Question: Solve A,B, and C using excel. please provide the excel sheets and formulas used on excel to solve. A firm has borrowed $100m by selling

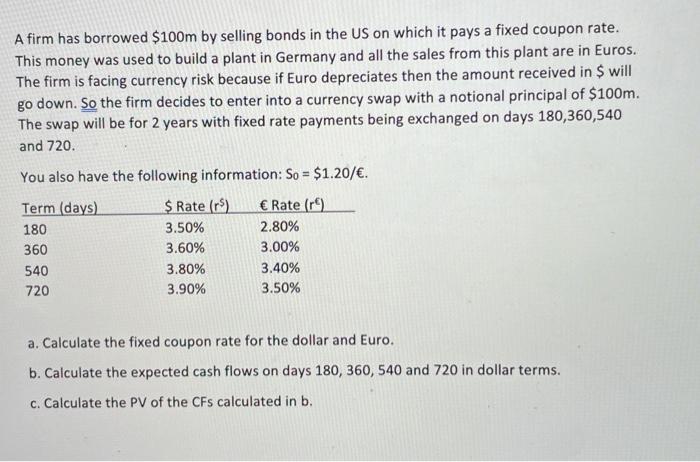

A firm has borrowed $100m by selling bonds in the US on which it pays a fixed coupon rate. This money was used to build a plant in Germany and all the sales from this plant are in Euros. The firm is facing currency risk because if Euro depreciates then the amount received in $ will go down. So the firm decides to enter into a currency swap with a notional principal of $100m. The swap will be for 2 years with fixed rate payments being exchanged on days 180,360,540 and 720. You also have the following information: So = $1.20/. Term (days) $ Rate (r) Rate (re) 180 3.50% 2.80% 360 3.60% 3.00% 540 3.80% 3.40% 720 3.90% 3.50% a. Calculate the fixed coupon rate for the dollar and Euro. b. Calculate the expected cash flows on days 180, 360, 540 and 720 in dollar terms. c. Calculate the PV of the CFs calculated in b

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts