Question: solve all parts Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen

solve all parts

solve all parts

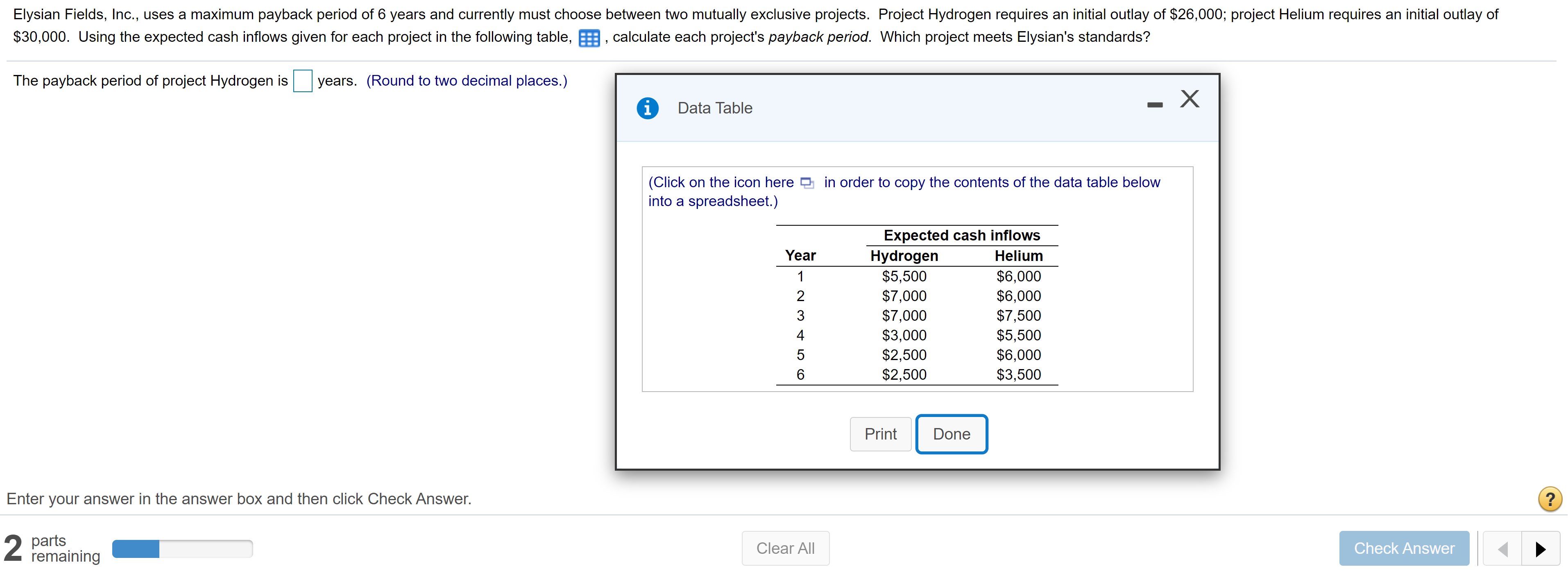

Elysian Fields, Inc., uses a maximum payback period of 6 years and currently must choose between two mutually exclusive projects. Project Hydrogen requires an initial outlay of $26,000; project Helium requires an initial outlay of $30,000. Using the expected cash inflows given for each project in the following table, , calculate each project's payback period. Which project meets Elysian's standards? The payback period of project Hydrogen is years. (Round to two decimal places.) i - X Data Table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Year 1 2 3 4 5 6 Expected cash inflows Hydrogen Helium $5,500 $6,000 $7,000 $6,000 $7,000 $7,500 $3,000 $5,500 $2,500 $6,000 $2,500 $3,500 Print Done Enter your answer in the answer box and then click Check Answer. ? 2 pemaining Clear All Check

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts