Question: solve all please Assignment 2 Equipment was acquired on January 1, 2021, at a cost of $12,00. The equipment was originally estimated to have a

solve all please

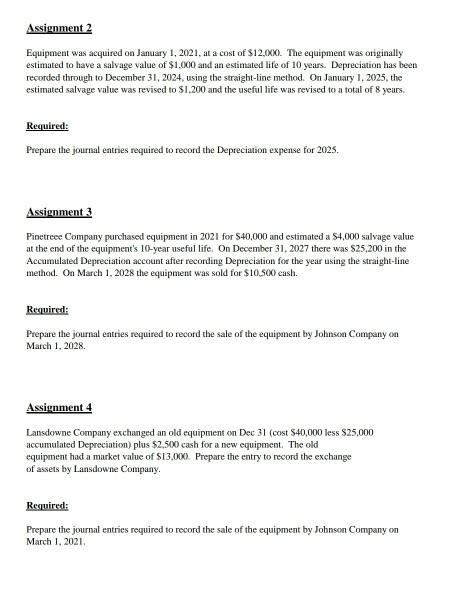

Assignment 2 Equipment was acquired on January 1, 2021, at a cost of $12,00. The equipment was originally estimated to have a salvage value of $1.000 and an estimated life of 10 years. Depreciation has been recorded through to December 31, 2024. using the straight-line method. On January 1, 2025, the estimated salvage value was revised to $1,200 and the useful life was revised to a total of 8 years. Required: Prepare the journal entries required to record the Depreciation expense for 2025. Assignment 3 Pinetrece Company purchased equipment in 2021 for $40,000 and estimated a S4,000 salvage value at the end of the equipment's 10-year useful life. On December 31, 2027 there was $25,200 in the Accumulated Depreciation account after recording Depreciation for the year using the straight-line method. On March 1, 2028 the equipment was sold for $10.500) cash. Required: Prepare the journal entries required to record the sale of the equipment by Johnson Company on March 1, 2028. Assignment 4 Lansdowne Company exchanged an old equipment on Dec 31 (cost $40,000 less S25,000 accumulated Depreciation) plus $2.500 cash for a new equipment. The old equipment had a market value of $13.000. Prepare the entry to record the exchange of assets by Lansdowne Company. Required: Prepare the journal entries required to record the sale of the equipment by Johnson Company on March 1, 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts