Question: Solve all questions briefly Question 37 (1 point) Bison Corp. has the following data available from its operations: Selling price per unit $284.38 Direct materials

Solve all questions briefly

Solve all questions briefly

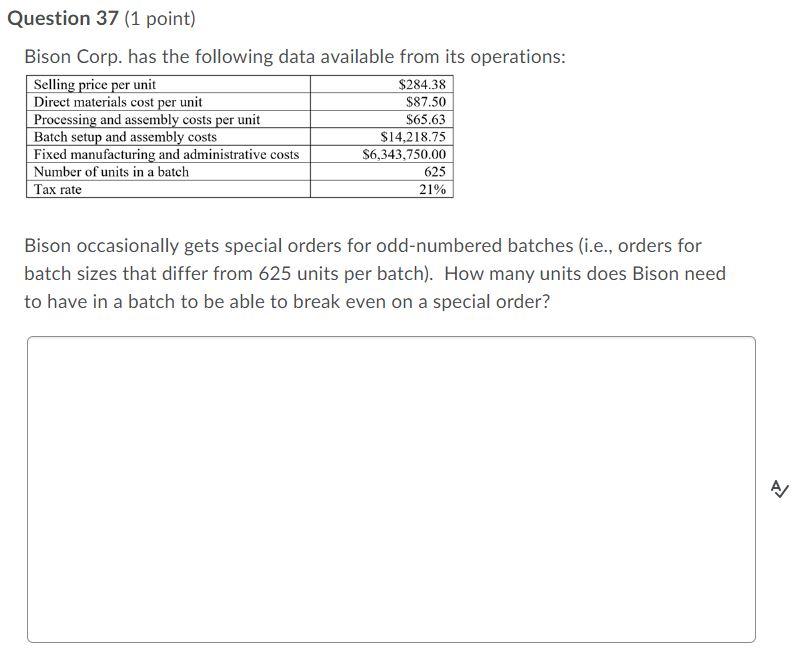

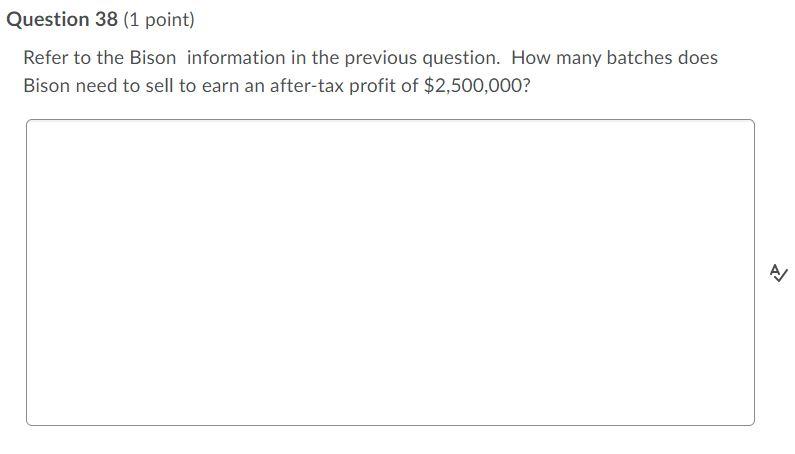

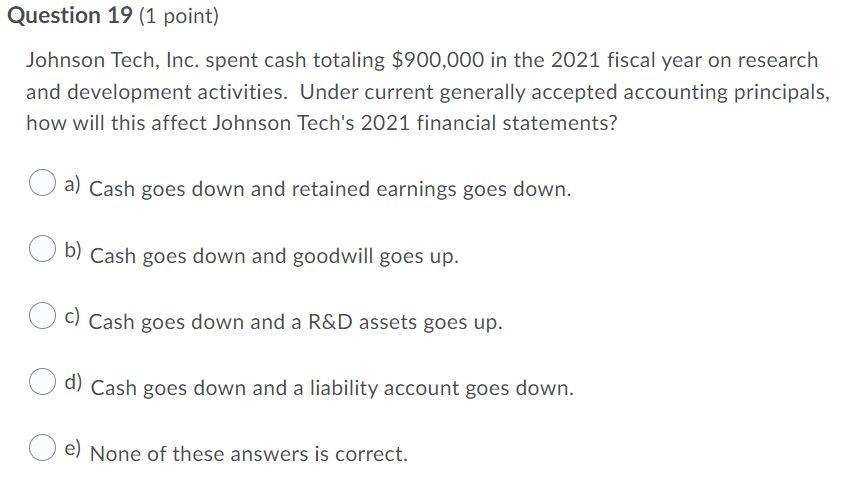

Question 37 (1 point) Bison Corp. has the following data available from its operations: Selling price per unit $284.38 Direct materials cost per unit $87.50 Processing and assembly costs per unit $65.63 Batch setup and assembly costs $14,218.75 Fixed manufacturing and administrative costs $6,343,750.00 Number of units in a batch Tax rate 21% 625 Bison occasionally gets special orders for odd-numbered batches (i.e., orders for batch sizes that differ from 625 units per batch). How many units does Bison need to have in a batch to be able to break even on a special order? A/ Question 38 (1 point) Refer to the Bison information in the previous question. How many batches does Bison need to sell to earn an after-tax profit of $2,500,000? pl Question 19 (1 point) Johnson Tech, Inc. spent cash totaling $900,000 in the 2021 fiscal year on research and development activities. Under current generally accepted accounting principals, how will this affect Johnson Tech's 2021 financial statements? a) Cash goes down and retained earnings goes down. b) Cash goes down and goodwill goes up. O c) Cash goes down and a R&D assets goes up. d) Cash goes down and a liability account goes down. e) None of these answers is correct

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts