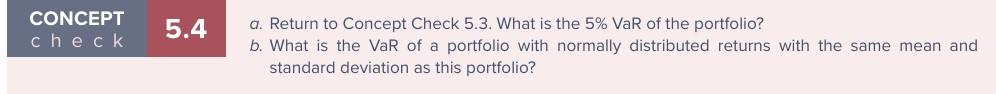

The current value of a stock portfolio is $23 million. A financial analyst summarizes the uncertainty about next year's holding-period return using the scenario analysis in the following spreadsheet. What are the holding-period returns of the portfolio in each scenario? Calculate the expected holding-period return and the standard deviation of returns. B A Business conditions Annual dividend ($ million) Scenario, s End-of-year value ($ million) Probability, p 1 0.30 35 4.40 2 0.45 27 4.00 2 High growth 3 Normal growth 4 No growth 5 Recession 3 0.20 un 4 0.05 8 2.00 CONCEPT check 5.4 a. Return to Concept Check 5.3. What is the 5% VaR of the portfolio? b. What is the VaR of a portfolio with normally distributed returns with the same mean and standard deviation as this portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts