Question: Solve all four parts quickly. Only final answer with short explanation needed. Please do it quickly and correctly . I will give you upvote immediately.

Solve all four parts quickly. Only final answer with short explanation needed. Please do it quickly and correctly . I will give you upvote immediately.

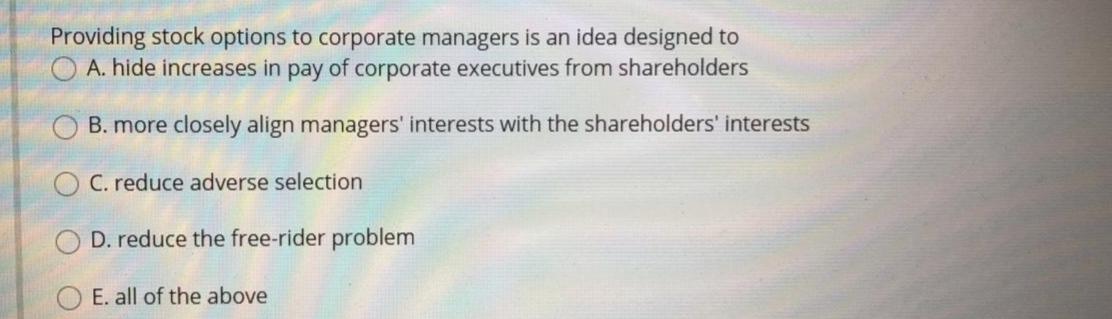

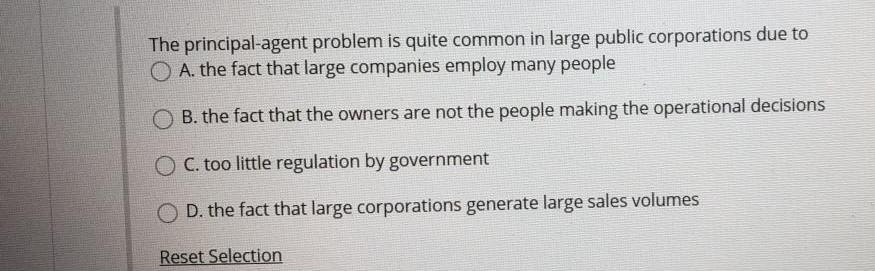

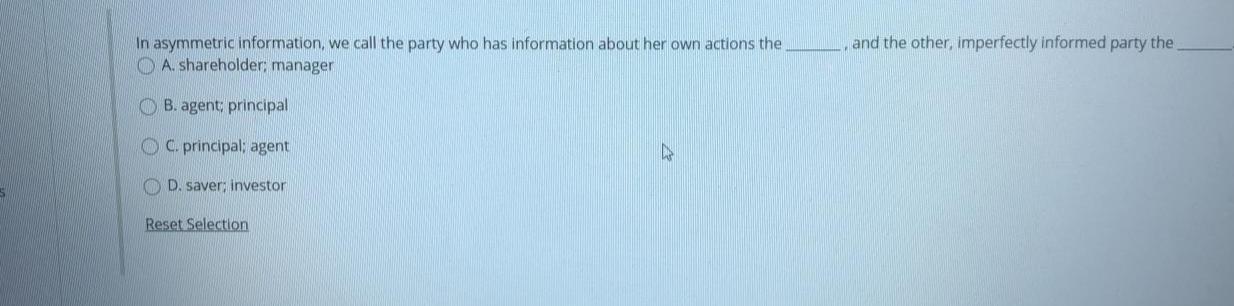

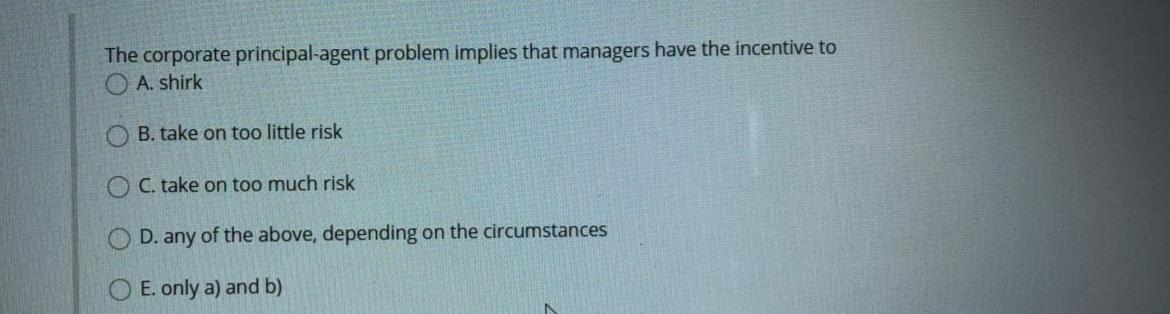

Providing stock options to corporate managers is an idea designed to O A. hide increases in pay of corporate executives from shareholders B. more closely align managers' interests with the shareholders' interests O C. reduce adverse selection O D. reduce the free-rider problem O E. all of the above The principal-agent problem is quite common in large public corporations due to A. the fact that large companies employ many people B. the fact that the owners are not the people making the operational decisions C. too little regulation by government D. the fact that large corporations generate large sales volumes Reset Selection in asymmetric information, we call the party who has information about her own actions the O A. shareholder manager and the other, imperfectly informed party the OB. agent principal C. principalagent D. saver, investor Reset Selection The corporate principal-agent problem implies that managers have the incentive to O A. shirk B. take on too little risk O C. take on too much risk O D. any of the above, depending on the circumstances E. only a) and b)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts