Question: solve all parts Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find

solve all parts

solve all parts

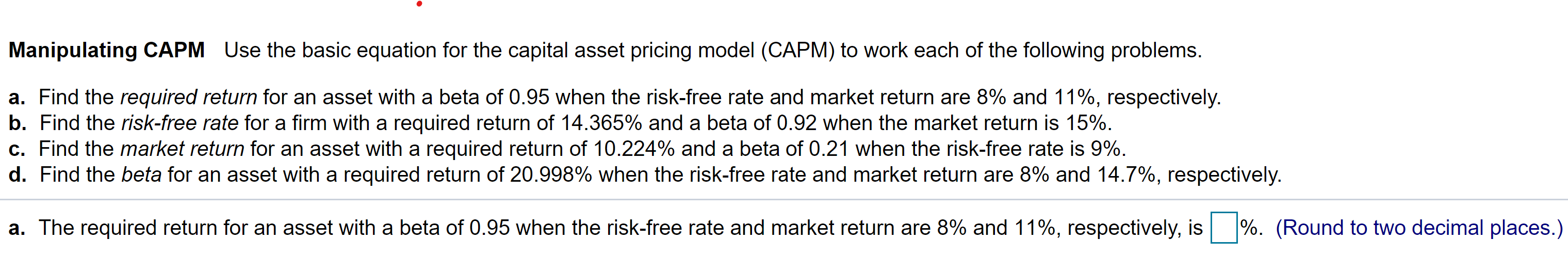

Manipulating CAPM Use the basic equation for the capital asset pricing model (CAPM) to work each of the following problems. a. Find the required return for an asset with a beta of 0.95 when the risk-free rate and market return are 8% and 11%, respectively. b. Find the risk-free rate for a firm with a required return of 14.365% and a beta of 0.92 when the market return is 15%. C. Find the market return for an asset with a required return of 10.224% and a beta of 0.21 when the risk-free rate is 9%. d. Find the beta for an asset with a required return of 20.998% when the risk-free rate and market return are 8% and 14.7%, respectively. a. The required return for an asset with a beta of 0.95 when the risk-free rate and market return are 8% and 11%, respectively, is 1%. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts