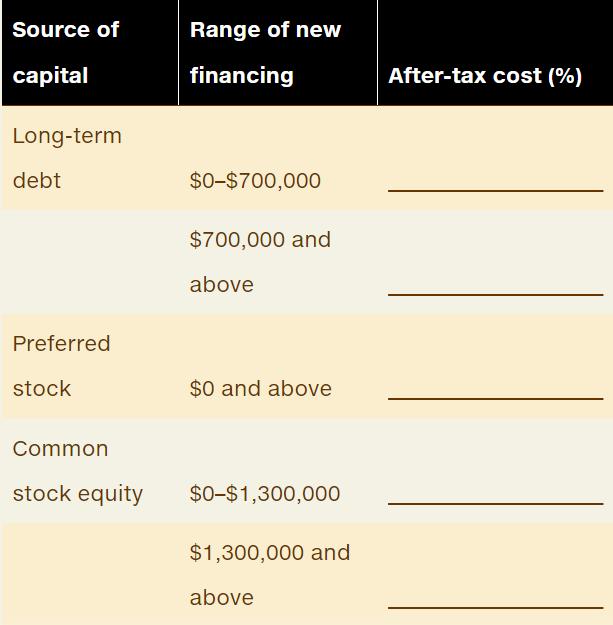

Question: solve after-tax cost % and explain using formulas: Information needed to answer, assume a 21% tax rate when needed: Source of capital Long-term debt Preferred

solve after-tax cost % and explain using formulas:

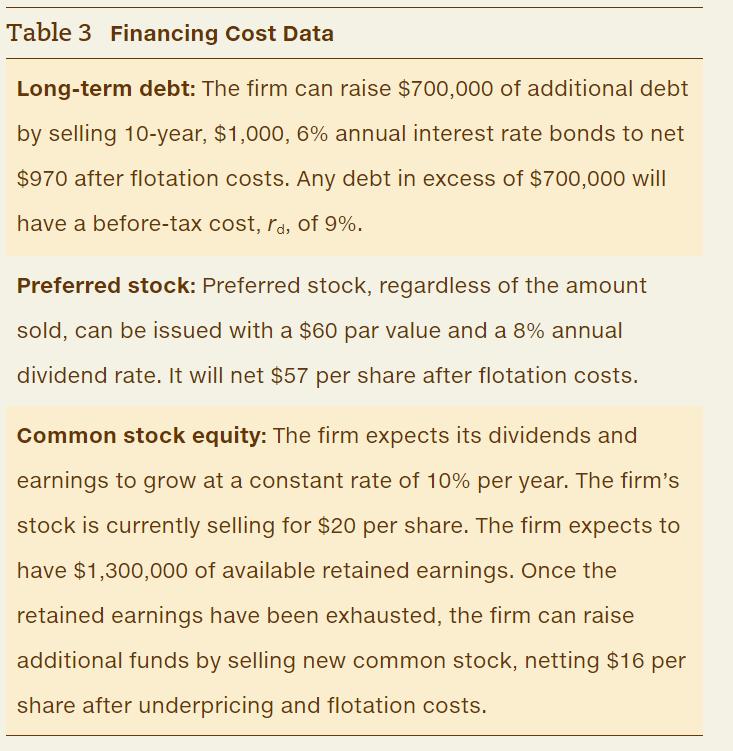

Information needed to answer, assume a 21% tax rate when needed:

Source of capital Long-term debt Preferred stock Common stock equity Range of new financing $0-$700,000 $700,000 and above $0 and above $0-$1,300,000 $1,300,000 and above After-tax cost (%)

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Longterm Debt up to 700000 The beforetax cost of debt rd 6 Aftertax cost of debt rd 1 Tax Ra... View full answer

Get step-by-step solutions from verified subject matter experts