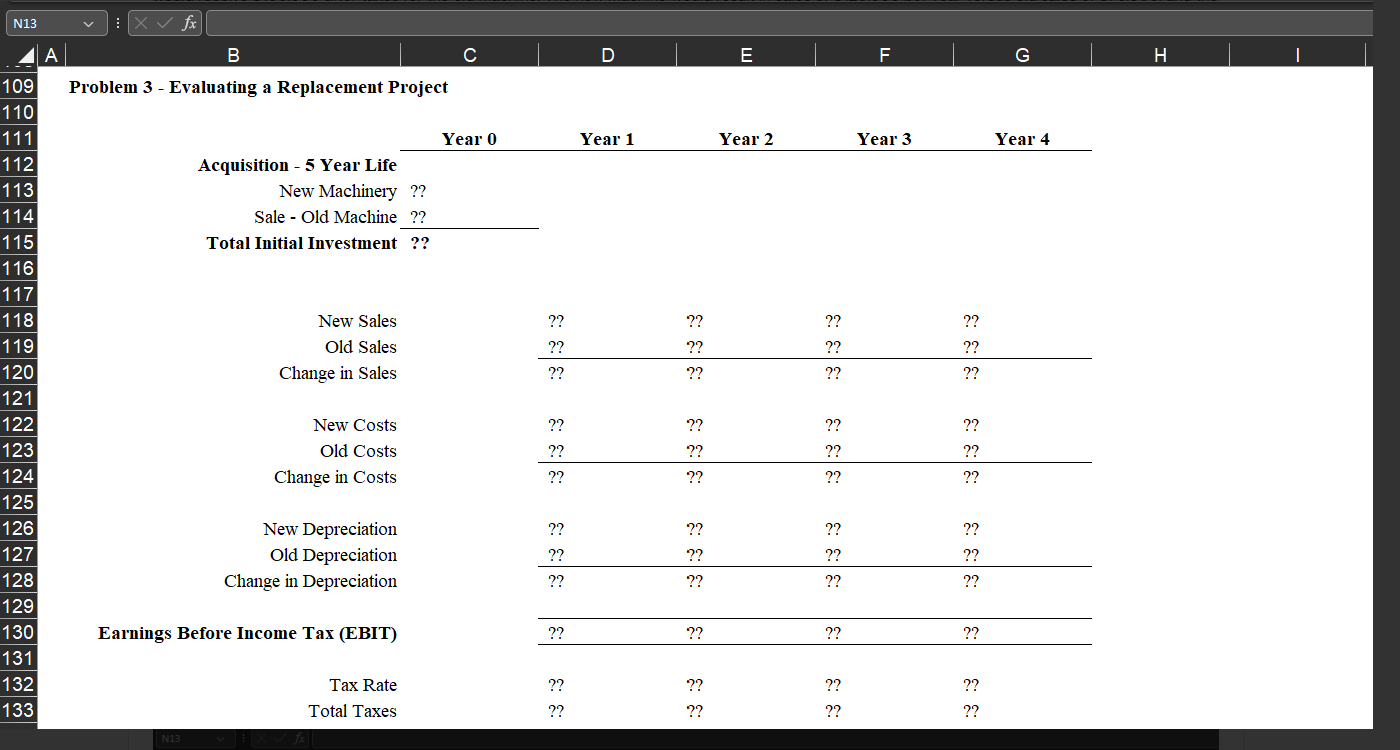

Question: Solve all problems in the Excel file provided Problem 3 ABC Inc. wishes to buy new machinery that would cost $166,000, but it would lead

Solve all problems in the Excel file provided

Problem 3

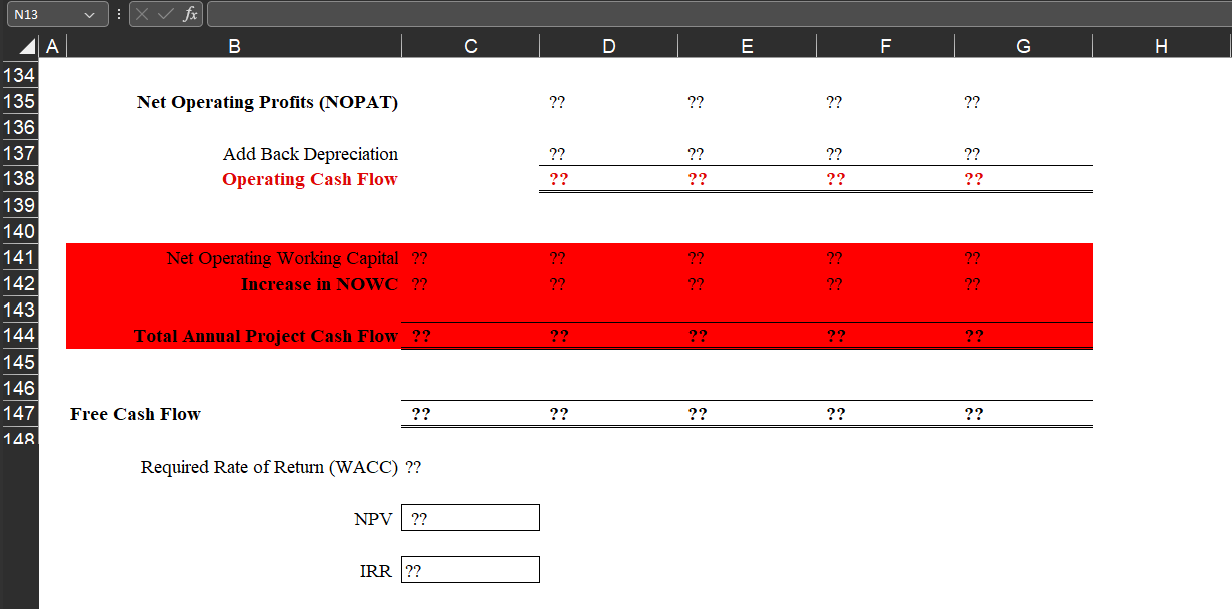

ABC Inc. wishes to buy new machinery that would cost $166,000, but it would lead to increased output, higher sales, and higher costs. Moreover, the firm would receive $100,000 after taxes for the old machine. The new machine would result in sales of $120,000 per year versus old sales of $70,000, and the new costs would be $40,000 versus old costs of $20,000. Finally, the old machine was being depreciated at the rate of $10,000 per year, but the new machine would have $30,000 of annual depreciation. The marginal tax rate is 22 percent and WACC is 8 percent. Based on these figures, and assuming the new and old machines both have a life of four years, find the incremental cash flows.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts