Question: Solve a & b please. Reporting Discontinued Operations On October 31, Leigh Corp. approved a formal plan to dispose of its Knit Products Division. On

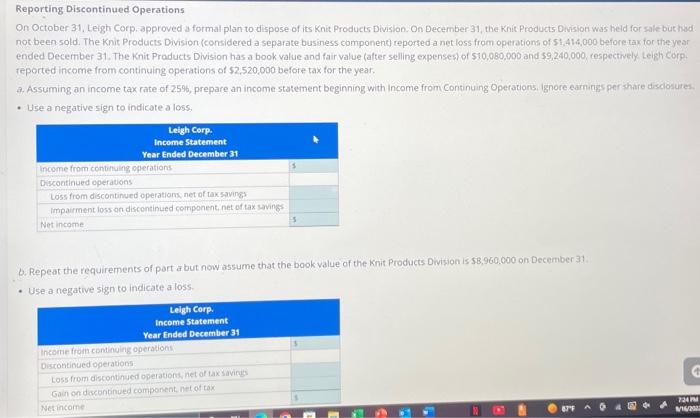

Reporting Discontinued Operations On October 31, Leigh Corp. approved a formal plan to dispose of its Knit Products Division. On December 31 , the Knit Products Division was heid for sale but had not been sold. The Knit Products Division (considered a separate business component) reported a net loss from operations of 51,414,000 before tax for the year ended December 31. The Knit Praducts Division has a book value and fair value (after selling expenses) of $10,0,50,000 and $9,240,000, respectively Leigh corp. reported income from continuing operations of $2,520,000 before tax for the year. a. Assuming an income tax rate of 25%, prepare an income statement beginning with income from Continuing Operations. Ignore earnings per share disalosures. - Use a negative sign to indicate a loss, b. Repeat the requirements of part a but now assume that the book value of the Knit Products Division is 58,960.000 on December 31 . - Use-a negative sign to indicate a loss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts